Southeast Asia Commercial Joint Stock Bank ( SeABank – HoSE: SSB) has just announced its audited semi-annual financial report for 2023, with pre-tax profit of only VND 2,016 billion.

Specifically, net interest income - the bank's main source of revenue, although slightly increased compared to the same period, reaching more than VND 3,303 billion, service activities and foreign exchange trading brought in VND 365 billion and VND 71 billion respectively, down 52% and 85% compared to the first half of 2022.

The two segments that brought in extraordinary revenue at the end of 2022, trading securities and investment securities, also declined due to the unfavorable performance of the stock market in the first months of the year.

In addition, the bank's operating expenses increased by 10% to over VND1,683 billion. During the period, SeABank reduced its credit risk provision to VND516 billion.

According to the bank's board of directors, in 2023, the economy is forecast to have many fluctuations, so SeABank aims for sustainable and certain development.

SeABank's General Meeting of Shareholders approved the 2023 business plan, including: Total assets increase by 10%; Net increase in mobilized capital of VND 18,000 billion (up 12% compared to 2022, in which priority is given to growth in demand deposits (CASA); Net increase in credit of VND 16,200 billion; Pre-tax profit of more than VND 5,633 billion. In addition, SeABank will also focus on risk management and control bad debt at less than 3%.

As of June 30, 2023, the bank's total assets reached VND245,206 billion, up 6% compared to the beginning of the year. Customer loans increased slightly by 5.2% to VND159,125 billion. Deposits from customers increased slightly by 5.64% to VND144,788 billion.

In the first half of 2023, SeABank also received additional foreign capital. By June 30, 2023, the total capital mobilized from international organizations reached nearly 11,772 billion VND, an increase of 26.15% compared to the end of 2022.

The bank said that this mobilized capital is used to serve SeABank's business activities in the trend of diversifying and globalizing operating capital sources.

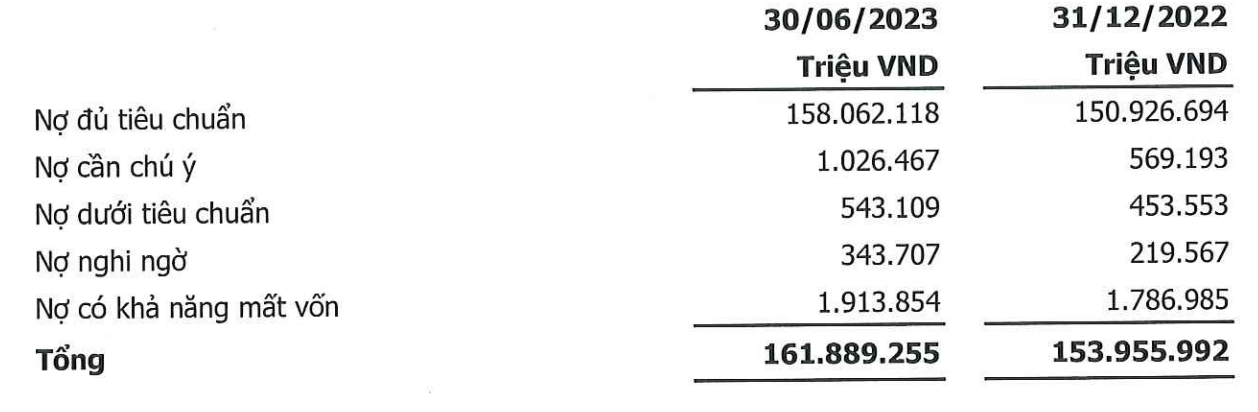

SeABank's debt quality (Source: Financial statements).

In June 2023, SeABank issued 295.2 million shares, equivalent to a rate of 14.5% to pay dividends in 2022 and issued 118,201,732 bonus shares, equivalent to a rate of 5.8%.

After completing the above issuance, SeABank's charter capital will increase by more than VND4,134 billion, from nearly VND20,403 billion to VND24,537 billion.

Previously, at the 2023 Annual General Meeting of Shareholders, SeABank expected to increase its charter capital from VND 20,403 billion to a maximum of VND 25,903 billion this year according to the plan to issue shares to pay dividends and bonus shares at a rate of nearly 20.3%, offer individual shares at a rate of more than 4.6% and issue shares under the Employee Stock Option Program (ESOP) .

Source

Comment (0)