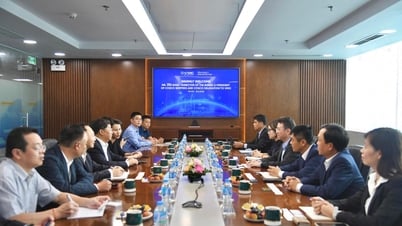

Recently, in Hanoi, the event of the Banking Industry Digital Transformation Day 2025 took place, promoting the implementation of technology application solutions, realizing the task of digital transformation "for the whole people, comprehensively, throughout the process to accelerate and break through the development of the digital economy" of the industry as well as the general orientation of the Government in the strategy of promoting science and technology, innovation and digital transformation. The event was attended by Politburo member, Prime Minister Pham Minh Chinh; Governor of the State Bank Nguyen Thi Hong, Deputy Governor of the State Bank Pham Tien Dung and leaders of the State Bank (SBV); representatives of Ministries/Departments/Industries and many banks and credit institutions in Vietnam.

Continuing the success of previous years, this year's banking digital transformation event with the theme "Smart digital ecosystem in the new era" will be a place to share achievements in digital transformation, cashless payments... In parallel, the event is also a place to exhibit and display digital transformation products, services, and applications in banking activities with 19 booths of commercial banks, payment intermediary companies, and domestic digital transformation solution providers...

Banks have been constantly promoting and improving their infrastructure to launch many friendly and convenient products and services, bringing practical values to meet the diverse needs of customers. Many basic operations such as savings deposits, opening accounts, opening cards, etc. have been completely digitized. Many credit institutions in Vietnam have a rate of more than 90% of transactions conducted on digital channels. To date, more than 87% of Vietnamese adults have bank accounts, and non-cash payments have grown positively.

Attending this year's event with other credit institutions, KienlongBank representative Mr. Tran Ngoc Minh - Chairman of the Board of Directors directly reported to the Prime Minister , Governor, State Leaders, Leaders of Ministries/Departments/Sectors on the results achieved in the Bank's digital transformation activities. One of the factors that creates a difference and brings digital imprints at KienlongBank is the spirit of technological autonomy, mastery of strategic technologies, core technologies and promoting technology application to improve the experience as well as increase surplus value for customers in the new era.

With that spirit, KienlongBank brought to the event a smart, all-powerful digital ecosystem with a variety of products and services, maximally meeting the needs of many different customer segments and groups such as: KienlongBank Plus application; MyShop & Paybox solution set; KienlongBank Pay solution set; X-Digi digital banking model...

The highlight of KienlongBank at this event is the AI Teller solution, an advanced AI version researched and developed by KienlongBank staff in the spirit of mastering technology.

Integrated on the X-Digi system, with a friendly interface, understanding natural language, KienlongBank's AI Teller can: guide customers to make transactions 24/7; provide specialized, specialized, personalized services, thereby helping customers, especially customers in remote areas, save time, easily access financial services, and also help reduce operating costs at the Bank.

AI tellers are continuously trained by KienlongBank on a huge data warehouse and can develop unlimited consulting and customer communication capabilities, fully personalizing to the needs of different customers.

With the goal of taking customers and businesses as the center of service, promoting the application of innovative products and services, developing a smart, interconnected and secure digital ecosystem, aiming at the goal of comprehensive, all-people digital transformation to accelerate and break through the development of the digital economy , the banking industry has been making pioneering efforts to closely follow the direction of the Party and Government in the process of national digital transformation.

In the era of development, with the spirit of mastering technology, KienlongBank is always ready with all resources to bring products and services, sharing increasingly high benefits for society and people; Bringing the most modern technology to all regions, especially remote areas according to the direction of the Government and the State Bank.

Towards the proud 30-year milestone (October 27, 1995 - October 27, 2025), KienlongBank strongly affirms its sustainable innovation, bringing real values to customers, investors, as well as the community and society. At the same time, the Bank also continues to affirm its position on the financial map to accompany and contribute to the development of the country in the era of national development.

Source: https://baodaknong.vn/chuyen-doi-so-ngan-hang-2025-xay-dung-he-sinh-thai-so-thong-minh-trong-ky-nguyen-moi-254026.html

![[Photo] General Secretary To Lam receives Chief of the Central Office of the Lao People's Revolutionary Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/140435f4b39d4599a3d17975dfb444c5)

![[Photo] A delegation of 100 journalists from the Vietnam Journalists Association visits the soldiers and people of Truong Sa island district.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/0984a986227d4e988177f560d2e1563e)

![[Photo] National Conference "100 years of Vietnamese Revolutionary Press accompanying the glorious cause of the Party and the nation"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/1cf6cd5c8a934ebfa347028dcb08358c)

![[Photo] Journalists moved to tears at the Memorial Service for the soldiers who died in Gac Ma](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/9454613a55c54c16bf8c0efa51883456)

Comment (0)