Domestic gold price today 5/4/2025

At the time of survey at 4:30 a.m. on May 4, 2025, domestic gold prices increased slightly compared to yesterday. Specifically:

The price of SJC gold bars was listed by DOJI Group at 119.3-121.3 million VND/tael (buy - sell), the price remained unchanged in both buying and selling directions compared to yesterday. Compared to last week, the gold price increased by 300 thousand VND/tael in both buying and selling directions.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119.3-121.3 million VND/tael (buy in - sell out), the price remained unchanged in both buying and selling directions compared to yesterday but increased by 300 thousand VND/tael in both buying and selling directions compared to last week.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 118-119.5 million VND/tael for buying and selling. Compared to yesterday, the gold price remained unchanged in both buying and selling directions. Compared to last week, the gold price decreased by 1 million VND/tael for buying and 1.5 million VND/tael for selling.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 118.3-121 million VND/tael (buying - selling, slightly increased by 200 thousand VND/tael in buying - unchanged in selling compared to yesterday. Decreased by 700 thousand VND/tael in buying - unchanged in selling compared to last week.

SJC gold price in Phu Quy is traded by businesses at 118.3-121.3 million VND/tael (buying - selling), gold price is unchanged in both buying and selling directions compared to yesterday. Gold price decreased 200 thousand VND/tael in buying direction - increased 300 thousand VND/tael in selling direction compared to last week.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to yesterday; unchanged in both buying and selling directions compared to last week.

Bao Tin Minh Chau listed the price of gold rings at 116.6-119.7 million VND/tael (buy - sell); increased by 200 thousand VND/tael in buying - unchanged in selling compared to yesterday; decreased by 400 thousand VND/tael in buying - decreased by 300 thousand VND/tael in selling compared to last week.

The latest gold price list today, May 4, 2025 is as follows:

| Gold price today | May 4, 2025 (Million VND) | Difference (thousand dong/tael) | ||

| Buy | Sell out | Buy | Sell out | |

| SJC in Hanoi | 119.3 | 121.3 | - | - |

| DOJI Group | 119.3 | 121.3 | - | - |

| Mi Hong | 118 | 119.5 | - | - |

| PNJ | 119.3 | 121.3 | - | - |

| Vietinbank Gold | 121.3 | - | ||

| Bao Tin Minh Chau | 118.3 | 121 | +200 | - |

| Phu Quy | 118.3 | 121.3 | - | - |

| 1. DOJI - Updated: 5/4/2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,300 | 121,300 |

| AVPL/SJC HCM | 119,300 | 121,300 |

| AVPL/SJC DN | 119,300 | 121,300 |

| Raw material 9999 - HN | 113,800 | 115,600 |

| Raw materials 999 - HN | 113,700 | 115,500 |

| 2. PNJ - Updated: 5/4/2025 04:30 - Website supply time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 114,000 | 117,000 |

| HCMC - SJC | 119,300 | 121,300 |

| Hanoi - PNJ | 114,000 | 117,000 |

| Hanoi - SJC | 119,300 | 121,300 |

| Da Nang - PNJ | 114,000 | 117,000 |

| Da Nang - SJC | 119,300 | 121,300 |

| Western Region - PNJ | 114,000 | 117,000 |

| Western Region - SJC | 119,300 | 121,300 |

| Jewelry gold price - PNJ | 114,000 | 117,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Southeast | PNJ | 114,000 |

| Jewelry gold price - SJC | 119,300 | 121,300 |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,000 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,000 | 117,000 |

| Jewelry gold price - Jewelry gold 999.9 | 114,000 | 116,500 |

| Jewelry gold price - 999 jewelry gold | 113,880 | 116,380 |

| Jewelry gold price - 9920 jewelry gold | 113,170 | 115,670 |

| Jewelry gold price - 99 jewelry gold | 112,940 | 115,440 |

| Jewelry gold price - 750 gold (18K) | 80,030 | 87,530 |

| Jewelry gold price - 585 gold (14K) | 60,800 | 68,300 |

| Jewelry gold price - 416 gold (10K) | 41,110 | 48,610 |

| Jewelry gold price - 916 gold (22K) | 104,310 | 106,810 |

| Jewelry gold price - 610 gold (14.6K) | 63,720 | 71,220 |

| Jewelry gold price - 650 gold (15.6K) | 68,380 | 75,880 |

| Jewelry gold price - 680 gold (16.3K) | 71,870 | 79,370 |

| Jewelry gold price - 375 gold (9K) | 36,340 | 43,840 |

| Jewelry gold price - 333 gold (8K) | 31,100 | 38,600 |

| 3. SJC - Updated: 5/4/2025 04:30 - Website time of supply - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,300 | 121,300 |

| SJC gold 5 chi | 119,300 | 121,300 |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,300 | 121,300 |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 | 116,500 |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 | 116,600 |

| 99.99% jewelry | 114,000 | 115,900 |

| 99% Jewelry | 110,752 | 114,752 |

| Jewelry 68% | 72,969 | 78,969 |

| Jewelry 41.7% | 42,485 | 48,485 |

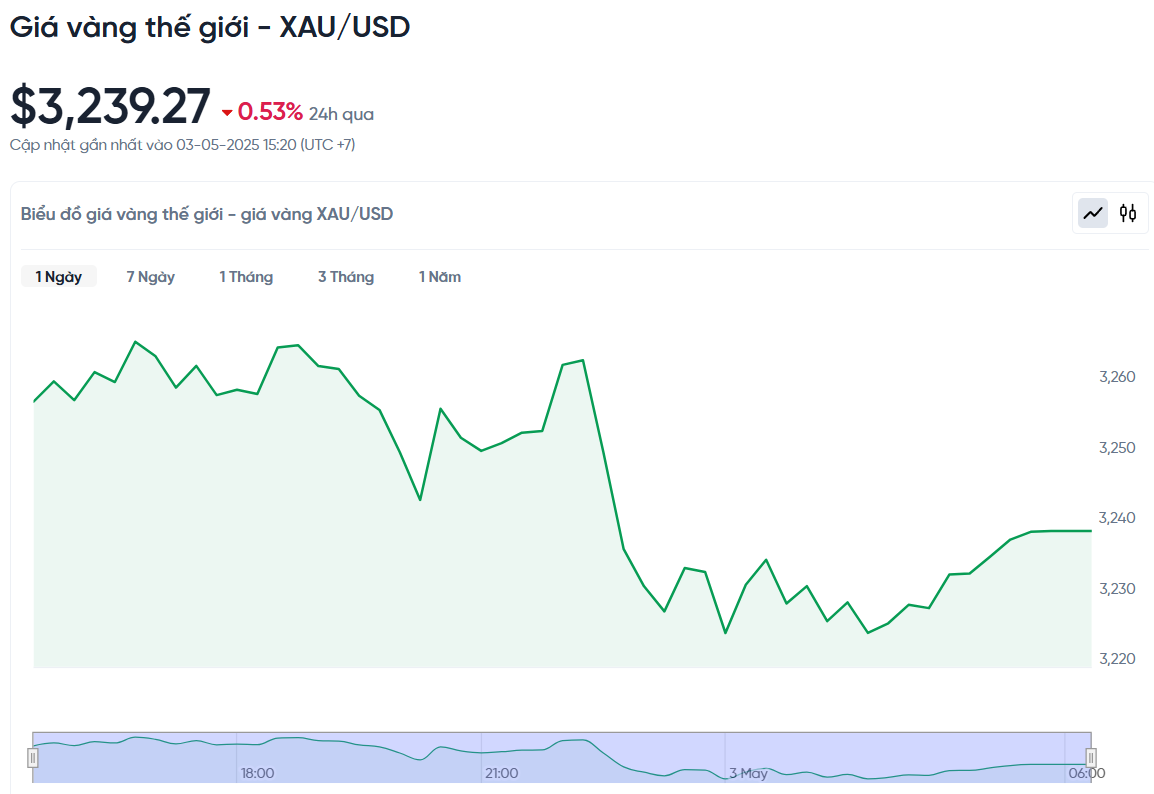

World gold price today May 4, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,239.27 USD/ounce. Today's gold price decreased by 17.15 USD/ounce compared to yesterday and decreased by 75.2 USD/ounce compared to last week. Converted according to the USD exchange rate at Vietcombank (26,180 VND/USD), the world gold price is about 103.27 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 18.03 million VND/tael higher than the international gold price.

The world gold price faced its second consecutive week of decline, down about 2.27% compared to the beginning of the week. According to Ms. Suki Cooper, an expert at Standard Chartered Bank, the flow of money from central banks has slowed down, while concerns about tariffs and economic recession are no longer as hot as before, causing many investors to sell gold and return to other financial markets.

Regarding the tariff situation, the Chinese Ministry of Commerce said that the US side has proactively contacted many times with the desire to resume negotiations. President Trump also expressed optimism when saying that there is a very high possibility that the US and China will reach an agreement. This is a positive signal, promoting risk-on investment sentiment. In that context, demand for gold may decrease.

US Treasury Secretary Scott Bessent said several major trading partners had made “very good” proposals to avoid US tariffs, further indicating the possibility of a thaw in global trade tensions.

Global demand for gold remains strong. According to the latest report from the World Gold Council (WGC), global gold consumption in the first quarter of 2025 reached 1,206 tonnes, up 1% year-on-year. This is a sign that gold still plays a role as a safe asset, in the context of increasing risks from financial markets, concerns about stagnant inflation and a weakening US dollar.

Mr. Joseph Cavatoni, senior strategist at WGC, said that the increase in gold demand is due to three main factors: individual investors continue to accumulate physical gold, strong capital flows into gold ETFs and regular gold purchases from central banks around the world.

According to him, the current demand is not just short-term speculation but is becoming a fundamental trend, in the context of growing concerns about public debt and the safety of US government bonds. According to him, gold is asserting its position as a key defensive channel in the context of an uncertain global economy.

Next week, markets will be closely watching the Fed’s May policy meeting, especially Chairman Jerome Powell’s remarks at a press conference on Wednesday. Although the Fed is widely expected to keep rates unchanged, investors are still looking for clues on policy direction in the coming period.

Following the meeting, Fed officials will attend the Economic Conference in Reykjavik, Iceland, where they are expected to discuss issues such as artificial intelligence, the labor market and the direction of monetary policy. In addition, the market will also monitor two important economic reports during the week: the ISM services PMI (released on Monday) and the weekly jobless claims (released on Thursday). These will be factors that can directly affect gold prices in the short term.

Gold price forecast

Kitco News’ weekly gold survey found that only a handful of experts believe gold prices will rise next week, while the majority of retail investors remain bullish. Of the 18 analysts surveyed, nine see further declines, five expect prices to rise, and four see them moving sideways. Of the 273 retail investors surveyed online, 143, or more than half, believe gold prices will rise.

Adrian Day, Chairman of Adrian Day Asset Management, said that concerns about a possible recession in the US and the prospect of easing tensions in the US-China trade war could weaken demand for gold in the short term. He said that gold prices could continue to fall in the near future.

This view is also shared by Mr. Darin Newsom from Barchart.com. He believes that the short-term trend of gold is still bearish if analyzed from a technical perspective, and the fact that the US Federal Reserve (FOMC) is likely to keep the operating interest rate unchanged next week could cause the USD to recover, thereby putting pressure on gold prices.

Fawad Razaqzada of StoneX Bullion warned that gold could fall to $3,000 an ounce if optimism about trade talks continues. While the S&P 500 has rallied more than 17% from its April low, gold has fallen nearly 8.5% to around $298. While there are other factors influencing gold, he said that if the stock market were correctly reflecting trade expectations, gold should have fallen further.

However, in the medium term, gold prices still have a chance to set a new high if there is no clear breakthrough in trade negotiations. However, he also warned that some technical indicators show that gold is overbought, and sellers have every reason to increase pressure.

John Weyer, director at Walsh Trading, said gold prices will continue to be affected by news surrounding tax policies, whether they are rumors or reality. He said markets are reacting quite sensitively to every piece of information related to tariffs, especially from the US and China.

In the short term, gold prices are fluctuating in a wide range and will continue to do so. John Weyer believes that gold is still a safe haven asset, but it is also very volatile, and gold investors need to be ready to face unexpected developments in the market.

However, not all experts are pessimistic. Mr. Rich Checkan, President of consulting firm Asset Strategies International, said that the recent correction in gold prices is overdone. He expects gold to rise again when the US economic data weakens, forcing Fed Chairman Jerome Powell to reconsider his stance at the upcoming policy meeting.

Source: https://baonghean.vn/gia-vang-hom-nay-4-5-2025-gia-vang-trong-nuoc-va-the-gioi-giam-manh-tuan-qua-10296465.html

![[Photo] Prime Minister Pham Minh Chinh inspects and directs the work of overcoming the consequences of floods after the storm in Thai Nguyen](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759930075451_dsc-9441-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends the World Congress of the International Federation of Freight Forwarders and Transport Associations - FIATA](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/08/1759936077106_dsc-0434-jpg.webp)

Comment (0)