VN-Index closed the week at 2,181.8 points, a record high in the past 18 months. The market ended a volatile week, with many investors successfully "catching the bottom".

"Catching the bottom" from the first session of the week's decline, Ms. Nguyen Thi Nga (44 years old, Thanh Xuan, Hanoi ) unexpectedly made a profit of several tens of millions when the stocks she held increased to the peak of today's session.

She shared, "I mainly invest in 'surfing'. Seeing the stock price drop sharply in the first session of the week, VN-Index plummeted by more than 20 points, I decided to collect more than 20,000 shares. Today, the stock I bought suddenly increased sharply, making a profit of nearly 50 million VND. Immediately, I disbursed all of it to get the profit. Because I am still not sure about the market's upward trend, today's session is somewhat unstable."

The market experienced a volatile trading week, leaving investors with mixed emotions as the session "free-fall" at the beginning of the week then increased sharply again in the middle and end of the week. This development helped many investors "surf" successfully.

VN-Index closed the week at 2,181.8 points, up 18.02 points, equivalent to 1.43% after a week of trading. This number of points helped VN-Index return to the old peak in August 2022.

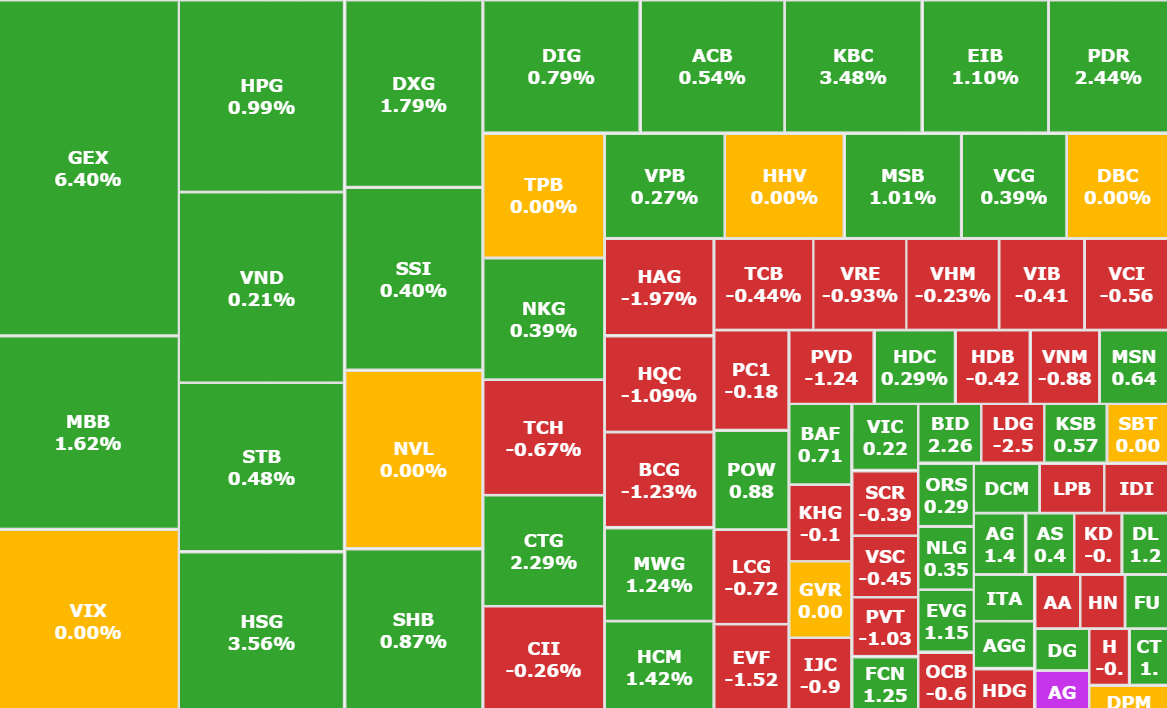

The market is clearly differentiated among stocks with "green" dominating.

Market liquidity is also a notable point when reaching 38,000 billion VND. Of which, on HOSE alone, the cash flow is 34,734 billion VND, equivalent to nearly 1,378 million shares, an increase of more than 18% compared to the average liquidity level of the past month. Previously, in the morning session, market liquidity reached nearly 21,700 billion VND.

The market was divided and there was a tug-of-war between the industry groups when 11/20 industries increased points. Electricity, banking, and construction materials had the strongest index increase, 3.68%, 0.95%, and 0.94% respectively.

GELEX is known as one of the leading multi-industry private corporations in Vietnam with key areas such as electrical equipment, construction materials, and industrial parks.

The focus of VN-Index came from the active trading status of GEX (GELEX Group, HOSE) which increased by 6.4%, reaching a market price of VND 24,950/share, the highest price since mid-September last year. At the same time, it became the leading stock in the market increase.

Record high matched trading volume in history at 72 million units, transaction value reached nearly 1,800 billion VND.

GEX increased to a record high since September 2023 (Source: SSI iBoard)

In addition, foreign investors also actively traded with GEX when they net bought nearly 7.8 million units, equivalent to 193 billion VND. This is the largest purchase volume from foreign investors since GEX was listed on the stock exchange.

With the above figures, GEX became the stock with the highest trading value (from both domestic and foreign investors) on the stock market today.

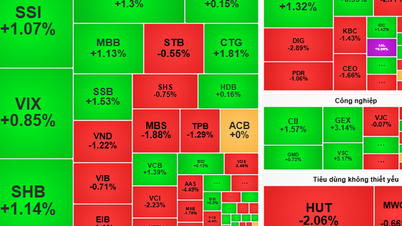

Besides, banking stocks continued to "fly high", becoming a pillar industry group for the market index.

Typically, MBB ( MBBank , HOSE) ranked 3rd for market growth with a positive increase of 1.21%.

BIG4 stocks also increased strongly with VCB (Vietcombank, HOSE) increasing by 1.26%, CTG (Vietinbank, HOSE) increasing by 2.29%, BID (BIDV, HOSE) increasing by 2.26%,... along with many other codes: EIB (Eximbank, HOSE), ACB (ACB, HOSE),...

Real estate and retail groups also rose up to contribute to the market with MWG (Mobile World, HOSE), KBC (Kinh Bac Real Estate, HOSE),...

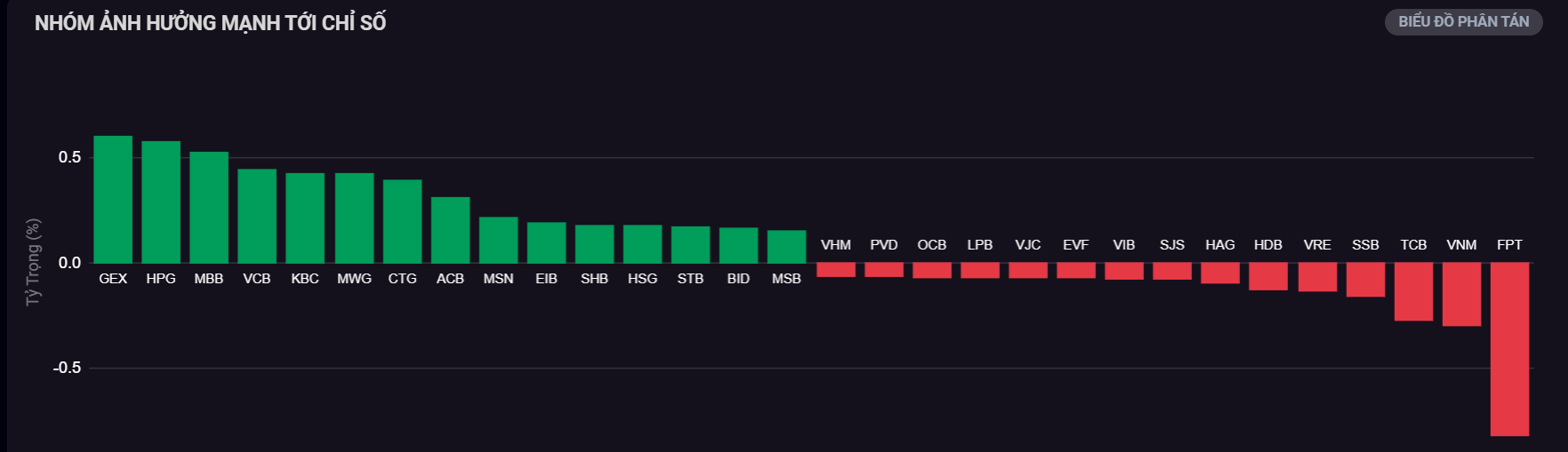

Group of stocks strongly affecting the index

Banking group continues to shine (Source: SSI iBoard)

On the other hand, FPT (FPT, HOSE) suddenly turned around and plummeted after 2 positive sessions with a 1.12% decrease, the market price was 114,900 VND/share, becoming the stock with the most negative impact on the floor.

Besides, the agriculture - forestry - fishery sector is not very positive, recording a decrease of nearly 1%.

Another "unhappy" thing is that foreign investors continued to have the 8th consecutive net selling session.

At HOSE, foreign investors net sold about 164 billion VND, of which VNM (Vinamilk, HOSE) was under the strongest selling pressure with 219 billion VND, HPG (Hoa Phat Steel) and VHM (Vinhomes, HOSE) followed with 136 and 116 billion VND respectively.

The VN-Index's increase at the end of the week was not very stable, with a clear differentiation between stocks, showing that investors' sentiment is still cautious as the market increases strongly again.

Experts believe that the market is on a steady uptrend when there are many factors from other investment channels and the macro-economy recovering, making the stock market more attractive, more potential, and the cash flow into the market is increasing. Investors should have a specific strategy and plan, avoid panic and scattered "wallet" allocation among investment channels.

Source

![[Photo] General Secretary To Lam attends the 1st Congress of the Central Party Committee of the Fatherland Front and Central Mass Organizations](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/9/23/2aa63d072cab4105a113d4fc0c68a839)

Comment (0)