On the morning of July 29, the central exchange rate announced by the State Bank of Vietnam (SBV) continued to increase sharply by 24 VND/USD, to 25,206 VND/USD. With a 5% amplitude, the exchange rate ceiling was raised to 26,466 VND/USD.

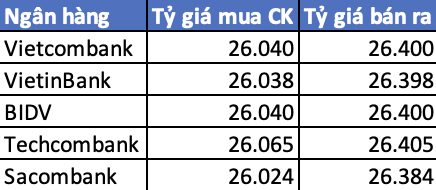

After slowing down last week, the central exchange rate and rates at commercial banks increased simultaneously in the first two sessions of the week. At commercial banks, the USD selling rate simultaneously exceeded 26,400 VND/USD. Early in the morning, VietinBank pushed the selling rate up to 26,428 VND/USD, then adjusted it down according to the general level, even falling below 26,400 VND/USD. By 11:00 a.m., the exchange rate at VietinBank had decreased while the exchange rates at Vietcombank and BIDV both recorded 26,040 VND/USD for buying and 26,400 VND/USD for selling. Private banks were also not out of the trend of sharply raising the selling rate in the first two sessions of the week.

|

| Exchange rates at banks on the morning of July 29 - Unit VND/USD |

Meanwhile, in the free market, the USD price has slightly adjusted. Some stores are trading around 26,370 VND for buying and 26,450 VND for each USD sold. The gap between the two markets has thus narrowed significantly.

The sharp increase in domestic exchange rates is in line with the recovery trend of the DXY index. The index measuring the strength of the greenback has now surpassed 98.6 points. This is also the highest level in many weeks. The greenback's increase was mainly supported by the weakening of the euro after the US and the EU announced a new trade agreement. This agreement imposes a 15% tax on European goods, causing strong reactions from France and Germany, warning of risks to the regional economy . Recently, US President Donald Trump said that most trading partners that do not negotiate separate trade agreements will soon face a tax of 15-20% on exports to the US.

Meanwhile, investors are still waiting for the results of the US Federal Reserve's policy meeting this week, which is expected to keep interest rates unchanged, but may reveal early signs of a rate cut in September.

In addition to international factors, internal pressure also causes the exchange rate to heat up. According to the currency market analysis report for the week of July 21-25, experts from Yuanta Securities assessed that the liquidity of the banking system is becoming tense again, although the State Bank of Vietnam has injected nearly VND78,900 billion in net last week and stopped issuing treasury bills. The value of circulating funds on the forward purchase channel by the end of last week had skyrocketed to VND210,900 billion.

According to experts from Yuanta Securities, interbank interest rates have increased sharply in short terms: overnight to 6.57% (up 0.94 percentage points), 1 week to 6.53% (+0.69 percentage points), 2 weeks to 6.33% (+0.79 percentage points). The difference between VND and USD interest rates at overnight terms is currently at 2.27 percentage points. Interest rates for deposits with terms of less than 12 months at some commercial banks have increased slightly in recent weeks.

“As we have previously predicted, deposit interest rates may increase slightly in the context of high demand for credit capital and lending interest rates will remain low to support economic growth according to the Prime Minister 's direction,” Yuanta Securities experts also reiterated.

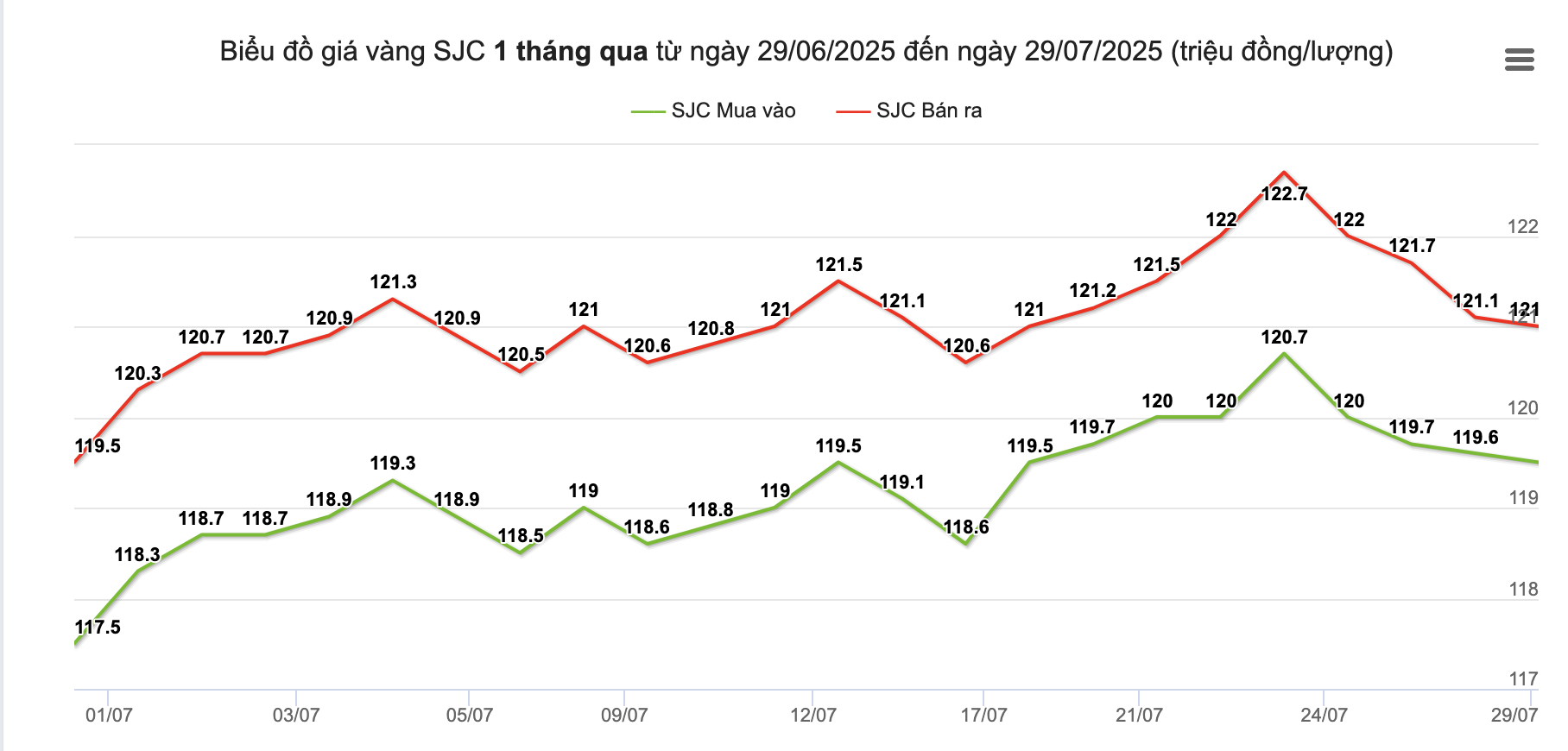

|

| Gold prices slightly decreased after the sharp fall of international gold last night - Source: Giavang |

While the USD/VND exchange rate increased sharply following the heat of the USD, domestic gold prices were not significantly affected by the downward trend of the international market. The world gold price is currently trading around 3,310 USD/ounce, near the lowest level since June 30, due to the stronger USD and expectations of easing trade tensions between the US and China.

At Saigon Jewelry Company (SJC), the price of gold bars was listed at VND119.5 million/tael (buy) and VND121 million/tael (sell), down VND100,000 compared to the end of yesterday. This price is about VND1.7 million/tael lower than last week, but still VND1.5 million/tael higher than at the end of June.

Source: https://baodautu.vn/ty-gia-usdvnd-vuot-26400-dong-d343467.html

![[Maritime News] Two Evergreen ships in a row: More than 50 containers fell into the sea](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/4/7c4aab5ced9d4b0e893092ffc2be8327)

Comment (0)