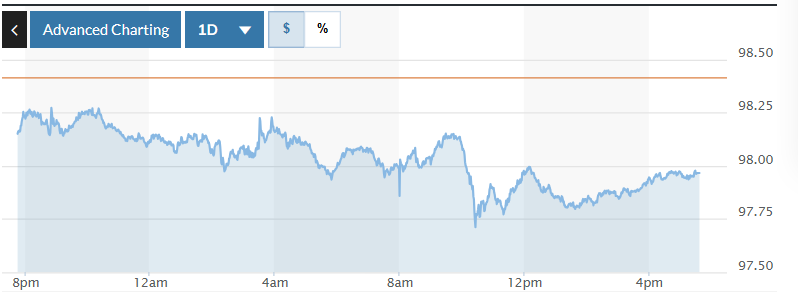

Meanwhile, in the US market, the US Dollar Index (DXY) measuring the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF) decreased by 0.46% to 97.97.

|

| DXY Index volatility chart over the past 24 hours. Photo: Marketwatch |

USD exchange rate today in the world

The dollar fell on Tuesday, while the euro rose to its highest since October 2021, after a ceasefire between Iran and Israel was announced, although US Federal Reserve Chairman Jerome Powell reiterated that he expected inflation to start rising again this summer.

“The market is currently unwinding Middle East-related trades,” said Adam Button, chief currency analyst at ForexLive in Toronto, Canada.

The euro and the yen rose as oil prices fell sharply. The European Union and Japan rely heavily on oil and liquefied natural gas imports, while the United States is a net exporter of oil. The euro rose 0.38 percent to $1.162 against the dollar. The dollar fell 1 percent to $144.68 against the yen.

Risk-sensitive assets, including the Australian dollar (AUD), also rose on improved risk sentiment. The AUD rose 0.68% against the greenback to $0.6503. The British pound rose 0.77% to $1.3626.

The dollar fell even as Powell said in congressional testimony that he and many Fed officials expect inflation to rise soon and that the Fed is in no rush to cut borrowing costs. Traders were particularly attentive to his comments after two other Fed members expressed support for a near-term rate cut, citing concerns about the labor market. Fed Vice Chair for Supervision Michelle Bowman said on Monday that a rate cut could be near, while Fed Governor Christopher Waller said on Friday that the Fed should consider cutting rates at its next meeting.

“The market has been expecting a big reaction to a potential rate cut, but Powell has been neutral,” Button said. “The biggest debate within the Fed right now is about the job market. Waller and Bowman say there are signs of weakness, while Powell says he doesn’t see any weakness,” Button added.

US President Donald Trump said on Tuesday that interest rates in the US should be cut by at least 2 to 3 percentage points.

The possibility of the Fed cutting interest rates at its meeting on July 29 and 30 is still considered very low, with the first cut expected to take place in September this year.

If the economy deteriorates and the Fed cuts rates faster than currently expected, that could be very negative for the dollar, said Vassili Serebriakov, a foreign exchange strategist at UBS in New York. However, “if the Fed doesn’t cut until September and only cuts twice this year, the dollar could weaken but not significantly, especially against USD/JPY, because the dollar still benefits quite a bit from the interest rate differential,” he said.

Data released on Tuesday showed U.S. consumer confidence unexpectedly fell in June, as households grew concerned about business conditions and the job outlook over the next six months.

|

| Illustration photo / Reuters |

Domestic USD exchange rate today

In the domestic market, at the beginning of the trading session on June 25, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 25,058 VND.

* The reference USD exchange rate at the State Bank's buying and selling exchange center increased slightly, currently at: 23,856 VND - 26,260 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,960 VND | 26,310 VND |

Vietinbank | 25,995 VND | 26,305 VND |

BIDV | 26,015 VND | 26,305 VND |

* The EUR exchange rate at the State Bank's buying and selling exchange center increased, currently at: 27,616 VND - 30,523 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,570 VND | 31,129 VND |

Vietinbank | 29,915 VND | 31,170 VND |

BIDV | 29,989 VND | 31,174 VND |

* The Japanese Yen exchange rate at the State Bank's exchange office increased, currently at: 164 VND - 181 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 173.97 VND | 185.02 VND |

Vietinbank | 176.34 VND | 184.34 VND |

BIDV | 177.18 VND | 184.49 VND |

THUY ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-25-6-dong-usd-tiep-tuc-giam-256571.html

![[Photo] General Secretary To Lam works with the Standing Committee of Quang Binh and Quang Tri Provincial Party Committees](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/25/6acdc70e139d44beaef4133fefbe2c7f)

Comment (0)