Domestic gold price today 7/23/2025

Gold price information as of 4:30 a.m. on July 23, 2025, domestic gold bar price according to yesterday's closing price, July 21. Specifically:

DOJI Group listed the price of SJC gold bars at 120-122 million VND/tael (buy - sell), the price remained unchanged in the buying direction - increased 500 thousand VND/tael in the selling direction compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 120-122 million VND/tael (buy - sell), the price remained unchanged in the buying direction - increased by 500 thousand VND/tael in the selling direction compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 120.8-121.8 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 300 thousand VND/tael for both buying and selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 120-121.5 million VND/tael (buy - sell), the price remains unchanged in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 119.5-122 million VND/tael (buy - sell), gold price increased by 300 thousand VND/tael in buying direction - increased by 800 thousand VND/tael in selling direction compared to yesterday.

As of 4:30 a.m. on July 23, 2025, the price of 9999 Hung Thinh Vuong round gold rings at DOJI was listed at 116.6-119.1 million VND/tael (buy - sell); the price increased by 500,000 VND/tael in both buying and selling directions compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 116.3-119.3 million VND/tael (buy - sell); the gold price remained unchanged in both buying and selling directions compared to yesterday.

The latest gold price list today, July 23, 2025 is as follows:

| Gold price today | July 23, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 120 | 122 | - | +500 |

| DOJI Group | 120 | 122 | - | +500 |

| Red Eyelashes | 120.8 | 121.8 | +300 | +300 |

| PNJ | 120 | 122 | - | +500 |

| Bao Tin Minh Chau | 120 | 121.5 | - | - |

| Phu Quy | 119.5 | 122 | +300 | +800 |

| 1. DOJI - Updated: 7/23/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 120,000 | 122,000 ▲500K |

| AVPL/SJC HCM | 120,000 | 122,000 ▲500K |

| AVPL/SJC DN | 120,000 | 122,000 ▲500K |

| Raw material 9999 - HN | 109,300 ▲500K | 110,100 ▲500K |

| Raw material 999 - HN | 109,200 ▲500K | 110,000 ▲500K |

| 2. PNJ - Updated: July 23, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| HCMC - SJC | 120,000 | 122,000 ▲500K |

| Hanoi - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Hanoi - SJC | 120,000 | 122,000 ▲500K |

| Da Nang - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Da Nang - SJC | 120,000 | 122,000 ▲500K |

| Western Region - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Western Region - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - PNJ | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 116,000 ▲900K |

| Jewelry gold price - SJC | 120,000 | 122,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 116,000 ▲900K |

| Jewelry gold price - Kim Bao Gold 999.9 | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 116,000 ▲900K | 119,000 ▲1000K |

| Jewelry gold price - Jewelry gold 999.9 | 115,000 ▲500K | 117,500 ▲500K |

| Jewelry gold price - Jewelry gold 999 | 114,880 ▲500K | 117,380 ▲500K |

| Jewelry gold price - Jewelry gold 9920 | 114,160 ▲500K | 116,660 ▲500K |

| Jewelry gold price - Jewelry gold 99 | 113,930 ▲500K | 116,430 ▲500K |

| Jewelry gold price - 750 gold (18K) | 80,780 ▲380K | 88,280 ▲380K |

| Jewelry gold price - 585 gold (14K) | 61,390 ▲290K | 68,890 ▲290K |

| Jewelry gold price - 416 gold (10K) | 41,530 ▲210K | 49,030 ▲210K |

| Jewelry gold price - 916 gold (22K) | 105,230 ▲460K | 107,730 ▲460K |

| Jewelry gold price - 610 gold (14.6K) | 64,330 ▲310K | 71,830 ▲310K |

| Jewelry gold price - 650 gold (15.6K) | 69,030 ▲330K | 76,530 ▲330K |

| Jewelry gold price - 680 gold (16.3K) | 72,550 ▲340K | 80,050 ▲340K |

| Jewelry gold price - 375 gold (9K) | 36,710 ▲180K | 44,210 ▲180K |

| Jewelry gold price - 333 gold (8K) | 31,430 ▲170K | 38,930 ▲170K |

| 3. SJC - Updated: 7/23/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 120,000 | 122,000 ▲500K |

| SJC gold 5 chi | 120,000 | 122,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 120,000 | 122,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 115,000 ▲500K | 117,500 ▲500K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 115,000 ▲500K | 117,600 ▲500K |

| Jewelry 99.99% | 115,000 ▲500K | 116,900 ▲500K |

| Jewelry 99% | 111,242 ▲495K | 115,742 ▲495K |

| Jewelry 68% | 72,750 ▲340K | 79,650 ▲340K |

| Jewelry 41.7% | 42,002 ▲208K | 48,902 ▲208K |

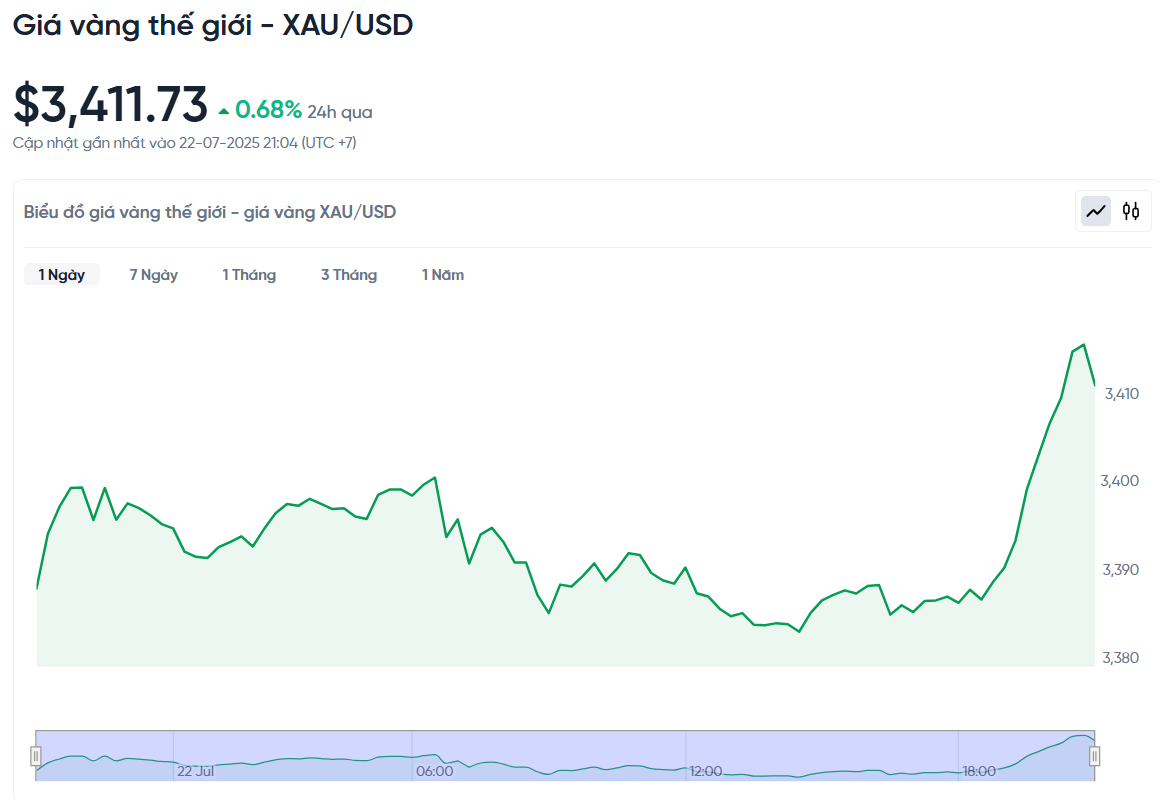

World gold price today 7/23/2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 a.m. on July 23, Vietnam time, was 3,411.73 USD/ounce. Today's gold price increased by 20.71 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,320 VND/USD), the world gold price is about 111.77 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 10.23 million VND/tael higher than the international gold price.

World gold prices rose sharply to a one-month high amid US-EU trade tensions. Meanwhile, the market is awaiting moves related to trade negotiations before the August 1 deadline of US President Donald Trump.

Specifically, spot gold prices increased by 0.68%, breaking the important level of 3,400 USD/ounce, while gold futures prices in the US also increased by 0.87% to 3,436.42 USD/ounce.

One of the main reasons for the rise in gold prices is the significant weakness of the US dollar. The ICE Dollar Index, which measures the strength of the greenback, fell 0.62 points to 97.86. When the US dollar falls, gold becomes cheaper for investors using other currencies, thereby boosting demand.

In addition, US government bond yields also fell significantly. Specifically, the yield on 2-year bonds fell to 3.854%, while the yield on 10-year bonds fell to 4.366%. This means that investors will receive less interest when holding bonds, making gold more attractive.

Gold was also supported by concerns about trade tensions between the US and its partners. US Commerce Secretary Howard Lutnick confirmed that a 10% tariff will be imposed if negotiations fail by August 1. This statement shows that the US is still maintaining a tough stance, causing many investors to worry about the possibility of a new trade war.

The European Union (EU) is also preparing retaliatory measures, dampening hopes of a trade deal in the near future. This instability has many people looking to gold as a safe haven.

Investors are also awaiting the US Federal Reserve's monetary policy meeting next week. The Fed is expected to keep interest rates unchanged for the time being and may start cutting them in October. Gold tends to rise in price in low-interest-rate environments and when there is geopolitical or economic uncertainty.

Besides gold, silver price decreased 0.2% to 38.86 USD/ounce, platinum increased slightly 0.2% to 1,440.47 USD, and palladium decreased 0.9% to 1,253.65 USD.

Gold Price Forecast

Investors are focused on an upcoming speech by Federal Reserve Chairman Jerome Powell, who is under pressure from the Trump administration to resign. Markets are also awaiting the Johnson Redbook weekly retail sales report and the Richmond Fed business survey.

Gold prices could find strong support if the US dollar continues to weaken, said Suki Cooper, precious metals analyst at Standard Chartered Bank. While gold may not be as strong as it was earlier this year when the tariff news broke, the inverse relationship between gold and the greenback remains strong. Whenever the US dollar falls, gold tends to rise, she said.

Not only that, gold is attracting great interest from investors in the UK. The Royal Mint recorded record high online sales of gold, silver and platinum in the last quarter. Notably, the price of gold in British pounds hit a new record when it surpassed 2,500 pounds/ounce in April, stimulating strong investment demand.

The market is waiting for the US Federal Reserve's policy meeting at the end of July. If the Fed signals a rate cut in September or the US dollar continues to weaken, gold prices could surpass the $3,400/ounce threshold.

CPM Group issued a buy recommendation for gold with an initial target of $3,425 in early August. Shortly after the forecast was issued, gold prices briefly hit $3,381.60 and fluctuated between $3,320 and $3,400 in the following days. CPM Group remains optimistic that gold prices could rebound and reach the target of $3,425 or higher by mid-August.

The World Gold Council (WGC) predicts that gold prices are likely to grow strongly this year, possibly even reaching $4,000 an ounce by the end of the year. However, the WGC also warns that annual growth may be modest, depending on geopolitical and macroeconomic factors.

Technically, the bulls still have the upper hand in the August gold futures market. Their next target is to push the price above the strong resistance at the June high of $3,476.30. Meanwhile, the bears are aiming to push the price below the important support level at $3,300.

In the short term, the first resistance is at this week’s high of $3,416.90, followed by $3,450. On the support side, the first level to watch is at $3,375, followed by this week’s low of $3,351. The market is currently tilted to the bulls with a score of 7.0/10, according to Wyckoff.

Source: https://baonghean.vn/gia-vang-hom-nay-23-7-2025-gia-vang-trong-nuoc-va-the-gioi-tang-tien-pha-vo-muc-quan-trong-10302905.html

![[Photo] Signing of cooperation between ministries, branches and localities of Vietnam and Senegal](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/24/6147c654b0ae4f2793188e982e272651)

Comment (0)