At the close of trading on June 5, the share price of the Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ) on the HoSE increased by 3.3% compared to the session at the end of last week to 98,000 VND/share, setting a new all-time high. This morning, at one point, VCB shares increased to 98,300 VND/share.

From there, Vietcombank's market capitalization increased to more than VND 463,786 billion (about USD 19.7 billion) at the end of the trading session, equivalent to an increase of about VND 173,000 billion compared to the bottom in October 2022.

VCB stock price movements (Source: TradingView).

This capitalization is nearly twice as large as the next stock, Vinhomes Joint Stock Company with code VHM (VND 233,829 billion).

Two other banking "giants" BIDV and VietinBank have capitalization ranked 3rd and 7th respectively, reaching 227,634 billion VND and 138,886 billion VND.

Also in the Top 10 stocks with the largest capitalization on the HoSE floor are two banks, VPBank and Techcombank, ranked 8th and 10th, with a scale of nearly VND 133,857 billion and VND 113,607 billion.

Vietcombank's stock price hit a new peak after the bank was approved to increase its charter capital to VND55,891 billion, leading the Big 4 banks and becoming the bank with the second largest charter capital in the system, after VPBank.

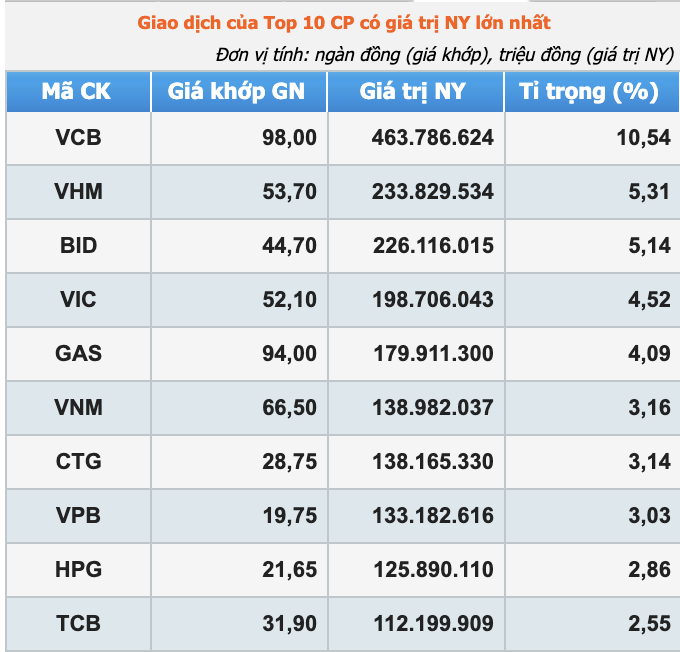

Top 10 stocks with the largest listed value on June 5 (Source: HoSE).

Specifically, the State Bank has approved Vietcombank's form of charter capital increase by issuing shares to pay dividends from the remaining profits of 2019 and 2020, which was previously approved by Vietcombank's 2022 Annual General Meeting of Shareholders.

Accordingly, Vietcombank plans to issue 856.5 million shares to pay dividends, corresponding to an issuance ratio of 18.1%. That means shareholders owning 1,000 shares at the time of issuance will receive 181 new shares.

The capital for implementation is taken from the remaining profit in 2019 after tax, after setting aside funds, distributing cash dividends, distributing stock dividends according to the Charter Capital Increase Plan in 2021 and the remaining profit in 2020 after tax, after setting aside funds and distributing cash dividends .

Source

![[Photo] Cat Ba - Green island paradise](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F04%2F1764821844074_ndo_br_1-dcbthienduongxanh638-jpg.webp&w=3840&q=75)

![[VIMC 40 days of lightning speed] Da Nang Port: Unity - Lightning speed - Breakthrough to the finish line](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/04/1764833540882_cdn_4-12-25.jpeg)

Comment (0)