Domestic gold price today 7/17/2025

As of 4:30 a.m. on July 17, 2025, the domestic gold bar price is based on the closing price yesterday, July 16. Specifically:

DOJI Group listed the price of SJC gold bars at 118.6-120.6 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 118.6-120.6 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey listed the price of SJC gold at 118.6-120.6 million VND/tael (buy - sell), a decrease of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by the enterprise at 118.6-120.6 million VND/tael (buy - sell), the price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 117.9-120.6 million VND/tael (buy - sell), gold price decreased 500 thousand VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. on July 17, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 115.6-118.1 million VND/tael (buy - sell); the price remained the same for buying - decreased by 500 thousand VND/tael for selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 115.3-118.3 million VND/tael (buy - sell); the gold price decreased by 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, July 17, 2025 is as follows:

| Gold price today | July 17, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 118.6 | 120.6 | -500 | -500 |

| DOJI Group | 118.6 | 120.6 | -500 | -500 |

| Red Eyelashes | 119.6 | 120.6 | -400 | -400 |

| PNJ | 118.6 | 120.6 | -500 | -500 |

| Bao Tin Minh Chau | 118.6 | 120.6 | -500 | -500 |

| Phu Quy | 117.9 | 120.6 | -500 | -500 |

| 1. DOJI - Updated: 7/17/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 118,600 ▼500K | 120,600 ▼500K |

| AVPL/SJC HCM | 118,600 ▼500K | 120,600 ▼500K |

| AVPL/SJC DN | 118,600 ▼500K | 120,600 ▼500K |

| Raw material 9999 - HN | 108,300 ▼200K | 109,100 ▼500K |

| Raw material 999 - HN | 108,200 ▼200K | 109,000 ▼500K |

| 2. PNJ - Updated: July 17, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| HCMC - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Hanoi - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Hanoi - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Da Nang - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Da Nang - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Western Region - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Western Region - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - PNJ | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - Southeast | PNJ | 114,700 ▼500K |

| Jewelry gold price - SJC | 118,600 ▼500K | 120,600 ▼500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,700 ▼500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,700 ▼500K | 117,600 ▼600K |

| Jewelry gold price - Jewelry gold 999.9 | 114,200 ▼400K | 116,700 ▼400K |

| Jewelry gold price - Jewelry gold 999 | 114,080 ▼400K | 116,580 ▼400K |

| Jewelry gold price - Jewelry gold 9920 | 113,370 ▼390K | 115,870 ▼390K |

| Jewelry gold price - Jewelry gold 99 | 113,130 ▼400K | 115,630 ▼400K |

| Jewelry gold price - 750 gold (18K) | 80,180 ▼300K | 87,680 ▼300K |

| Jewelry gold price - 585 gold (14K) | 60,920 ▼230K | 68,420 ▼230K |

| Jewelry gold price - 416 gold (10K) | 41,200 ▼160K | 48,700 ▼160K |

| Jewelry gold price - 916 gold (22K) | 104,500 ▼360K | 107,000 ▼360K |

| Jewelry gold price - 610 gold (14.6K) | 63,840 ▼240K | 71,340 ▼240K |

| Jewelry gold price - 650 gold (15.6K) | 68,510 ▼260K | 76,010 ▼260K |

| Jewelry gold price - 680 gold (16.3K) | 72,010 ▼270K | 79,510 ▼270K |

| Jewelry gold price - 375 gold (9K) | 36,410 ▼150K | 43,910 ▼150K |

| Jewelry gold price - 333 gold (8K) | 31,160 ▼130K | 38,660 ▼130K |

| 3. SJC - Updated: 7/17/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 118,600 ▼500K | 120,600 ▼500K |

| SJC gold 5 chi | 118,600 ▼500K | 120,620 ▼500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 118,600 ▼500K | 120,630 ▼500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,200 ▼400K | 116,700 ▼400K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,200 ▼400K | 116,800 ▼400K |

| Jewelry 99.99% | 114,200 ▼400K | 116,100 ▼400K |

| Jewelry 99% | 110,450 ▼396K | 114,950 ▼396K |

| Jewelry 68% | 72,205 ▼272K | 79,105 ▼272K |

| Jewelry 41.7% | 41,668 ▼166K | 48,568 ▼166K |

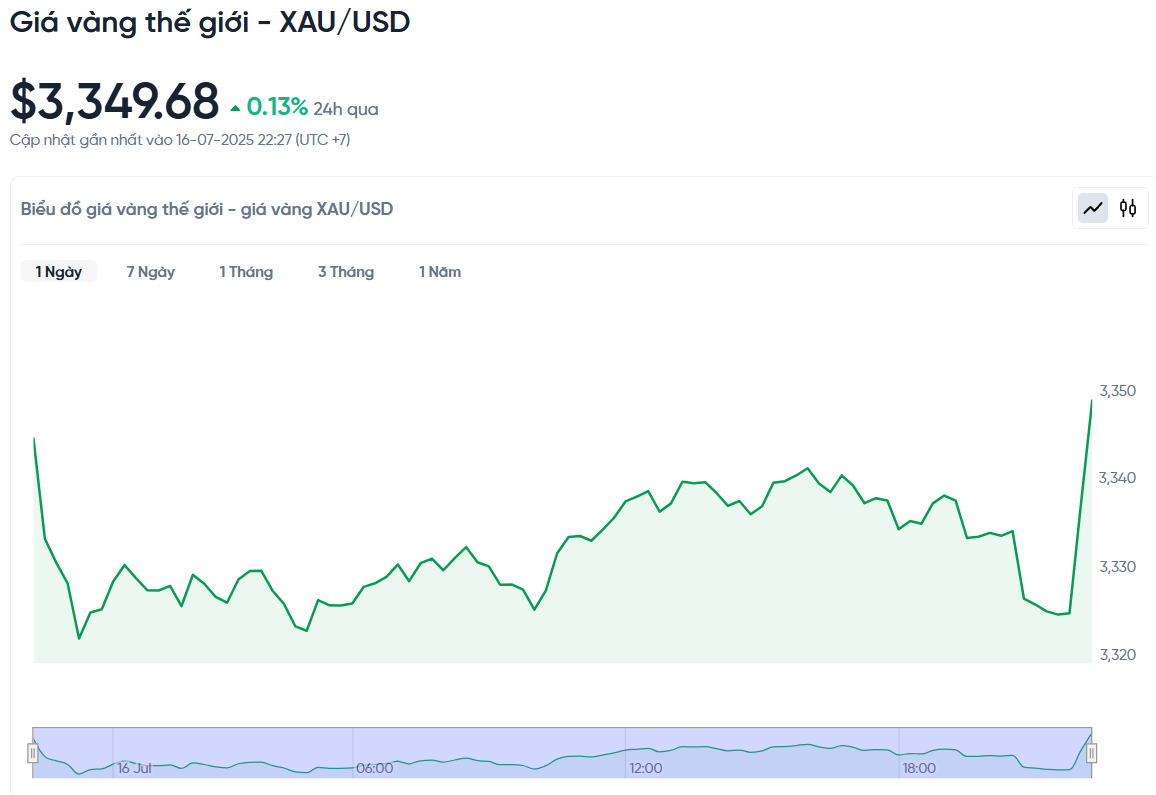

World gold price today July 17, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 17, Vietnam time, was 3,349.68 USD/ounce. Today's gold price increased by 4.33 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,330 VND/USD), the world gold price is about 109.8 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.8 million VND/tael higher than the international gold price.

World gold prices increased due to demand for safe assets amid geopolitical tensions and global trade policy instability.

Specifically, spot gold prices increased by 0.13%, while gold futures in the US decreased slightly by 0.1% to 3,333.60 USD/ounce. According to experts, conflicts in the Middle East and US tariff policies are creating many risks for the market.

"Geopolitical factors such as Israeli airstrikes and tough US trade policy are keeping the market uncertain. I expect gold prices to fluctuate between $3,250 and $3,476 in the near term," said Jim Wyckoff, senior analyst at Kitco Metals.

One of the main reasons for the increase in gold prices is the tension in the Middle East. According to Reuters, an Israeli airstrike targeted an area near the presidential palace in the Syrian capital Damascus.

In addition, the US tariff policy has also caused concern when President Donald Trump announced a 19% tax on goods from Indonesia. The European Union (EU) is also preparing retaliatory measures if trade negotiations with the US fail.

In addition, US economic data also supported gold prices when the producer price index (PPI) in June was unchanged from May, contrary to the forecast of a 0.3% increase. This raised doubts about the possibility of the Federal Reserve (Fed) cutting interest rates in the near future. Gold usually benefits in the context of low interest rates and economic uncertainty.

While gold prices have risen globally, demand in India, the world’s largest gold consumer, has fallen sharply. The country’s gold imports in June fell 40% from a year earlier, the lowest in more than two years, as high prices kept consumers on their toes.

Silver prices held steady at $37.73 an ounce, near a 14-year high, while platinum rose 1.6 percent to $1,393.51 and palladium rose 1.8 percent to $1,227.75.

Gold Price Forecast

Gold prices have been on the rise in recent days, thanks to factors such as rising inflation and trade tensions, making gold a rare bright spot in volatile global financial markets.

Not only gold, the world financial markets are also going through a difficult period. The MSCI global index fell 0.1%, while the European market also recorded a similar decline. In the UK alone, the pound rose slightly after the country's inflation reached its highest level in more than a year.

If the Fed continues to delay rate cuts and trade tensions escalate, gold prices are likely to maintain their upward momentum. In addition, geopolitical factors and the global economic situation will also have a strong impact on the trend of this precious metal.

Meanwhile, global oil prices fell slightly due to concerns about the negative impact of the trade war, despite strong oil demand from China. Investors are also waiting for second-quarter profit reports from major banks such as Goldman Sachs and Morgan Stanley to get a clearer view of the health of the US economy.

The recent surge in gold prices has prompted many central banks to change the way they store the precious metal. Instead of importing gold from abroad with hard currency as before, many countries are switching to buying gold directly from domestic mines. This approach not only saves foreign currency but also supports the development of the domestic gold mining industry.

Countries such as Colombia, Tanzania, Ghana, Zambia, Mongolia and the Philippines are leading the way. In Ghana, the government requires mining companies to sell 20% of their gold production to the central bank. Tanzania has a similar rule, requiring gold exporters to reserve at least 20% of their production for domestic sale.

Currently, gold prices are strongly supported at around $3,300/ounce. Analysts say gold needs more momentum to break through the $3,400 threshold and move towards the record high of $3,500/ounce set in April. One of the factors that could boost gold prices is the US Federal Reserve (Fed) cutting interest rates in the near future.

With the current trend, the increase in domestic gold purchases by central banks is expected to continue, especially in countries with abundant gold resources. This will not only help stabilize national reserves but also contribute to local economic development. Meanwhile, global gold prices will still be greatly influenced by the Fed's monetary policy and world economic developments.

Source: https://baonghean.vn/gia-vang-hom-nay-17-7-2025-gia-vang-trong-nuoc-roi-moc-121-trieu-vang-the-gioi-tang-nhe-10302443.html

Comment (0)