SJC gold bar price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 119-121 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119-121 million VND/tael (buy - sell); increased 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.3-121 million VND/tael (buy - sell); increased by 200,000 VND/tael in both directions. The difference between buying and selling prices is at 2.7 million VND/tael.

The latest gold price list today, July 12, 2025 is as follows:

| SJC gold bars | Area | Today's session 7/12 | Difference from yesterday | ||

| Buy | Sell | Buy | Sell | ||

| Unit: Million VND/tael | Unit: Thousand VND/tael | ||||

| SJC | Ho Chi Minh City | 119 | 121 | +200 | +200 |

| Doji | Hanoi | 119 | 121 | +200 | +200 |

| Ho Chi Minh City | 119 | 121 | +200 | +200 | |

| Phu Quy | Hanoi | 118.3 | 121 | +200 | +200 |

| PNJ | Ho Chi Minh City | 119 | 121 | +200 | +200 |

| Hanoi | 119 | 121 | +200 | +200 | |

| BTMC | Nationwide | 119 | 121 | +200 | +200 |

| Red Eyelashes | Ho Chi Minh City | 119.6 | 120.8 | +200 | +400 |

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy - sell), an increase of 300,000 VND/tael for buying and 1.3 million VND/tael for selling. The difference between buying and selling increased to 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115.7-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Gemstone Group listed the price of gold rings at 114.7-117.7 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

| Plain round gold ring | Today's session 7/12 | Difference from yesterday | ||

| Buy | Sell | Buy | Sell | |

| Unit: Million VND/tael | Unit: Thousand VND/tael | |||

| SJC | 114.5 | 117 | +300 | +300 |

| Doji | 115.5 | 118.5 | +300 | +1300 |

| Phu Quy | 114.7 | 117.7 | +500 | +500 |

| PNJ | 114.9 | 117.9 | +600 | +700 |

| BTMC | 115.7 | 118.7 | +400 | +400 |

In the domestic gold market, many investors expect the price of SJC gold bars and gold rings to decrease as the July 15 milestone approaches. This is the time when the Prime Minister requests the State Bank to submit a draft Decree amending Decree No. 24/2012/ND-CP on the management of gold trading activities.

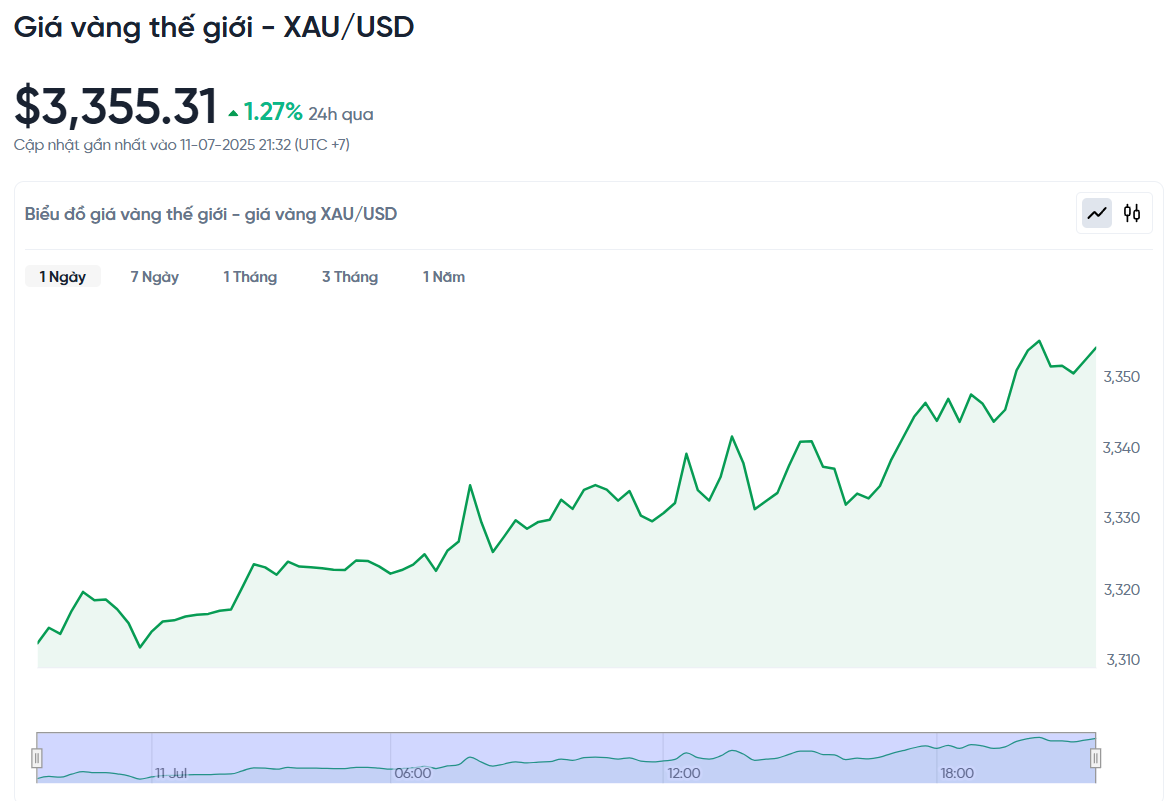

World gold price

Recorded at 0:00, spot gold was listed at 3,355.31 USD/ounce, up 41.93 USD/ounce compared to yesterday.

Converted according to the USD exchange rate at Vietcombank (26,270 VND/USD), the world gold price is about 109.73 million VND/tael (excluding taxes and fees). Thus, the price of gold bars is 11.27 million VND/tael higher than the international gold price.

Gold Price Forecast

Gold prices rose 1.27% to a one-week high after US President Donald Trump widened the global trade war by sending letters as a trade deal to impose tariffs, prompting investors to rush to buy gold as a safe haven against economic uncertainties.

Specifically, spot gold price increased to 3,355.31 USD/ounce, while gold futures price in the US also increased 1.3%, to 3,369 USD/ounce.

The gold price increase came shortly after Trump announced that he would impose a 35% tariff on goods imported from Canada next month, while also planning to impose 15-20% tariffs on many other trading partners.

This week, US President Donald Trump also announced a 50% tax on copper imported into the US and goods from Brazil. Brazil also made a strong statement in response to similar taxes, opening a new tariff war.

According to Aakash Doshi, gold strategist at State Street Global Advisors, the market is currently witnessing a return of uncertainty, and gold is benefiting from its role as a safe-haven asset.

He predicted that gold prices in the third quarter could fluctuate between $3,100 and $3,500, after a strong first half of the year and entering a correction phase.

Gold tends to rise in price amid economic uncertainty and low interest rates. Recently, US Federal Reserve Governor Christopher Waller affirmed the possibility of the Fed cutting interest rates at its policy meeting later this month. Currently, investors expect the Fed to reduce interest rates by a total of 50 basis points before the end of the year.

Besides gold, other precious metals such as silver, platinum and palladium also increased in price. Silver price increased 2.1% to $37.79/ounce, platinum increased 1.4% to $1,379.15 and palladium increased 2.6% to $1,171.18.

Gold demand in Asia falls sharply due to volatile prices

Demand for physical gold in Asian markets remained low this week due to concerns about price fluctuations. Meanwhile, gold prices in China remained higher than the world price, while in India, the price gap decreased compared to last week.

In China, the world’s largest gold consumer, dealers are selling gold at a premium of $10 to $25 an ounce above global spot prices, up from $4.2 to $33 last week. Gold prices briefly dipped below $3,300 this week, their lowest in more than a week, before recovering to $3,335 on Friday morning.

Although US President Donald Trump has recently expanded the trade war by imposing new tariffs on many countries (effective from August 1), the uncertainty has not been enough to stimulate demand for gold in China. Hugo Pascal, a precious metals trader at InProved, said the market is quite quiet at the moment.

Another factor affecting gold demand in China is the central bank’s new anti-money laundering and anti-terrorist financing regulations for dealers in precious metals and gemstones. This could dampen potential demand, and buyers may only return if gold prices fall to around $3,000-$3,100, according to a local trader.

In India, the discount (selling price below world prices) has narrowed from $14 an ounce last week to a maximum of $8 an ounce (including 6% import duty and 3% sales tax). Supply is tight due to lower gold imports in May and June and a shortage of recycled scrap, a gold dealer in Mumbai said.

Domestic gold prices are currently around 97,300 rupees per 10 grams, down from a record 101,078 rupees last month. Demand for gold in India typically falls during the monsoon season, which runs from June to September.

Other markets such as Hong Kong, Singapore and Japan also recorded quiet trading. In Hong Kong, gold was sold at par or a slight premium of $1.50 an ounce, while in Singapore, the premium ranged from par to +$2.20.

In Japan, gold bars are traded at or above the reference price by $0.50.

Source: https://baonghean.vn/gia-vang-hom-nay-12-7-gia-vang-trong-nuoc-lay-lai-moc-quan-trong-121-trieu-dong-10302111.html

Comment (0)