Responding to this issue, a representative of MB Bank's communications said that the bank currently does not require customers to update location information and this does not affect the transaction process, so customers can rest assured to carry out normal transactions.

“In fact, the customer’s address information has changed but the current location remains. The bank mainly coordinates with the postal service to handle the delivery of documents,” the representative said.

According to this person, when the State Bank and competent authorities have written instructions, requesting to update and change information about provinces and cities for customers, the bank will officially notify and send officers and employees to guide and support so as not to affect individual customers as well as transactions.

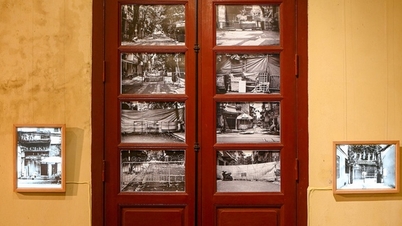

Bank customers do not have to change information after province and city merger? (Illustration photo).

Similarly, a representative of a joint stock commercial bank also said that although the merger of provinces and cities leads to changes in customers' personal information, it currently does not affect transactions, so customers can rest assured. The bank will notify and provide specific instructions to each customer if the State Bank and competent authorities have specific instructions.

According to the State Bank's regulations in Circular No. 17/2024/TT-NHNN, from July 1, the legal representative of an institutional customer must provide and verify the correct identification documents and biometrics so that the organization can continue to withdraw money and make electronic payment transactions on the organization's payment account at the bank.

After this period, if the update is not completed, money transfer and withdrawal transactions via electronic banking services will be suspended to ensure compliance with legal regulations and enhance security.

For legal representatives of institutional customers, who are also individual customers, whose identification documents and biometrics have been collected and compared at the bank, for convenience, banks will proactively update the results, matching individual customer data to the data of the legal representative of the institutional customer.

There are 2 ways to perform biometric authentication: go directly to a bank branch/transaction office or do it on the bank's app (only applicable to Vietnamese citizens).

Also from July 1, banks officially stopped transactions using magnetic strips on domestic cards, including: magnetic technology cards, magnetic strips on chip cards. This change aims to improve the level of safety when making transactions and comply with state regulations.

In fact, banks and card users have had a long time to prepare for this by offering free conversion from magnetic cards to chip cards for customers.

In case the customer has not converted, to avoid transaction interruption, the bank recommends that the customer check the card. If the card only has a magnetic strip (no chip), the customer needs to bring the ID/Citizen ID to the nearest bank transaction point to convert to a chip card for free.

Source: https://vtcnews.vn/khach-giao-dich-ngan-hang-co-phai-thay-doi-thong-tin-sau-sap-nhap-tinh-thanh-ar952081.html

![[Photo] Prime Minister Pham Minh Chinh chairs the second meeting of the Steering Committee on private economic development.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/01/1762006716873_dsc-9145-jpg.webp)

Comment (0)