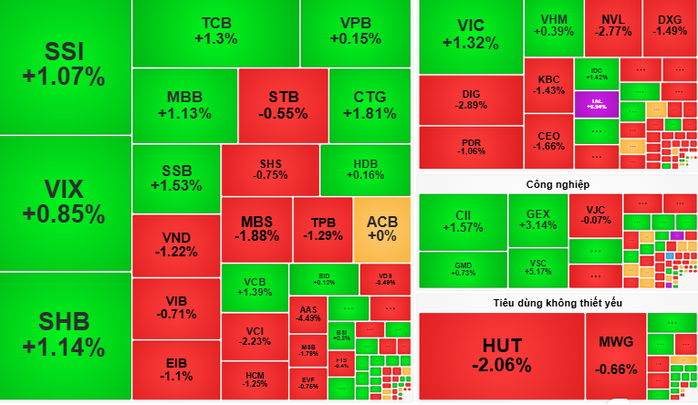

At the end of the session on September 10, VN-Index closed at 1,643 points, up nearly 6 points (+0.36%).

Continuing the recovery momentum from the previous stock market session, VN-Index opened on September 10 with an increase of 9 points compared to the reference level. Banking stocks played a leading role, highlighted by green from codes such as TCB, MBB and CTG. However, market liquidity remained low, selling pressure prevailed, causing the market to narrow its growth momentum.

In the afternoon session, the VN-Index continued to fluctuate within a narrow range around 1,635 points. Although supply still dominated, recovery efforts from large-cap stocks in the Vingroup group (VIC, VHM) and banks helped the index regain green at the end of the session. Notably, some mid-cap stocks in the food industry (DBC, PAN) and oil and gas (BSR, PVD) recorded positive demand, becoming bright spots in the session. However, foreign investors continued to net sell strongly with a value of VND 2,937 billion, focusing on codes such as HPG, MWG and MBB.

At the end of the session, VN-Index closed at 1,643 points, up nearly 6 points (+0.36%). Market liquidity decreased, reaching about 42,515 billion VND, reflecting the cautiousness of cash flow.

According to Vietcombank Securities Company (VCBS), active buying cash flow is still circulating, helping the VN-Index balance and maintain the recovery momentum to move towards higher levels. Investors should take advantage of the cash flow trend to selectively disburse into stocks that have successfully confirmed the support price zone, accompanied by increased active buying liquidity. Prioritize codes in the banking group (TCB, MBB, CTG), retail (MWG, MSN) and oil and gas ( BSR , PVD, PLX). However, caution is needed when the VN-Index approaches the resistance zone of 1,650 points, due to the possibility of tug-of-war or downward adjustment.

Meanwhile, Dragon Capital Securities Company (VDSC) recommends that investors observe supply and demand developments to assess market trends, continue to consider short-term profit taking during recoveries, and reduce stock holdings to prevent risks.

Source: https://nld.com.vn/chung-khoan-ngay-11-9-co-hoi-giai-ngan-co-phieu-ngan-hang-ban-le-dau-khi-196250910165041728.htm

![[Photo] President Luong Cuong attends the 80th Anniversary of the Traditional Day of the Armed Forces of Military Region 3](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/28/1761635584312_ndo_br_1-jpg.webp)

![[Photo] The 5th Patriotic Emulation Congress of the Central Inspection Commission](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761566862838_ndo_br_1-1858-jpg.webp)

![[Photo] Party Committees of Central Party agencies summarize the implementation of Resolution No. 18-NQ/TW and the direction of the Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761545645968_ndo_br_1-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man receives Chairman of the House of Representatives of Uzbekistan Nuriddin Ismoilov](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/27/1761542647910_bnd-2610-jpg.webp)

Comment (0)