Can you tell me what taxes and fees must be paid when transferring the red book in 2023? - Reader Thanh Uyen

|

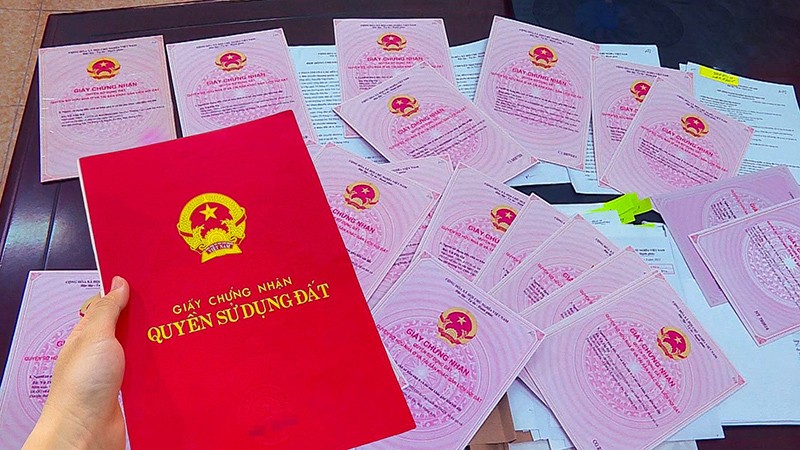

1. What is a red book?

Currently, there is no document regulating the concept of red book. However, it can be understood that red book is a certificate issued by the Ministry of Natural Resources and Environment before December 10, 2009 with the legal name of "land use right certificate."

2. Taxes and fees to be paid when transferring land use rights in 2023

2.1 Registration fee

Pursuant to Article 3 of Decree 10/2020/ND-CP, organizations and individuals must pay registration fees when registering home ownership and land use rights.

The current registration fee rate for houses and land is 0.5%.

2.2 Application appraisal fee

File appraisal fees are regulated by the People's Councils of provinces and cities:

Circular 85/2019/TT-BTC stipulates that the fee for appraisal of documents when transferring real estate ownership is under the authority of the Provincial People's Council (province, centrally-run city), so the collection rate between provinces and cities will be different.

The fee for appraising the application for a land use right certificate is the fee for appraising the application, the necessary and sufficient conditions to ensure the issuance of a certificate of land use right, house ownership right and property attached to land (including initial issuance, new issuance, exchange, re-issuance of certificates and certification of changes to the issued certificates) according to the provisions of law.

Based on the area scale of the land plot, the complexity of each type of file, the purpose of land use and specific local conditions to determine the fee level for each case.

2.3 Certificate issuance fee (red book issuance fee)

When transferring real estate ownership, if the transferee or donee requests and is granted a new Certificate, this fee will be required.

Fees for granting certificates of land use rights, house ownership rights, and assets attached to land are the fees that organizations, households, and individuals must pay when being granted certificates of land use rights, house ownership rights, and assets attached to land by competent state agencies.

Fees for granting certificates of land use rights, house ownership rights, and assets attached to land include: Granting certificates of land use rights, house ownership rights, and assets attached to land; certificates of land change registration; extracts of cadastral maps; documents; cadastral records data.

Based on specific local conditions and local socio -economic development policies, appropriate fee collection levels are prescribed, ensuring the following principles: Collection levels for households and individuals in districts of centrally-run cities, inner-city wards of cities or towns under provinces are higher than collection levels in other areas; collection levels for organizations are higher than collection levels for households and individuals.

2.4 Notarization and certification fees

The fee for notarization of contracts is determined as follows:

Asset value or contract value | Fee/1 case |

Under 50 million VND | 50,000 VND |

From 50-100 million VND | 100,000 VND |

From 100-1 billion VND | 0.1% of contract value or asset value |

From 1-3 billion VND | 1 million VND and 0.06% of contract value or asset value exceeding 1 billion VND |

From 3-5 billion VND | 2.2 million VND and 0.05% of contract value or asset value exceeding 3 billion VND |

From 5-10 billion VND | 3.2 million VND and 0.04% of contract value or asset value exceeding 5 billion VND |

From 10-100 billion VND | 5.2 million VND and 0.03% of contract value or asset value exceeding 10 billion VND |

Over 100 billion VND | 32.2 million VND and 0.02% of contract value or asset value exceeding 100 billion VND |

Note : GTHD is contract value.

2.5 Personal income tax

- The tax rate for land transactions is 2% of the purchase, sale or sublease price.

- Tax calculation:

+ Personal income tax on income from buying and selling land is determined as follows:

Personal income tax payable = Transfer price x Tax rate 2%

+ In case of land sale and purchase under co-ownership, tax liability is determined separately for each taxpayer according to the ratio of real estate ownership.

3. Cases exempted from tax and fees when transferring red book ownership

3.1 Exemption from registration fee

Exemption from registration fee for houses and land received as inheritance or gifts between:

- Husband and wife;

- Biological father, biological mother and biological child;

- Foster father, foster mother with foster child;

- Father-in-law, mother-in-law and daughter-in-law;

- Father-in-law, mother-in-law and son-in-law;

- Grandfather, grandmother with grandchildren;

- Grandparents with grandchildren;

- Brothers and sisters are now granted certificates of land use rights, house ownership rights and other assets attached to land by competent state agencies.

3.2 Personal income tax exemption

Cases of personal income tax exemption:

- In case of transfer, donation, inheritance of real estate (including future housing, future construction works according to the provisions of law on real estate business) between husband and wife; biological father, biological mother and biological child; adoptive father, adoptive mother and adopted child; father-in-law, mother-in-law and daughter-in-law; father-in-law, mother-in-law and son-in-law; paternal grandfather, paternal grandmother and grandson; maternal grandfather, maternal grandmother and granddaughter; siblings.

- In case the individual transferring only has one house and land use rights in Vietnam.

- Land created by the husband or wife during the marriage is determined to be the common property of the couple. When divorced, it is divided by agreement or by court judgment. The division of this property is exempt from tax.

3.3 Exemption and reduction of appraisal fees and fees for granting Red Book

The Provincial People's Council specifically decides on the subjects eligible for exemption and reduction; and the reduction level for fees and charges.

Subjects eligible for exemption or reduction of fees and charges include poor households, the elderly, people with disabilities, people with revolutionary contributions, ethnic minorities in communes with particularly difficult socio-economic conditions and some special subjects as prescribed by law.

Legal basis:

- Decree 10/2020/ND-CP

- Circular 85/2019/TT-BTC

- Law on Fees and Charges 2015

- Circular 257/2016/TT-BTC

- Circular 111/2013/TT-BTC

Source

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)