|

Samsung Galaxy S25 Edge. Photo: The Verge . |

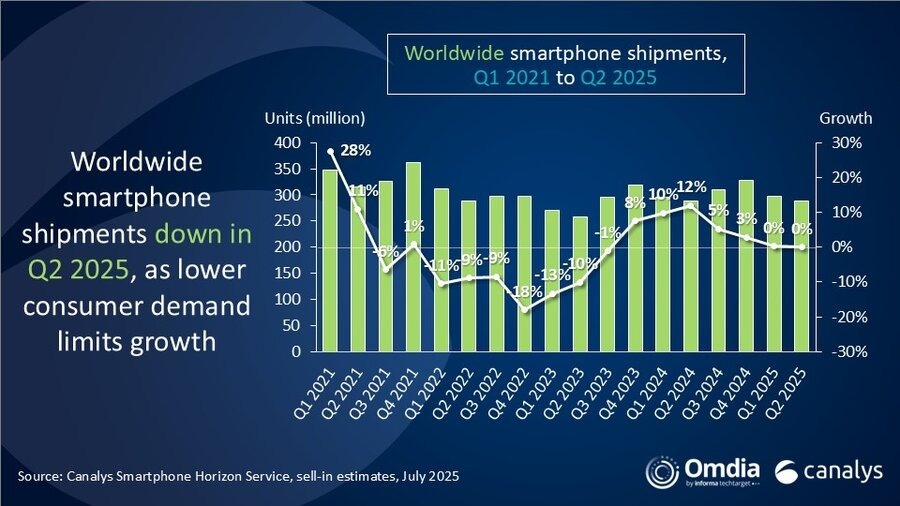

Data from market research firm Canalys shows that global smartphone sales in the second quarter fell slightly from the previous quarter to 288.9 million units.

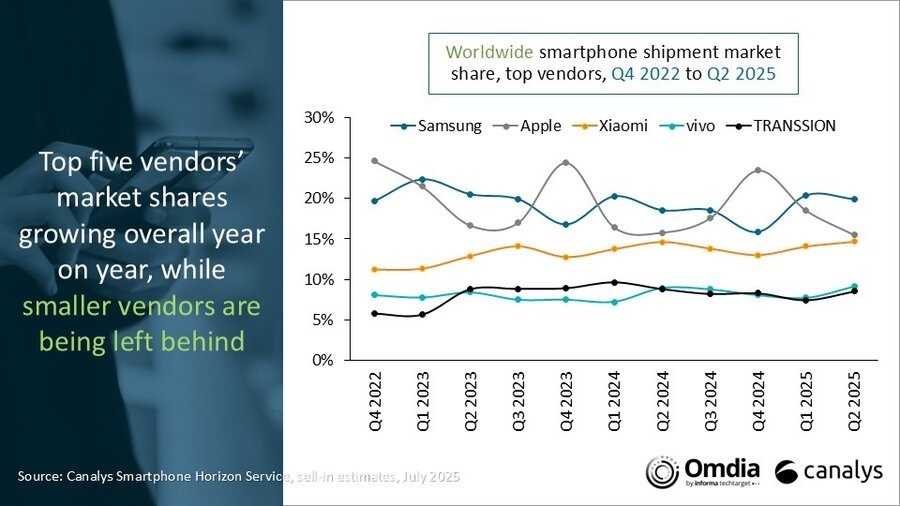

Samsung remained the market leader in the second quarter with sales of 57.5 million smartphones, up 7% year-on-year, driven mainly by the mass-market Galaxy A series. Meanwhile, iPhone sales fell 2% to 44.8 million units.

Xiaomi held the third position with 42.4 million smartphones sold, contributed by high growth rates in Latin America and Africa. Meanwhile, the Indian market contributed to Vivo's sales increasing by 2%, ranking fourth in terms of market share. The last name in the top 5 is Transsion with 24.6 million smartphones sold in the second quarter.

Galaxy S25 still creates attraction

Commenting on Samsung's leading position, analyst Aaron West from Omdia emphasized that this is the first time since Q4/2021 that the Korean company recorded the highest sales growth (7%) among the top 5 companies.

“Samsung has refocused on a smart sales strategy, aiming to expand profits for the Galaxy A series (which is intended for the mass market), while continuing to develop high-end models.

In particular, the low-cost A0x and A1x series drove the strongest sales in the second quarter, including the newly launched Galaxy A06 5G model, helping Samsung create appeal in emerging markets," West commented.

|

Total global smartphone sales from Q1/2021 to Q2/2025. Photo: Canalys . |

The Galaxy S25 series maintained stable sales despite lower-than-expected demand for the S25 Edge. According to analysts, Samsung's second-quarter sales mainly came from the trend of increasing imports into the US market, amid tariff concerns.

“While most vendors maintained stable sales in the second quarter, their success still depends on strong growth in some regions to offset weak demand elsewhere,” said Canalys analyst Manish Pravinkumar.

According to Pravinkumar, the Middle East and Africa were the main growth regions in the second quarter. In Africa, government policies, competition between vendors, the shift from feature phones to smartphones, combined with financial support models were factors that encouraged users to upgrade their phones.

In the Middle East, consumers are opting for premium smartphones thanks to buy-now-pay-later programs, Eid Al-Adha promotions, and collaborative efforts between retailers and suppliers to boost sales ahead of a busy product launch schedule in the second half of the year.

The name quietly rises

According to Canalys , Nothing was a standout performer in Q2. While it didn’t make the top five, the brand saw 177% year-on-year growth, with sales surpassing 1 million units for the first time.

Analysts say Nothing’s early success is largely coming from India. The general trend among companies today is to prioritize short-term profits while still investing in long-term business strategies.

|

Market share of 5 major smartphone brands from Q4/2022 to Q2/2025. Photo: Canalys . |

“Tight cost control and optimal planning of corporate resources are top priorities for large companies, as lofty goals in the past need to be adjusted to the actual context of 2025.

Many companies expect a vibrant period in the third quarter, focusing on AI tools, foldable and ultra-thin smartphones to create initial demand before entering the year-end shopping season," said analyst Sheng Win Chow from Canalys .

Despite the positive picture, Chow said that companies need to be cautious when approaching the market because consumers are not yet ready. In addition, the market adjustment after the massive import of goods into the US, combined with the subsidy policy in China, could have a negative impact.

“It is important for suppliers to work closely with channel partners to look for opportunities and balance inventory, which is crucial to avoid any missteps that could hamper the 2026 target,” Chow added.

Source: https://znews.vn/samsung-ban-nhieu-smartphone-nhat-quy-ii-post1573652.html

Comment (0)