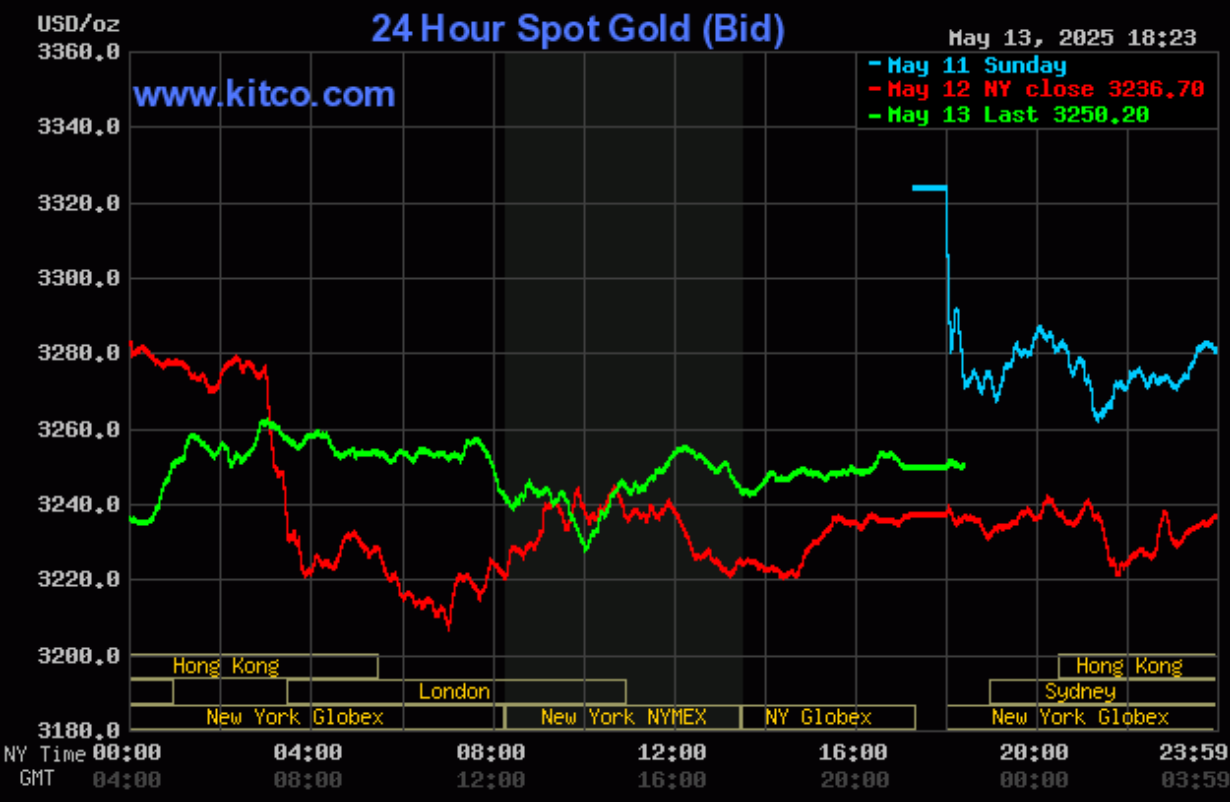

World gold price developments in the past 24 hours.

World market

At 05:24:28 on May 14, the spot gold price on Kitco stopped at 3,250.87 USD/ounce, up 24.88 USD/ounce, equivalent to an increase of 0.77% in the past 24 hours.

Converted at the current exchange rate at Vietcombank, world gold is equivalent to about 101,042 million VND/tael (excluding taxes and fees).

Converted according to the USD exchange rate on the free market (26,469 VND/USD), world gold costs about 103.4 million VND/tael (excluding taxes and fees).

Domestic market

At 5:30 a.m. on May 14, the price of 9999 gold bars at SJC and Doji, Bao Tin Minh Chau Company Limited was simultaneously listed at 118.5-120.5 million VND/tael (buy - sell).

PNJ Group alone listed SJC gold bars at 113 million VND/tael for selling and 115.5 million VND/tael for buying.

With the above price, SJC gold bars are about 17 million VND/tael more expensive than the world gold price.

For gold rings, DOJI brand in Hanoi and Ho Chi Minh City markets listed at 113 million VND/tael for buying and 115.5 million VND/tael for selling, an increase of 500,000 VND for both buying and selling prices.

The price of Bao Tin Minh Chau brand gold rings is listed at 116 million VND/tael for buying and 119 million VND/tael for selling, an increase of 1 million VND in both directions.

Phu Quy SJC is buying gold rings at 114 million VND/tael and selling at 117 million VND/tael, an increase of 1 million VND in both buying and selling prices compared to early this morning.

PNJ brand gold ring price is listed at 113 million VND/tael for buying and 115.5 million VND/tael for selling, an increase of 500,000 VND in both directions.

Forecast

Key supporting factors include the prolonged global geopolitical uncertainty, especially tensions in the Middle East, Ukraine and Asia-Pacific. In addition, the weakening trend of the US dollar and the loose monetary policy of the US Federal Reserve (Fed) are also fundamental factors supporting gold prices.

In addition, gold purchases from central banks - especially China, Russia, and Türkiye - continue to increase, creating a solid demand. Meanwhile, confidence in risky assets such as stocks and cryptocurrencies is still fluctuating strongly due to concerns about the global economic recession, high public debt and persistent inflation.

UOB Bank recently predicted that gold prices could reach $3,600 an ounce by the first quarter of 2026 as the dollar continues to weaken. The DXY index will fall below 97 points in the first quarter of next year, compared to the current level of 101.4 points./.

Source thoibaotaichinhvietnam

Source: https://baotayninh.vn/gia-vang-hom-nay-14-5-the-gioi-vang-mieng-vang-nhan-dong-loat-tang-manh-a190020.html

![[Photo] Prime Minister Pham Minh Chinh chairs conference on anti-smuggling, trade fraud, and counterfeit goods](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/14/6cd67667e99e4248b7d4f587fd21e37c)

Comment (0)