To protect taxpayers' rights, the Tax Department of Region I recommends that individuals update their tax registration information (specifically, update information on citizen identification).

Taxpayer updates are the basis for tax authorities to standardize data, aiming to use identification codes as tax codes according to regulations.

Individual taxpayers can choose one of the following ways to update or change tax registration information:

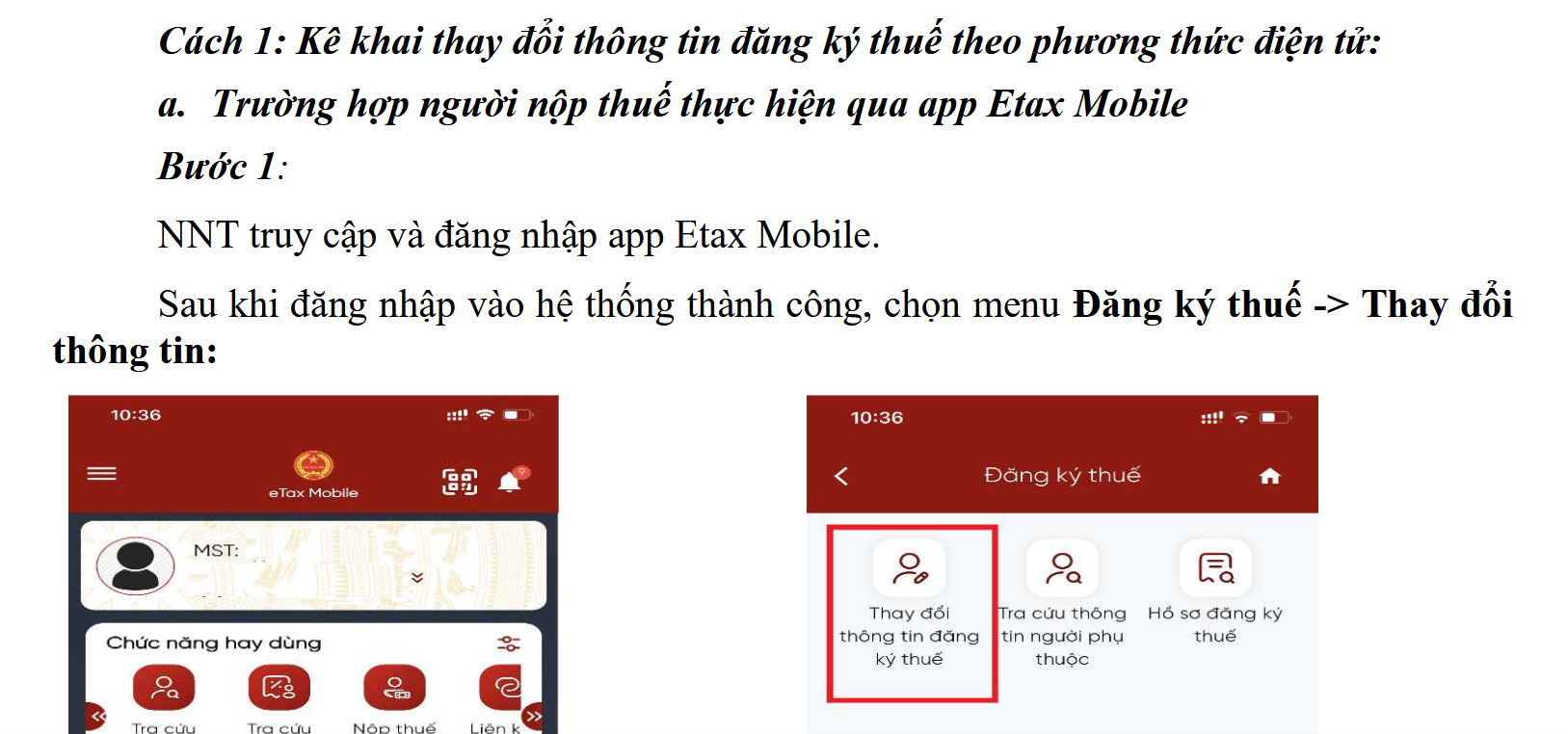

Method 1: Declare changes to tax registration information electronically. Follow the instructions here: https://qr.me-qr.com/mobile/pdf/7b2521be-5a42-44ce-978c-66f031feb0a9.

Method 2: Declare changes to tax registration information through the income paying agency

Individual taxpayers can update changes in citizen identification information in tax registration through the income paying organization as follows:

- Taxpayers are individuals who submit applications to change tax registration information to the paying agency, including:

+Authorization document (in case there is no authorization document for the previous income payment agency).

+ Copies of documents with changes in information related to tax registration of individuals or dependents.

- The taxpayer is the agency that pays and synthesizes employee information, submits a tax registration information change application to the direct tax authority, with the following components:

+ Tax Registration Declaration, Form No. 05-DK-TH-TCT, Form 20-DK-TH-TCT issued with Circular 86/2024/TT-BTC to change information of taxpayers and taxpayers' dependents (note to fully update 3 fields of information: full name, date of birth, personal identification documents (update latest citizen identification number).

+ Form No. 20-DK-TH-TCT issued with Circular 86/2024/TT-BTC to change NPT information (note to fully update 03 fields of full name, date of birth, personal identification documents (priority to updating the latest citizen identification number).

Method 3: Declare changes to tax registration information directly with the tax authority

- Place to submit application: Tax team where the individual registers permanent or temporary residence (in case the individual does not work at the income paying agency).

- Profile components:

+ Declaration of adjustment and supplement to tax registration information Form No. 08-MST issued with Circular 86/2024/TT-BTC to declare changes to tax registration information of the taxpayer himself.

+ Tax registration form No. 20-DK-TCT issued with Circular 86/2024/TT-BTC to change tax registration information of dependents.

+ A copy of the citizen identification card or a copy of the valid identity card for taxpayers/dependents who are Vietnamese nationals; a copy of the valid passport for taxpayers/dependents who are foreign nationals or Vietnamese nationals living abroad in case the tax registration information on these documents changes.

Source: https://hanoimoi.vn/ba-cach-ca-nhan-cap-nhat-thay-doi-thong-tin-dang-ky-thue-truoc-ngay-1-7-706177.html

![[Photo] Unique art of painting Tuong masks](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763094089301_ndo_br_1-jpg.webp)

![[Photo] Unique architecture of the deepest metro station in France](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763107592365_ga-sau-nhat-nuoc-phap-duy-1-6403-jpg.webp)

![[Photo] Special class in Tra Linh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/14/1763078485441_ndo_br_lop-hoc-7-jpg.webp)

Comment (0)