|

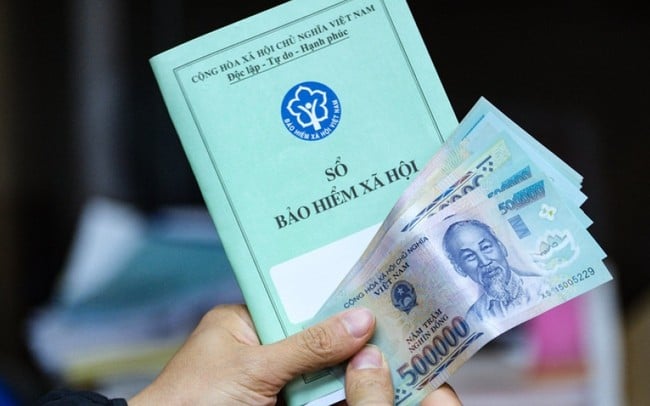

1. Cases eligible for one-time withdrawal of social insurance

Specifically, Clause 1, Article 8 of Decree 115/2015/ND-CP and Article 60 of the Law on Social Insurance 2014 stipulate that employees who request are entitled to receive one-time social insurance if they fall into one of the following cases:

- Reaching retirement age as prescribed in Clauses 1, 2 and 4, Article 54 of the Law on Social Insurance 2014 but not having paid social insurance for 20 years or according to the provisions of Clause 3, Article 54 of the Law on Social Insurance 2014 but not having paid social insurance for 15 years and not continuing to participate in voluntary social insurance;

- After one year of leaving work without having paid social insurance for 20 years and not continuing to pay social insurance;

- Go abroad to settle;

- People who are suffering from one of the life-threatening diseases such as cancer, paralysis, cirrhosis, leprosy, severe tuberculosis, HIV infection that has progressed to AIDS;

People with diseases or disabilities that reduce their ability to work by 81% or more and cannot control or perform daily personal activities on their own and need someone to monitor, assist, and care for them.

- In case of employees who are demobilized, discharged, or quit their jobs but are not eligible for pension, including:

+ Officers and professional soldiers of the people's army; professional officers and non-commissioned officers; officers and technical non-commissioned officers of the people's police; people doing cryptographic work receiving salaries like soldiers;

+ Non-commissioned officers and soldiers of the People's Army; non-commissioned officers and soldiers of the People's Police serving for a limited period; military, police, and cryptographic students currently studying are entitled to living expenses.

2. One-time social insurance benefit level

Pursuant to Clause 2, Article 8 of Decree 115/2015/ND-CP, the one-time social insurance benefit is calculated based on the number of years of social insurance payment, each year is calculated as follows:

- 1.5 months of average monthly salary for social insurance contributions for years before 2014;

- 02 months of average monthly salary for social insurance contributions for years from 2014 onwards;

- In case the social insurance payment period is less than one year, the social insurance benefit level is equal to the paid amount, the maximum level is equal to 02 months of the average monthly salary for social insurance payment.

3. Can I pay social insurance again if I have withdrawn it once?

According to Clause 1, Article 2 of the Law on Social Insurance 2014, employees who are Vietnamese citizens are subject to compulsory social insurance, including:

- People working under indefinite-term labor contracts, fixed-term labor contracts, seasonal labor contracts or labor contracts for a certain job with a term from 03 months to less than 12 months, including labor contracts signed between the employer and the legal representative of a person under 15 years of age in accordance with the provisions of labor law;

- Employees working under a labor contract with a term from 01 month to less than 03 months;

- Cadres, civil servants, public employees;

- Defense workers, police workers, and people working in other key organizations;

- Officers, professional soldiers of the people's army, officers, professional non-commissioned officers, officers, technical non-commissioned officers of the people's police, and people working in cryptography receive salaries like military soldiers.

- Non-commissioned officers and soldiers of the People's Army; non-commissioned officers and soldiers of the People's Police serving for a limited term; military, police and cryptographic students currently studying are entitled to living expenses;

- People working abroad under contracts as prescribed in the Law on Vietnamese Workers Working Abroad under Contracts;

- Business managers and cooperative executives receive salaries;

- Non-professional workers in communes, wards and towns.

Thus, in case the employee signs a labor contract with the company, he/she will be subject to compulsory social participation. At that time, the employee has the right to participate in social insurance at the new company even though he/she previously participated in social insurance and withdrew social insurance once.

In this case, you need to report to the company to request the employer to participate in social insurance for you. If the social insurance book number has not been deleted, provide the old social insurance book and continue to pay social insurance. If the social insurance book number has been deleted, a new social insurance book will be issued.

Source

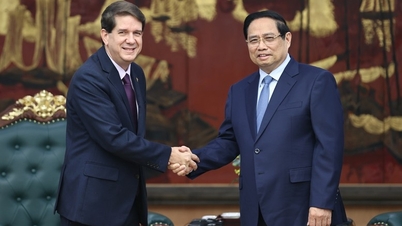

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong holds talks with Sultan of Brunei Darussalam Haji Hassanal Bolkiah](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/01/1764574719668_image.jpeg)

Comment (0)