May 12, 2025 - Prudential Vietnam Life Insurance Company Limited ("Prudential") launched the universal life insurance product PRU-Maximum Protection - Maximum protection value per premium, up to 80 times (*) the basic insurance premium - This is Prudential's latest life insurance product, meeting the need for optimal protection on the insurance premium that best suits financial capacity. This product is also designed to accumulate sustainable finance with committed interest rates and attractive bonuses such as customer appreciation bonuses on the first 10th Contract Year anniversary and every 5 years thereafter. In addition, customers also receive a contract maintenance bonus from the 20th Contract Year when meeting the conditions according to the Product Terms and Conditions.

Representatives of Prudential and the Insurance Association share information at the event.

Mr. Conor M O'Neill, Deputy Chief Financial Officer of Prudential Vietnam, shared: “The PRU-Maximum Protection universal life insurance product is the first product that Prudential has launched after the changes of the new Law on Insurance Business. Always pursuing the commitment to be a model enterprise in the industry, we believe that this product not only complies with the requirements of the Law on the basis of putting the interests of customers first, but is also improved and designed by Prudential to provide optimal protection benefits for customers on each participating fee, while flexibly meeting the financial protection needs both increasing and decreasing at each meaningful milestone of life.”

Mr. Conor M. O'Neill - Deputy General Director of Finance of Prudential Vietnam speaking at the event

According to the WTW (Willis Towers Watson) Global Healthcare Trends 2025 Report, healthcare costs in Vietnam are expected to increase by 11.2% by 2025, higher than the global average of 10.4%. This reflects the rising trend of healthcare inflation in the Asia- Pacific region while the need for healthcare protection is constantly increasing. In response to that need, the PRU-Maxi Protection universal insurance product was born with the goal of accompanying customers in building an optimal financial protection plan according to their needs, while increasing the opportunity to accumulate for long-term financial goals in the future.

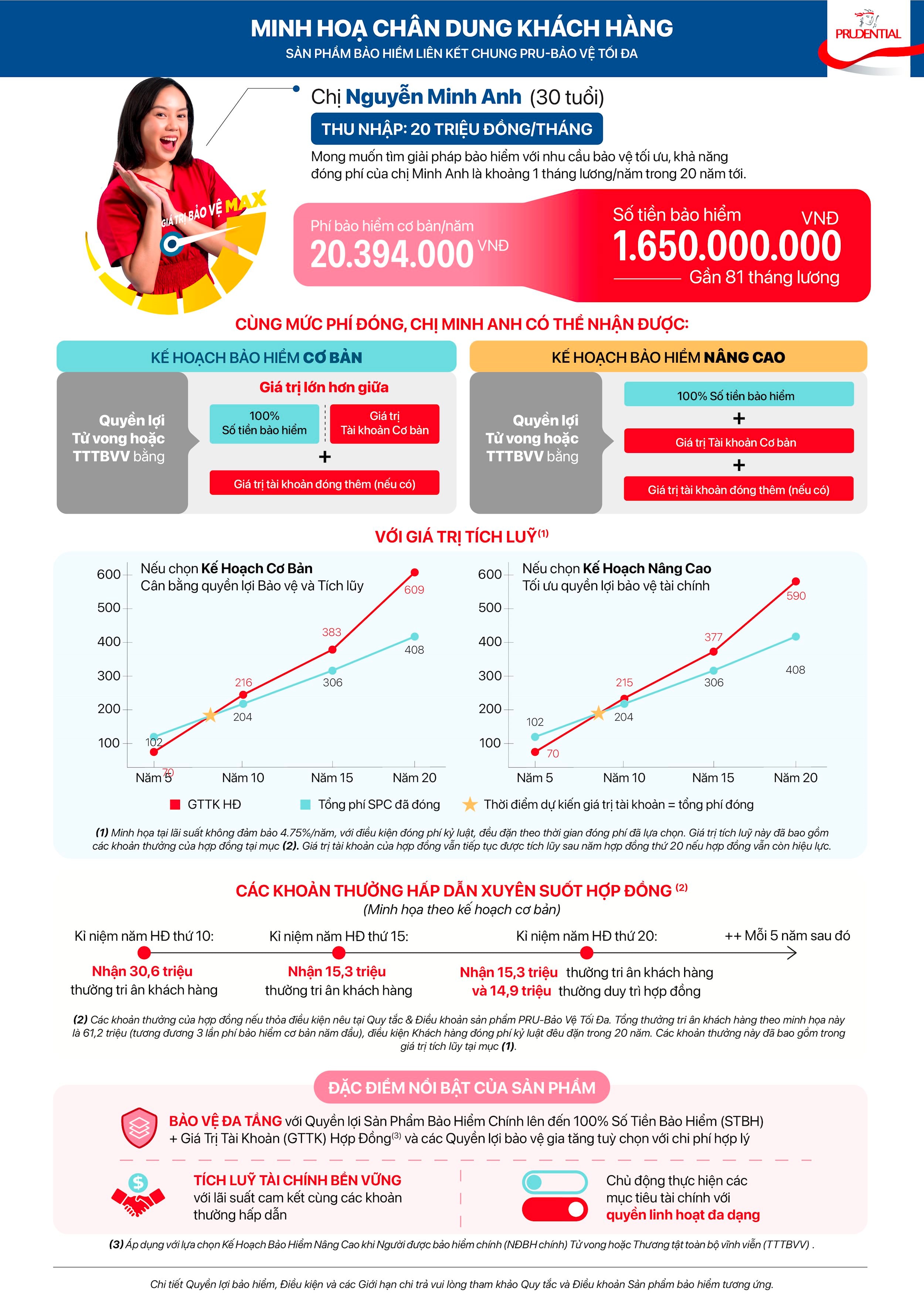

Illustration of customer portrait participating in PRU-Maximum Protection

By participating in PRU-Max Protection, customers can choose the “basic insurance plan” to balance protection and accumulation benefits or the “advanced insurance plan” to optimize financial protection benefits. The highlight of the product is that customers can flexibly switch the insurance plan from basic to advanced or vice versa when protection needs change with the same basic insurance premium of the main product.

Mr. Luong The Vinh - Product Director of Prudential Vietnam shares about the advantages of the new product

Meeting customer expectations for accumulation needs, customer account value is increased with conditional bonuses throughout the contract term such as: Customer Appreciation Bonus on the 10th Contract anniversary up to 150% of the first year's basic insurance premium , 75% on every 5 years thereafter; Contract Maintenance Bonus of 4% of the average contract account value in the last 60 months on the 20th Contract anniversary and every 5 years thereafter. These are attractive benefits that encourage customers to maintain their insurance contracts for long-term protection.

Furthermore, PRU-Max Protection provides customers with sustainable financial savings with a committed interest rate throughout the contract term. In all cases, the actual investment interest rate is not lower than the committed investment interest rate announced by Prudential and ensures a competitive level in the market. Prudential's Universal Life Fund is managed by Eastspring Investments Vietnam, currently one of the fund management companies with the largest total assets under management in the Vietnamese market, with a team of professional and experienced investment experts.

In addition to the above outstanding features of the product, PRU-Maximum Protection also gives customers the initiative based on the product's diverse flexible rights, allowing customers to: Proactively pay additional insurance premiums in each contract year up to 5 times the annualized Basic Insurance Premium to enjoy competitive investment interest rates of the Universal Linked Fund for outstanding accumulation goals; Proactively increase the insurance amount without health assessment at important milestones in life such as marriage, childbirth/adoption or children starting primary school, or secondary school, or high school, or university; Proactively change the insurance amount and join/terminate Co-Sold Insurance products according to protection needs at each stage of life; and Proactively withdraw money from the account value according to financial needs.

Mr. Ngo Trung Dung - Deputy General Secretary of Vietnam Insurance Association spoke at the event

Customers can also participate in co-sold insurance products with reasonable costs, wide coverage and high protection levels to increase health protection and care benefits for themselves and their families.

Refer to the detailed Benefits of the PRU-Maximum Protection joint insurance product in the product's Terms and Conditions and receive product advice here .

(*) The insurance amount of 80 times the basic insurance premium is estimated based on the common age group of Prudential customers. The actual insurance amount of each customer will be calculated depending on the age, gender and health status of the customer. Customers can access Prudential's Insurance Premium Calculator to calculate and refer to the insurance premium based on the insurance amount required for the financial protection needs of themselves and their families.

About Prudential Vietnam |

|---|

Source: https://daibieunhandan.vn/prudential-ra-mat-thi-truong-san-pham-bao-hiem-lien-ket-chung-moi-pru-bao-ve-toi-da-10372260.html

![[Photo] Worshiping the Tuyet Son statue - a nearly 400-year-old treasure at Keo Pagoda](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764679323086_ndo_br_tempimageomw0hi-4884-jpg.webp&w=3840&q=75)

![[Photo] Parade to celebrate the 50th anniversary of Laos' National Day](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F02%2F1764691918289_ndo_br_0-jpg.webp&w=3840&q=75)

Comment (0)