Crude oil prices plunged another week

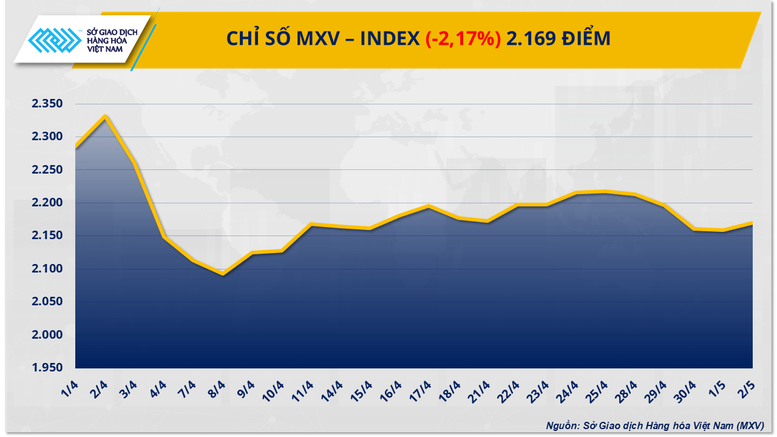

According to MXV, oil prices have just experienced their second consecutive week of decline as the global market faces many uncertainties regarding supply, while investor sentiment is under pressure amid many concerns about the health of the world's number one economy .

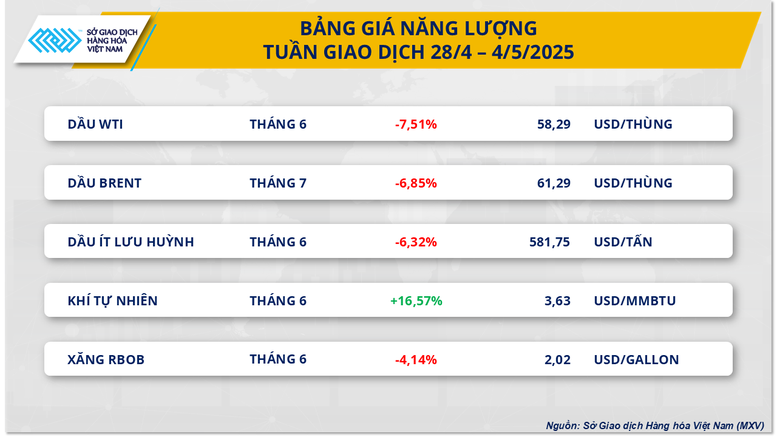

At the end of the week, Brent crude oil price stopped at 61.29 USD/barrel, down 6.85%. WTI crude oil also recorded a decline of 7.51%, falling below the 60 USD/barrel threshold and closing at 58.29 USD/barrel.

The downward pressure on prices mainly comes from speculation that OPEC+ will continue to increase production sharply in June, following the decision to increase production in May. This information, which appeared on April 23, has caused Brent and WTI oil prices to fall sharply in the first three sessions of the week, with a decrease of 5.61% and 7.63%, respectively, in just three days from April 28 to April 30. This information becomes even more negative when some OPEC+ members still produce more than their quotas, raising concerns about oversupply in the market. Notably, the meeting between the 8 OPEC+ member countries was also moved up two days earlier than expected on May 3, making the market wait even longer for the decision on June production.

In addition to the supply factor, a series of negative macroeconomic data from the US also contributed to increasing pressure on oil prices. In the three days from April 29 to May 1, negative indicators were continuously announced, from the narrowing of the labor market, the decline in consumer confidence to the first decline in GDP in the first quarter of 2025 of the US in the past three years. Concerns about the US economic outlook led to doubts about future oil consumption demand.

However, investors still have expectations about the possibility of reaching new trade agreements between the US and major partners, especially between the US and China; information that helps to curb the decline in oil prices.

In addition, the decline in US crude oil reserves as well as the decline in oil exports from Venezuela also contributed to the support for oil prices. In addition, the unstable developments in the US-Iran relationship also made the market speculate about the prospect of no more supply from Iran, the main reason for the only price recovery session this week on International Labor Day, May 1.

Agricultural product price list is flooded with red

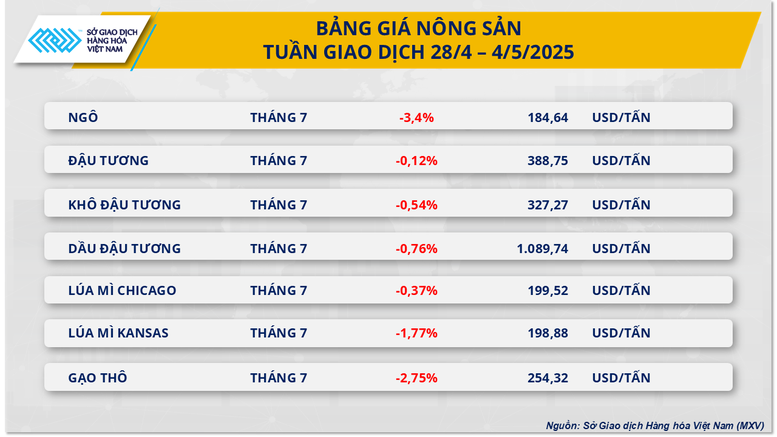

At the end of the last trading week, the agricultural market recorded negative developments when all 7 commodities in the group weakened. In particular, the corn and wheat markets simultaneously closed the trading week in red, clearly reflecting the impact of supply and demand factors as well as technical developments.

Corn prices alone recorded their third consecutive weekly decline, losing about 3.4% to $184 per ton, while wheat prices fell slightly by 0.37% to $199 per ton thanks to strong recovery in the last sessions of the week.

Source: https://baochinhphu.vn/luc-ban-bao-trum-mxv-index-roi-manh-xuong-2169-diem-102250505085652365.htm

![[Photo] Prime Minister Pham Minh Chinh chairs the 16th meeting of the National Steering Committee on combating illegal fishing.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759848378556_dsc-9253-jpg.webp)

![[Photo] Super harvest moon shines brightly on Mid-Autumn Festival night around the world](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/07/1759816565798_1759814567021-jpg.webp)

Comment (0)