LIVE UPDATE TABLE OF GOLD PRICE TODAY OCTOBER 22 AND EXCHANGE RATE TODAY OCTOBER 22

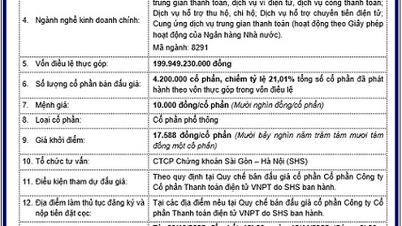

| 1. PNJ - Updated: October 21, 2023 10:30 PM - Website supply time - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell out |

| HCMC - PNJ | 58,100 ▲50K | 59,300 ▲250K |

| HCMC - SJC | 70,200 ▼50K | 71,100 |

| Hanoi - PNJ | 58,100 ▲50K | 59,300 ▲250K |

| Hanoi - SJC | 70,200 ▼100K | 71,100 |

| Da Nang - PNJ | 58,100 ▲50K | 59,300 ▲250K |

| Da Nang - SJC | 70,200 ▼50K | 71,100 |

| Western Region - PNJ | 58,100 ▲50K | 59,300 ▲250K |

| Western Region - SJC | 70,350 | 71,050 ▲100K |

| Jewelry gold price - PNJ rings (24K) | 58,100 ▲50K | 59,200 ▲200K |

| Jewelry gold price - 24K jewelry | 58,000 | 58,800 |

| Jewelry gold price - 18K jewelry | 42,850 | 44,250 |

| Jewelry Gold Price - 14K Jewelry | 33,150 | 34,550 |

| Jewelry gold price - 10K jewelry | 23,210 | 24,610 |

The domestic gold price at Saigon Jewelry Company (SJC) was bought at 70.25 million VND and sold at 71.05 million VND. The difference between the buying and selling price of SJC gold bars increased to 800,000 VND/tael, instead of the previous 700,000 VND.

SJC 9999 gold rings of type 1, 2 and 5 are bought for only 58.1 million VND, sold for 59.1 million VND. This is a record price ever for SJC gold rings. The difference between buying and selling price of gold rings is maintained by SJC at 1 million VND/tael.

Similarly, SJC's 4-number 9 gold rings but with a smaller weight of 0.3 or 0.5 taels also skyrocketed to a new record and sold for a higher price of 59.2 million VND.

Gold prices continue to rise due to safe-haven demand. The precious metal continues its upward trend and is at its highest level in the past 5 months as investors worry about escalating tensions in the Middle East. That has made many people more interested in safe assets such as gold despite the US Treasury bond yields also hitting new highs.

The yield on the 10-year US Treasury bond hit 5.001%, marking the first time it has crossed the 5% threshold in 16 years. This yield level can impact the economy by increasing interest rates on mortgages, credit cards, auto loans, etc.

The yield on the 30-year Treasury bond also hit its highest level since July 2007. Meanwhile, the 30-year fixed mortgage rate hit 8% this week, a level not seen since 2000.

According to TG&VN , the world gold price on the Kitco electronic trading floor ended the week at 1,981.2 USD/ounce.

At the current price, the world gold price converted to VND (including tax and processing fees) differs from the domestic SJC gold price by about 11.72 million VND/tael.

|

| Gold price today September 29 (Source: Kitco News) |

Summary of SJC gold prices at major domestic trading brands at the closing time of October 21:

Saigon Jewelry Company listed the price of SJC gold at 70.25 - 71.07 million VND/tael.

Doji Group currently lists SJC gold price at: 70.30 - 71.10 million VND/tael.

Phu Quy Group currently lists SJC gold price at: 70.15 - 71.00 million VND/tael.

PNJ system listed at: 70.20 - 71.10 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at 70.25 - 70.95 million VND/tael; Rong Thang Long gold brand is traded at 57.83 - 58.83 million VND/tael; jewelry gold price is traded at 57.50 - 58.70 million VND/tael.

Is gold overbought?

As tensions in the Middle East continue to rise, geopolitical uncertainty continues to support the safe-haven appeal of gold. Similar to last week, the precious metal continued to gain momentum. This safe-haven demand pushed gold prices to a three-month high and up about 4% over the past week.

It's no surprise that the negative sentiment is ongoing and gold prices continue to rise, said Phillip Streible, chief market strategist at Blue Line Futures.

“Gold is undervalued and investors are now looking to own the precious metal,” he said.

David Morrison, senior market analyst at Trade Nation, said gold is doing exactly what it should do in times of crisis. “Gold has broken through all the major resistance levels at $1,900, $1,950 and $1,980; I think the market wants to see $2,000. This could be the rally that takes prices to new all-time highs,” he said.

Gold has not only seen an impressive recovery over the past two weeks, but it also came as US Federal Reserve Chairman Jerome Powell said the bank is committed to bringing inflation down to 2%.

This stance has helped push long-term bond yields to a new 16-year high, with the 10-year bond hitting 5% this week. However, some economists and market analysts note that concerns about growing U.S. government debt are also a major factor in the rise in bond yields.

With geopolitical uncertainty, gold has now become an economic safe haven, said Ole Hansen, head of commodity strategy at Saxo Bank.

However, Mr. Hansen also noted that while speculative interest appears to be driving gold, a significant investment segment remains reluctant to enter the market.

“Asset managers, many of whom trade gold through ETFs, continue to focus on the strength of the US economy, rising bond yields and the possibility of another delay in peak interest rates as reasons to stay out of the market,” he said.

Buying gold as a geopolitical safe haven has never proven sustainable, according to Alex Kuptsikevich, senior market analyst at FxPro. He said the growing geopolitical uncertainty is not reflected in the bond or equity markets.

“Gold is currently rising against the current. The precious metal is currently near overbought territory and may reverse under pressure from fundamental factors such as high bond yields and strong growth in the US dollar,” analyst Alex Kuptsikevich emphasized.

Source

![[Photo] Solemn opening of the 10th Session, 15th National Assembly](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760937111622_ndo_br_1-202-jpg.webp)

![[Photo] Chairman of the Hungarian Parliament visits President Ho Chi Minh's Mausoleum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760941009023_ndo_br_hungary-jpg.webp)

![[Photo] National Assembly Chairman Tran Thanh Man holds talks with Hungarian National Assembly Chairman Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760952711347_ndo_br_bnd-1603-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh meets with Speaker of the Hungarian National Assembly Kover Laszlo](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/20/1760970413415_dsc-8111-jpg.webp)

Comment (0)