Draft Circular amending and supplementing Circular No. 45/2013/TT-BTC guiding the management, use and depreciation of fixed assets.

The draft proposes adding Clause 12 to Article 9 of Circular No. 45/2013/TT-BTC on "Principles of depreciation of fixed assets" as follows:

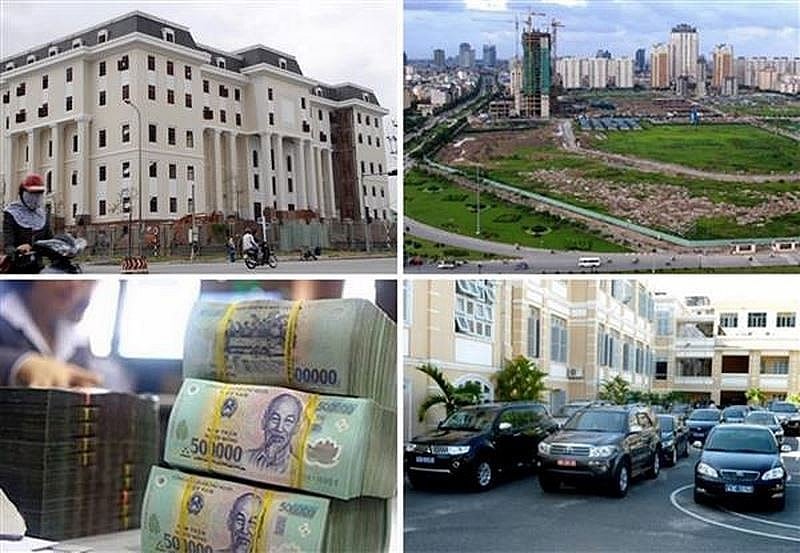

Existing tangible fixed assets that are temporarily not in use and not participating in production or business activities in enterprises with 100% state-owned capital, as per Decision No. 1468/QD-TTg dated September 29, 2017, of the Prime Minister approving the "Scheme for handling shortcomings and weaknesses of some slow-progressing and inefficient projects and enterprises in the Industry and Trade sector": Enterprises may proactively postpone or temporarily suspend depreciation during the period of non-use, ensuring that the depreciation period of fixed assets adheres to the depreciation timeframe stipulated in this Circular. Enterprises must notify the tax authority directly managing them for monitoring and management.

According to current regulations in Circular No. 45/2013/TT-BTC, the Ministry of Finance stipulates the principles for depreciating fixed assets as follows:

All existing fixed assets of the enterprise must be depreciated, except for the following: fixed assets that have been fully depreciated but are still being used in production and business activities; fixed assets that have not been fully depreciated but have been lost; other fixed assets managed by the enterprise but not owned by the enterprise (except for leased fixed assets); fixed assets that are not managed, monitored, or accounted for in the enterprise's accounting books...

Depreciation expenses for fixed assets are considered deductible expenses when calculating corporate income tax, in accordance with the regulations stipulated in the relevant laws on corporate income tax.

If fixed assets that have not been fully depreciated are lost or damaged beyond repair, the enterprise shall determine the cause and the responsibility for compensation of the collective or individuals responsible. The difference between the remaining value of the asset and the compensation from the organization or individual causing the damage, the compensation from the insurance company, and any recoverable value (if any) shall be covered by the enterprise's financial reserve fund. If the financial reserve fund is insufficient to cover the difference, the remaining deficit shall be included as a deductible expense when determining corporate income tax.

Businesses that lease out operating fixed assets must depreciate the leased fixed assets.

Businesses that lease fixed assets under a financial lease (referred to as leased fixed assets) must depreciate the leased fixed assets as if they were owned by the business, in accordance with current regulations. If, at the time of commencement of the lease, the lessee commits not to repurchase the leased asset under the financial lease contract, then the lessee may depreciate the leased fixed assets for the lease term specified in the contract...

Readers are invited to view the full draft and provide feedback here.

Source: https://thoibaonganhang.vn/de-xuat-quy-dinh-moi-ve-trich-khau-hao-tai-san-co-dinh-160979.html

![[Photo] Prime Minister Pham Minh Chinh attends the Conference summarizing and implementing tasks of the judicial sector.](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F13%2F1765616082148_dsc-5565-jpg.webp&w=3840&q=75)

Comment (0)