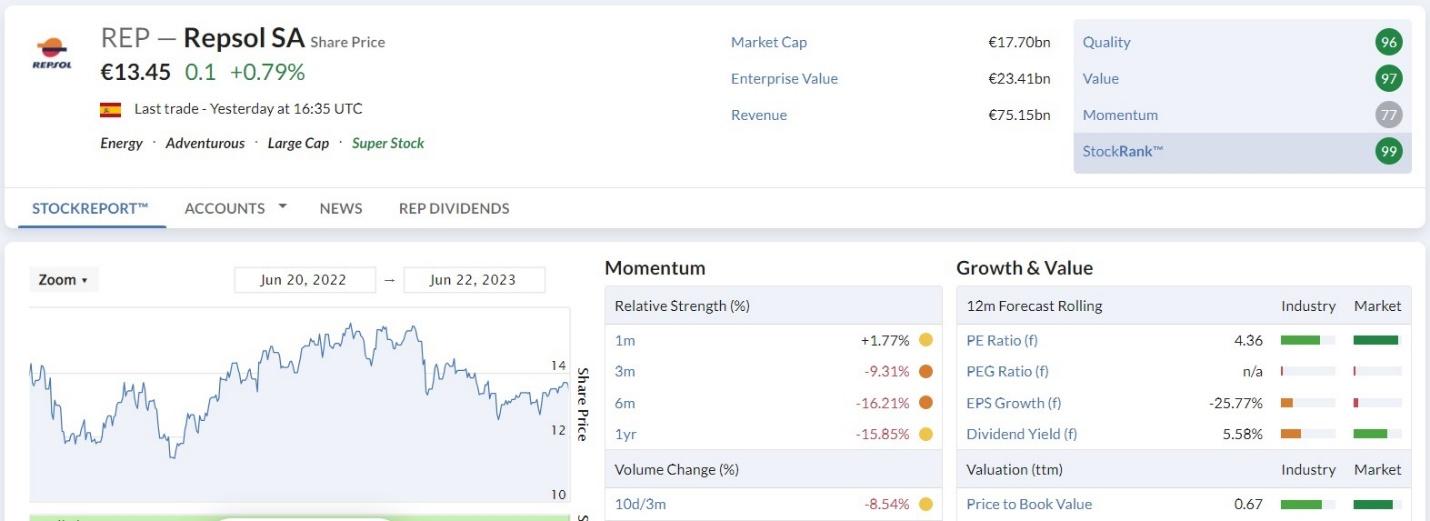

Repsol SA Energy Group (REP)

Oil prices on the international market have increased since mid-June after Saudi Arabia, the world's largest crude oil exporter, pledged to cut production in July, while the Organization of the Petroleum Exporting Countries and its allies (OPEC+) agreed to extend supply cuts to 2024. At the recent OPEC+ meeting, Saudi Arabia said it would cut production by about 1 million barrels per day to 9 million barrels per day.

OPEC+ produces about 40% of the world's crude oil, meaning its policy decisions can have a significant impact on oil prices. Moreover, according to the International Energy Agency (IEA), oil prices are likely to rise further after the OPEC+ decision. In addition, the Chinese economy is also the most important link in the oil market.

ANZ Group Holdings Limited analysts recently reiterated their predicted Brent price target of $100 a barrel by the end of 2023. Goldman Sachs alone expects Brent to be at $95 a barrel by December.

Oil prices are expected to rise significantly this year amid high demand and tight supplies, and Repsol has a stable foothold in this business.

In March 2023, Repsol completed the sale of a 25% stake in its upstream business to EIG as a strategic partner in its Exploration and Production business. The deal valued Repsol’s upstream operations at USD 19 billion, further enhancing the value and supporting the decarbonization of its asset portfolio.

In the same month, Repsol and transport company SEUR signed a strategic agreement to promote electric transport in Spain. Under the agreement, Repsol will install and operate more than 150 charging points at SEUR’s 55 hubs across Spain.

REPYY currently has one of the most important charging networks in Spain, with more than 1,200 public charging points installed, of which more than 530 are operational.

REP stock is trading at 3.56x, 59.9% lower than the industry average of 8.89x.

Repsol's cash flow from operations was EUR 1.61 billion in the first quarter ended March 31, 2023, up 128.1% year-on-year. Additionally, as of March 2023, the company's cash and cash equivalents were EUR 5.49 billion, while its total assets were EUR 60.12 billion.

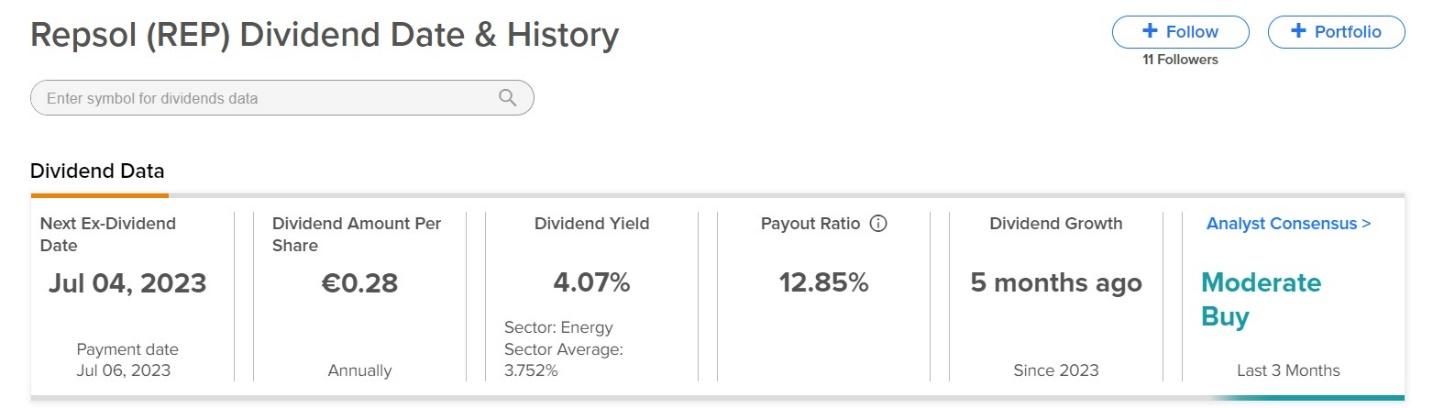

REP shares have risen nearly 19% since bottoming in September 2022 and have been consolidating for quite a while in the EUR 12.5 – 14.5 base range. Repsol will soon pay a dividend of EUR 0.28 with the ex-dividend date before July 4, payable on July 6.

Repsol, like other European energy companies, benefited in 2022 from high oil and gas prices, but is now facing the reality that much lower oil and gas prices will also partly affect revenues in the first months of 2023. Renta 4 Banco analyst Alfonso Batalla said that despite the lower oil and gas prices, Repsol's overall performance was still above market expectations.

Source

![[Maritime News] More than 80% of global container shipping capacity is in the hands of MSC and major shipping alliances](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/7/16/6b4d586c984b4cbf8c5680352b9eaeb0)

Comment (0)