Contrary to the predictions of many securities companies about the recovery scenario, the index representing the Ho Chi Minh City Stock Exchange only increased in the first few minutes of the session, then corrected sharply. The selling pressure became more and more intense, causing the index to fall to nearly 1,600 points at times.

Cash flow found some stocks that fell deeply in the afternoon session, helping the VN-Index narrow its range, but it was not enough to reverse the situation. The index closed at 1,614 points, down 31 points from the reference.

Two consecutive sessions of deep decline caused the VN-Index to be "blown away" by nearly 74 points, returning to the mid-month price range. Some analysis groups have lowered their forecasts for the short-term outlook from bullish to neutral.

Ho Chi Minh City Stock Exchange today had 233 stocks closing below reference, double the number of stocks increasing. Red also dominated the large-cap basket with 23 stocks decreasing, while only 5 stocks increased.

The banking group was the main factor causing the index to correct deeply. All stocks in this group closed below the reference, in which many stocks that had just experienced a rapid increase such as VIB, EIB, OCB... all decreased by the entire amplitude. 9 out of 10 stocks at the top of the list of stocks with the most negative impact on the VN-Index belonged to this group. Large-cap stocks such as VPB, ACB,SHB , BID all changed status from increasing to decreasing by more than 5%.

Other sectors saw strong differentiation. In the securities group, VIX, VND, VCI and HCM all made strong adjustments of over 2.6%. Meanwhile, SSI remained green throughout the session and closed with an increase of 2.5%. ORS of Tien Phong Securities Company also had a similar increase, even reaching the ceiling price at times.

The performance of the real estate group was similar. KDH, NLG, HDG, PDR were all under selling pressure, causing their market prices to lose 1-6%, while NVL, DXG, QCG, SCR went against the market trend to increase.

Vingroup -related stocks are an important pillar for the market. VIC increased by 5.6% to VND131,000 today, while VHM also closed in the green, although the increase was only 0.3%.

Cautious investor sentiment, focusing on reducing the proportion of stocks in the investment portfolio, caused market liquidity to decrease sharply. The volume of shares traded today reached 1.5 billion, about 700 million shares lower than last weekend. The transaction value also decreased sharply from over 62,000 billion VND to 42,000 billion VND. This is the session with the lowest matched value in the past 3 weeks.

SSI topped the liquidity rankings with over VND2,550 billion. VPB, SHB and HPG shared the next positions with about VND1,800-2,300 billion each.

Foreign investors extended their net selling streak to 13 consecutive sessions. This group disbursed about VND4,050 billion, but sold more than VND5,760 billion. HPG was the focus of foreign investors' selling with a net volume of more than 22 million shares, followed by VPB and STB.

PV (synthesis)Source: https://baohaiphong.vn/vn-index-tiep-tuc-giam-sau-dong-cua-tai-1-614-diem-519086.html

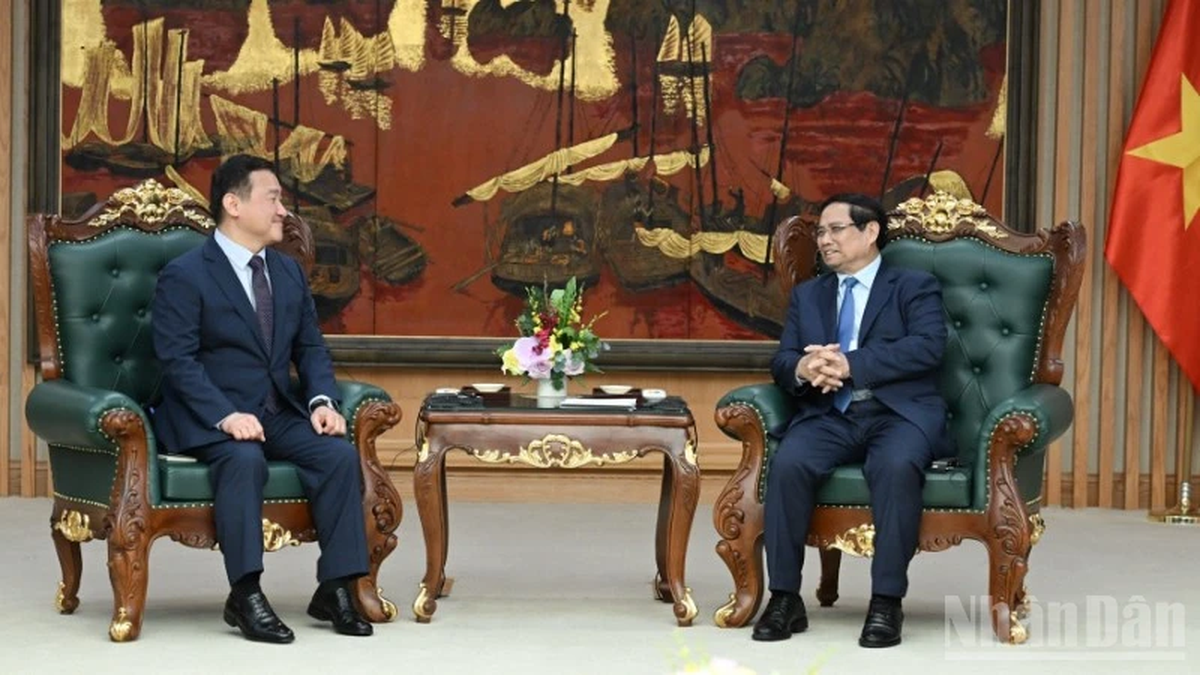

![[Photo] Prime Minister Pham Minh Chinh receives CEO of Samsung Electronics](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/373f5db99f704e6eb1321c787485c3c2)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting of National Steering Committee on International Integration](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/9d34a506f9fb42ac90a48179fc89abb3)

![[Photo] Multi-colored cultural space at the Exhibition "80 years of the journey of Independence - Freedom - Happiness"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/26/fe69de34803e4ac1bf88ce49813d95d8)

Comment (0)