SJC gold price today has not stopped, setting a new record. surpassing the peak of 127 million

SJC, DOJI and PNJ gold prices increased to 127.1 million VND/tael

In this morning's trading session, the latest gold price today, August 26, 2025, of SJC in Hanoi and DOJI Group increased significantly. The buying price of both brands increased by 500 thousand VND/tael, up to 126.1 million VND/tael. On the selling side, the increase was even more impressive, 600 thousand VND/tael, bringing the price to 127.7 million VND/tael.

Gold price at brands remains at 126.9 million

At Mi Hong, SJC gold price increased sharply by 600 thousand VND/tael in both buying and selling directions, reaching 127.0 million VND/tael for buying and 127.7 million VND/tael for selling.

Meanwhile, PNJ also followed SJC and DOJI with similar increases: buying increased by 500 thousand VND/tael to 126.1 million VND/tael and selling increased by 600 thousand VND/tael to 127.7 million VND/tael.

Bao Tin Minh Chau also recorded a similar increase, keeping the buying price at 126.1 million VND/tael and selling price at 127.7 million VND/tael with increases of 500 thousand and 600 thousand VND/tael, respectively.

Notably, Vietinbank Gold's selling price increased by 600,000 VND/tael, reaching 127.7 million VND/tael.

Phu Quy is a bit different when the buying price remains the same at 125.1 million VND/tael, but the selling price increases by 600 thousand VND/tael, to 127.7 million VND/tael.

The price of 9999 plain gold rings today, August 26, 2025, is stable.

At 10:00 a.m. on August 25, 2025, the price of DOJI's 9999 Hung Thinh Vuong round gold ring was listed at VND 119.3 million/tael (buy) and VND 122.3 million/tael (sell), an increase of VND 500,000/tael in both buying and selling directions compared to the previous day, with a buying - selling difference of VND 3 million/tael.

Plain gold ring price today August 26, 2025 increased in Phu Quy

Bao Tin Minh Chau kept the price of gold rings at 119.6 million VND/tael (buy) and 122.6 million VND/tael (sell), an increase of 400 thousand VND/tael in both directions compared to early this morning, with a difference of 3 million VND/tael.

Phu Quy Group also listed the price of gold rings at 119.2 million VND/tael (buy) and 122.2 million VND/tael (sell), an increase of 400 thousand VND/tael in both directions compared to yesterday, with a difference of 3 million VND/tael between buying and selling.

Gold price list today 8/26/2025 in Vietnam in detail

| Gold price today | August 26, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 126.1 | 127.7 | +500 | +600 |

| DOJI Group | 126.1 | 127.7 | +500 | +600 |

| Red Eyelashes | 127.0 | 127.7 | +600 | +600 |

| PNJ | 126.1 | 127.7 | +500 | +600 |

| Vietinbank Gold | 127.7 | +600 | ||

| Bao Tin Minh Chau | 126.1 | 127.7 | +500 | +600 |

| Phu Quy | 125.1 | 127.7 | - | +600 |

Update on world gold price this morning recovered

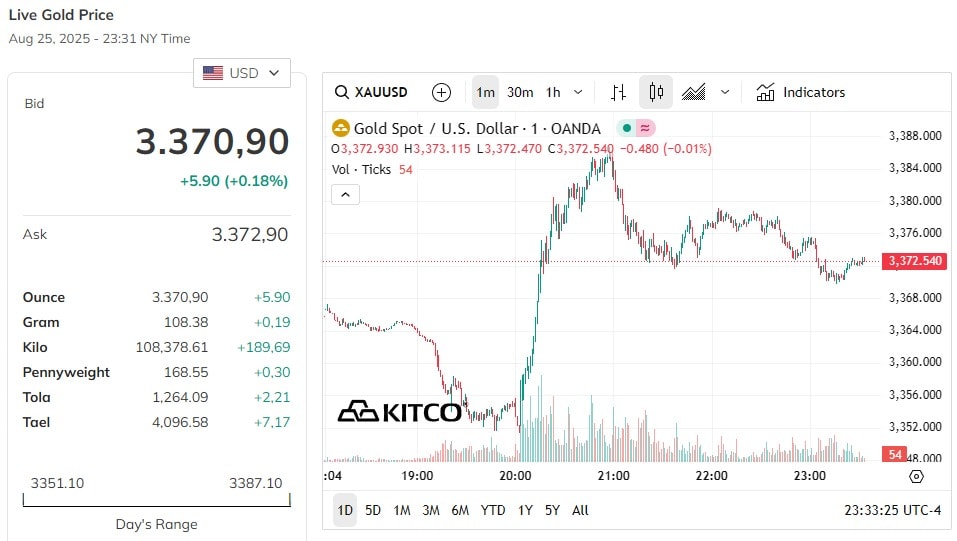

World gold price, at 10:00 a.m. on August 26, 2025 (Vietnam time), the world spot gold price was at 3,370.9 USD/ounce. Today's gold price increased by 5.9 USD compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,510 VND/USD), world gold is priced at about 112.05 million VND/tael (excluding taxes and fees). Compared to the domestic SJC gold bar price on the same day (126.1-127.7 million VND/tael), the current SJC gold price is about 15.65 million higher than the international gold price.

Gold prices rose to a two-week high on Tuesday, as the dollar weakened after US President Donald Trump announced the removal of Federal Reserve Governor Lisa Cook.

As of 03:09 GMT (10:09 Vietnam time), spot gold prices rose 0.2% to $3,371.28 an ounce, after hitting their highest level since August 11. Meanwhile, US gold futures for December delivery held at $3,418.90.

"Trump's comments about Fed Governor Cook once again made traders nervous, leading to gold attracting more safe-haven flows today," said Tim Waterer, chief market analyst at KCM Trade.

“There is a sense that Mr Trump may be reshaping the Fed into a more dovish institution. Any depreciation in the dollar or a drop in bond yields would be positive for gold.”

The US dollar index fell 0.2% against other currencies, reducing gold's appeal to overseas buyers.

Earlier on Friday, Fed Chairman Jerome Powell signaled the possibility of a rate cut at the US central bank's meeting next month, saying risks to the job market were rising, but also noting that inflation remained a threat and a final decision had not been made.

Gold, a non-yielding asset, typically appreciates in a low-interest-rate environment, reducing the opportunity cost of holding the precious metal.

Market attention now turns to the Personal Consumption Expenditures (PCE) price index, the Fed's preferred inflation gauge, due out on Friday, for further clues on the path of US interest rate cuts.

In other developments, the world's largest gold-backed exchange-traded fund (ETF), SPDR Gold Trust, said its holdings rose 0.18% to 958.49 tonnes on Monday, from 956.77 tonnes on Friday.

Other precious metals also saw volatility. Spot silver rose 0.3% to $38.67 an ounce, platinum was flat at $1,341.83, and palladium rose 0.8% to $1,095.49.

News, gold price trends today August 26, 2025

The global gold market is still in a tug-of-war, fluctuating around the threshold of 3,400 USD/ounce, although the increase has slowed down. According to analysis from Société Générale Bank (SocGen), gold is still receiving strong support, even when global uncertainties are gradually cooling down and money flows are shifting.

SocGen experts said that while there may be short-term risks as markets return to normal, the likelihood of a sharp decline in gold prices is very low. The bank's report highlighted that ETF flows remain stable, and that moderate selling by hedge funds has created an even more solid price foundation, as these are the investors who often cause volatility.

SocGen remains bullish on gold this year, having said in June that it would not sell until gold surpassed $4,000 an ounce, a level it forecasts could be reached by the second quarter of 2025.

However, profit-taking is still taking place, keeping gold prices in a tight range for now. Spot gold was last recorded at $3,371.90 an ounce, almost flat on the session. The main reason for gold’s rise earlier this year was a rare combination of strong ETF inflows, persistent buying from central banks, and increased long positions by hedge funds.

Looking ahead, gold prices will be influenced by the pace of normalization of uncertainty and any breakthroughs in the Russia-Ukraine conflict. However, experts believe that a peace deal will not weaken long-term demand for the precious metal. They further explain that the Russian central bank’s asset freeze has set a strong precedent, which will help maintain high demand for gold from central banks. Although geopolitical tensions have eased, the level of global uncertainty remains significantly higher than its historical average.

Source: https://baodanang.vn/gia-vang-hom-nay-26-8-2025-gia-vang-sjc-tang-gan-trieu-vuot-127-5-trieu-lap-ky-luc-moi-3300345.html

![[Photo] Hanoi: Authorities work hard to overcome the effects of heavy rain](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/380f98ee36a34e62a9b7894b020112a8)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

![[Podcast] - Decoding Danang University's 2025 admission scores](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/26/c89fdb410fec44479fd37acd9fd76093)

Comment (0)