The USD Index (DXY), which measures the greenback's performance against six major currencies, fell 1.07% this week to 98.14.

USD exchange rate in the world last week

The US dollar has seen notable volatility over the past week, influenced by a variety of economic, political and geopolitical factors. Events such as US-China trade negotiations, inflation data, US Federal Reserve policy and geopolitical tensions in the Middle East have had a strong impact on the value of the US dollar.

The US dollar started the week on a positive note thanks to the US jobs report released on Friday (June 6). The report showed that the US economy still maintained some strength, despite some negative economic data before. The US dollar index, which measures the strength of the US dollar against six major currencies, has recovered somewhat. However, since the beginning of 2025, the US dollar has lost more than 8.6% of its value and is heading for its second consecutive week of decline, showing that investors are still not completely confident in the long-term stability of this currency.

|

| Chart of DXY Index fluctuations over the past week. Photo: Marketwatch |

The US dollar has faced downward pressure this week as global market sentiment has been volatile, mainly due to Moody's downgrade of the US credit rating. As a result, investors have turned to safe havens such as the Japanese yen and the euro, weakening the dollar. Notably, US inflation data released on Wednesday (June 11) showed that the core CPI rose 0.1%, lower than the forecast of 0.2%, which is seen as a negative signal for the dollar.

Geopolitical tensions, especially Israel’s attack on Iran’s nuclear program, also indirectly affected the USD. In the context of escalating instability, international financial markets reacted strongly: Oil and gold prices soared, global stocks fell, US bond yields fluctuated, and the USD, one of the traditional safe-haven assets, also experienced complicated developments. These developments pushed the USD to increase in value because this currency is often considered a “safe haven” in times of instability.

The reaction of other currency markets also played a role in shaping the greenback’s direction. While the dollar rose against the euro and the pound, which were also hurt by the unrest in the Middle East, the Japanese yen and Swiss franc, which are also considered safe-haven assets, rose strongly against the greenback. This led to competition for safe-haven status, limiting the dollar’s gains. In particular, European and Asian funds increased their holdings of gold and the yen, while reducing their holdings of dollar-denominated assets, a defensive move amid the growing tensions.

In addition to market factors, political factors also play a role in shaping investors' expectations for the USD. The ambiguity in the US government's response to Israel's actions, as well as unclear statements from the White House about the possibility of military or diplomatic support, have caused the market sentiment to fall into a "wait and see" state.

|

| The US dollar recorded a sharp weekly decline. Photo: Reuters |

Domestic USD exchange rate today

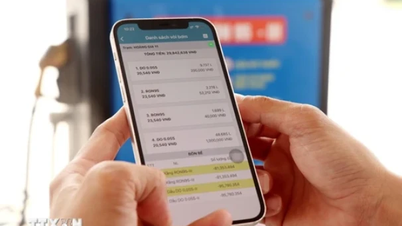

In the domestic market, at the beginning of the trading session on June 15, the State Bank announced the central exchange rate of the Vietnamese Dong against the USD at 24,975 VND.

* The reference USD exchange rate at the State Bank's transaction office for buying and selling is kept at: 23,777 VND - 26,173 VND.

USD exchange rates at commercial banks are as follows:

USD exchange rate | Buy | Sell |

Vietcombank | 25,833 VND | 26,223 VND |

Vietinbank | 25,853 VND | 26,223 VND |

BIDV | 25,863 VND | 26,223 VND |

* The EUR exchange rate at the State Bank's exchange office remains unchanged at: 27,398 VND - 30,282 VND.

EUR exchange rates at commercial banks are as follows:

EUR exchange rate | Buy | Sell |

Vietcombank | 29,271 VND | 30,815 VND |

Vietinbank | 29,629 VND | 30,884 VND |

BIDV | 29,608 VND | 30,860 VND |

* The buying and selling rates of Japanese Yen at the State Bank of Vietnam remain unchanged, currently at: 166 VND - 183 VND.

Japanese Yen Exchange Rate | Buy | Sell |

Vietcombank | 174.68 VND | 185.77 VND |

Vietinbank | 178.49 VND | 186.49 VND |

BIDV | 178.08 VND | 185.93 VND |

THUY ANH

*Please visit the Economics section to see related news and articles.

Source: https://baodaknong.vn/ty-gia-usd-hom-nay-15-6-dong-usd-ghi-nhan-muc-giam-hang-tuan-255607.html

Comment (0)