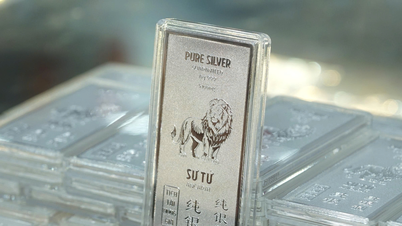

Today's silver price is listed at 900,000 VND/tael for buying and 945,000 VND/tael for selling in Hanoi. The silver price in Ho Chi Minh City is listed higher at 901,000 VND/tael for buying and 946,000 VND/tael for selling. The world silver price is at 732,000 VND/ounce for buying and 737,000 VND/ounce for selling.

Specifically, the latest information on silver prices today in the two largest markets of Hanoi and Ho Chi Minh City on September 13, 2024:

Silver type | Unit | Hanoi | Ho Chi Minh City | ||

Buy | Sell out | Buy | Sell out | ||

99.9 silver | 1 amount | 900,000 | 945,000 | 901,000 | 946,000 |

| 1 kg | 23,991,000 | 25,189,000 | 24,029,000 | 25,235,000 | |

| Silver 99.99 | 1 amount | 905,000 | 945,000 | 906,000 | 950,000 |

| 1 kg | 24,139,000 | 25,201,000 | 24,159,000 | 25,338,000 | |

Latest update on world silver prices on September 13, 2024

| Unit | World silver price today (VND) | |

Buy | Sell out | |

| 1 Ounce | 732,000 | 737,000 |

| 1 finger | 88,287 | 88,880 |

| 1 amount | 883,000 | 889,000 |

| 1 kg | 23,543,000 | 23,701,000 |

The metal market had a good trading day as all commodities increased in price. For precious metals, silver and platinum prices both increased by more than 1%, closing at $28.93/ounce and $956.2/ounce, respectively. Precious metal prices benefited after the US announced cooling inflation data, helping the market confirm that the US Federal Reserve (FED) will cut interest rates by 25 basis points at its September meeting.

Specifically, according to data released by the US Department of Labor's Bureau of Labor Statistics yesterday, the country's consumer price index (CPI) increased 2.5% year-on-year in August, in line with forecasts and down from the previous month's 2.9% increase. In addition, the core CPI, which excludes volatile energy and food prices, held at 3.2% for the second consecutive month. However, on a monthly basis, the core CPI unexpectedly increased 0.3% in August. This figure was 0.1 percentage point higher than forecasts and the highest level in the past four months.

The unexpected monthly increase in core CPI data has dampened the case for a large-scale rate cut by the Fed. However, overall, the report continues to confirm that US inflation remains on track to fall back to the 2% target, allowing the Fed to cut interest rates at next week's meeting, expected to be by 25 basis points. Silver and platinum prices have also benefited as the low interest rate environment is a favorable investment environment for precious metals.

Source: https://congthuong.vn/gia-bac-hom-nay-1392024-bac-the-gioi-tiep-tuc-khoi-sac-345497.html

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763715853195_ndo_br_bnd-6440-jpg.webp&w=3840&q=75)

![[Photo] Visit Hung Yen to admire the "wooden masterpiece" pagoda in the heart of the Northern Delta](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763716446000_a1-bnd-8471-1769-jpg.webp&w=3840&q=75)

![[Photo] General Secretary To Lam receives President of the Senate of the Czech Republic Milos Vystrcil](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763723946294_ndo_br_1-8401-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong receives Speaker of the Korean National Assembly Woo Won Shik](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F21%2F1763720046458_ndo_br_1-jpg.webp&w=3840&q=75)

Comment (0)