However, by 8:40 p.m. on September 6 (Vietnam time), VinFast shares fell more than 4.4% to below the threshold of 25 USD/share. VinFast's capitalization fell to 57 billion USD.

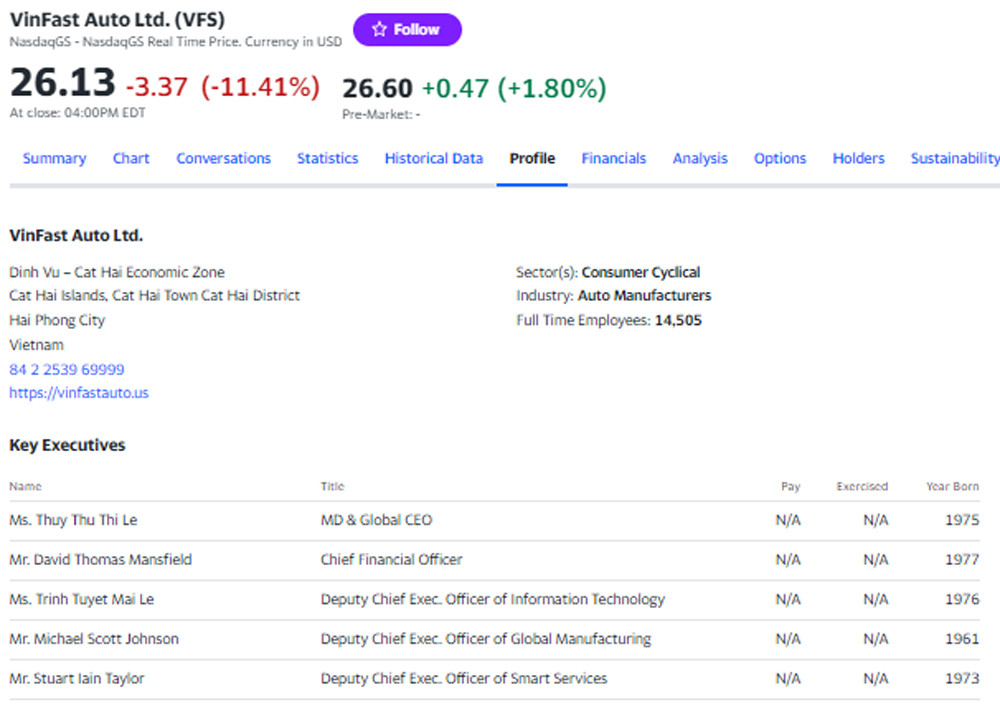

Previously, at the opening session on September 6 on the Nasdaq floor (September 6 evening Vietnam time), VinFast Auto (VFS) shares of billionaire Pham Nhat Vuong turned to increase again after falling sharply in the previous 5 sessions.

As of 6:12 p.m. on September 6 (Vietnam time), VFS shares increased by 1.8% to $26.6/share. A few minutes earlier, this stock had reached nearly $27, equivalent to a capitalization of $62 billion.

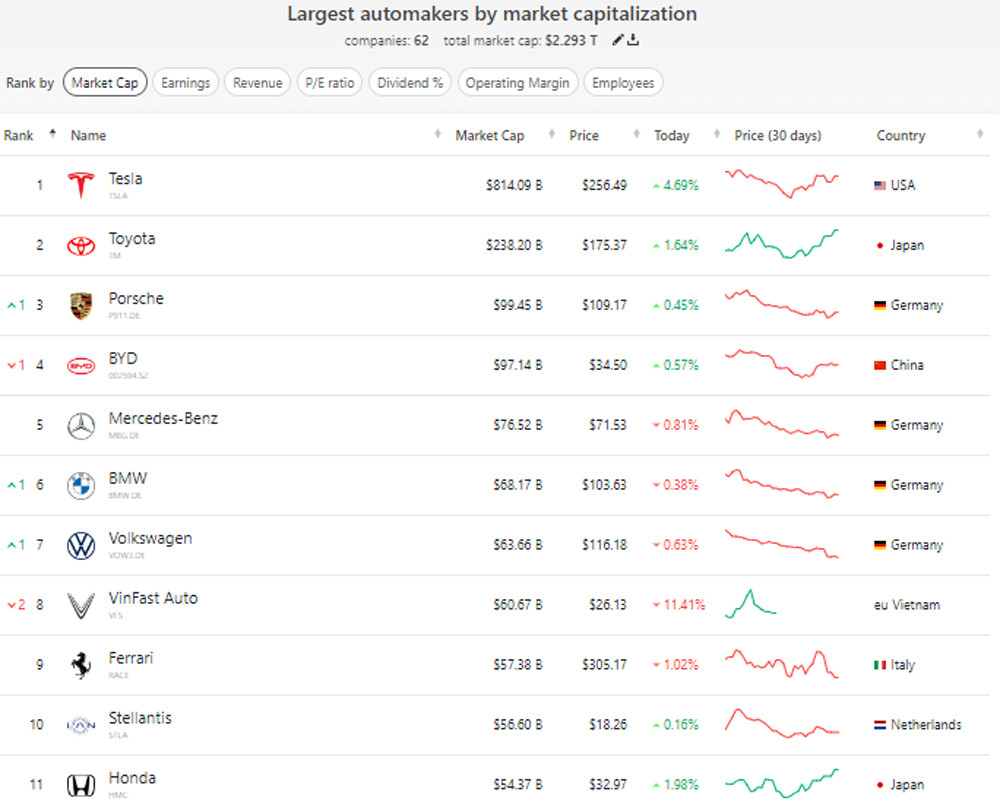

In the previous 5 consecutive sessions, VinFast shares decreased from 93 USD/share to 26.13 USD/share at the end of the session on September 5. VinFast's capitalization also decreased from nearly 210 billion USD to 60 billion USD.

With a capitalization of 62 billion USD, VinFast returned to 8th place in the world's car company community, right above Italy's Ferrari.

If VinFast shares reach $28/share, the Vietnamese electric car company's capitalization will surpass Volkswagen to 7th place.

At 28 USD/share, VinFast's capitalization is currently behind the following car companies: Tesla (814 billion USD, as of September 5) of billionaire Elon Musk, Toyota of Japan (238 billion USD), German supercar company Porsche (99.5 billion USD), China's largest electric car company BYD (97 billion USD), Mercedes-Benz (76 billion USD), BMW (68 billion USD), Volkswagen (63.7 billion USD).

VinFast still has a higher capitalization than industry giants with a very long history of development such as General Motors, Ford, Honda, and Ferrari.

VinFast shares rebounded after a heavy sell-off on the Nasdaq stock exchange, with a drop of more than 70%.

However, the current price is still very high compared to the starting price of 10 USD/share (equivalent to a capitalization of 23 billion USD) that VinFast CEO Le Thi Thu Thuy previously admitted.

At the ASEAN Business and Investment Summit (ASEAN BIS) in Jakarta on September 4, VinFast CEO said that the stock price fluctuations are unpredictable but not worrying and believes in the company's potential.

VinFast was founded in 2017 and officially switched to electric vehicles from 2022. The company recorded an increasing trend in car sales in the US market, but still at a very modest level of a few hundred cars/month and mainly concentrated in California.

VinFast estimates it will sell 50,000 electric cars in 2023 in both domestic and foreign markets. Tesla estimates it could sell 2 million this year, while BYD could reach 2.5 million.

Source

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)