In particular, the Department requires functional departments and the Inter-District Tax Team to carefully review enterprises with signs of high tax risks, especially those units that are likely to be involved in using fake invoices to evade taxes. Thereby, strengthening inspection and examination work to ensure transparency and compliance with regulations in tax management.

Accumulated to May 2025, the entire regional Tax sector has issued 53 inspection and examination decisions; of which 41 have been completed.

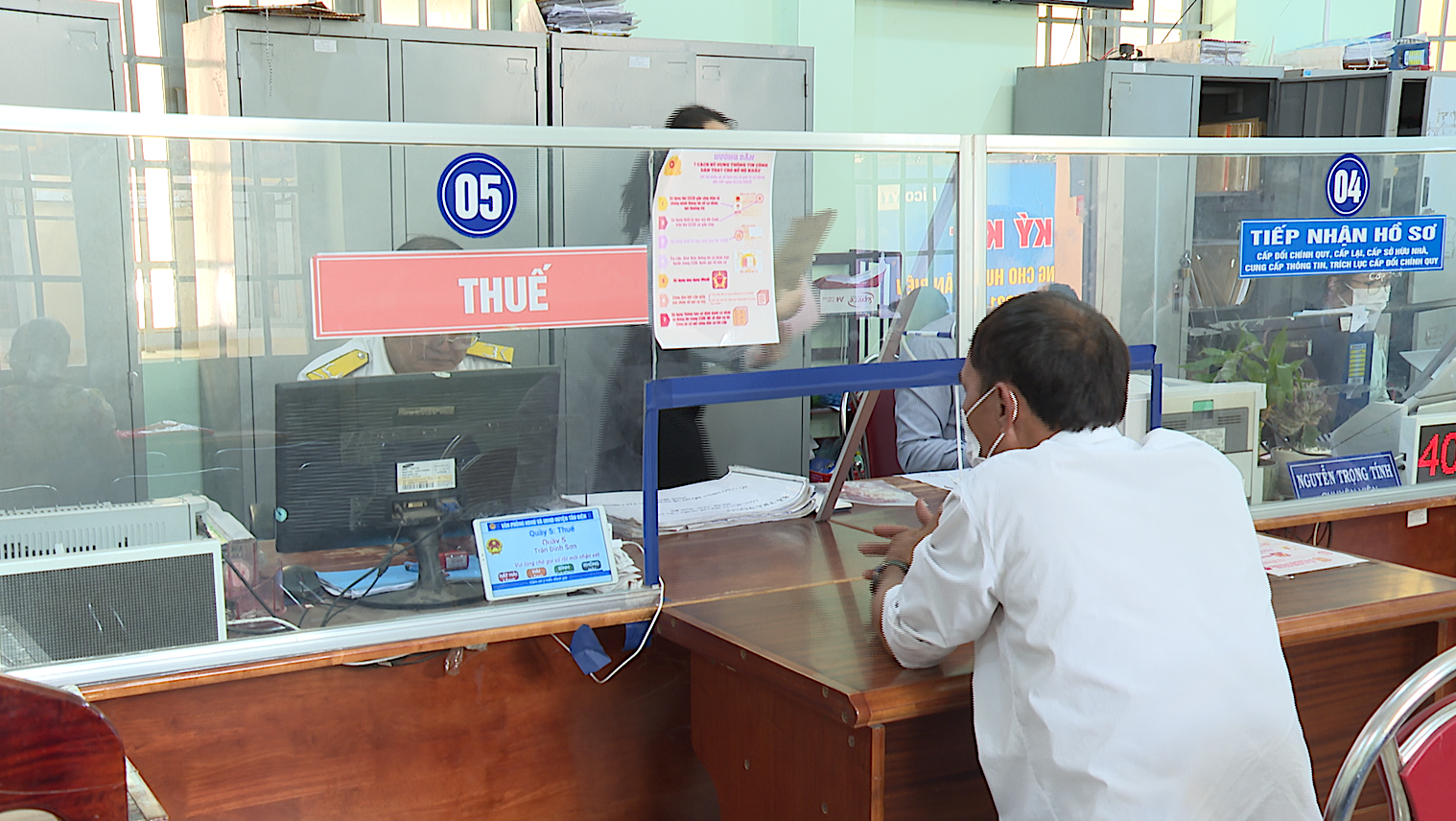

People make tax declaration procedures at the Tax Department of Region XVI, Tay Ninh One-Stop Department.

The results recorded a total amount of over 8.4 billion VND in arrears, over 1.8 billion VND in refunds and a total fine of nearly 4.4 billion VND. In particular, the tax sector also recorded a loss reduction of over 52 billion VND, contributing to increasing the State budget revenue and protecting the legitimate rights of legitimate businesses.

In the coming time, the Tax Department directs tax agencies to continue to thoroughly strengthen discipline, rectify working style, attitude, and behavior of civil servants and public employees of their units in performing public duties and promptly handle violations.

Focus on solving and handling work according to the new organizational model, thoroughly handling handover work, especially arising work and situations, so as not to affect the production and business activities of the People and enterprises.

Tax officer at Tax Branch Region XVI, Tay Ninh One-Stop Department.

The tax authority shall develop and implement a plan to review the national revenue sources by each taxpayer, by industry, locality, and group of subjects, to serve the work of making estimates, managing and operating revenue, and evaluating the effectiveness of the tax authority's management work.

Focus on implementing topics to combat revenue loss, invoice trading, tax refund fraud, and tax evasion; review and cut administrative procedures, improve the quality of online public services throughout the process, and develop a detailed implementation plan to strive to cut at least 30% of administrative procedures in the tax sector.

Coordinate with press agencies to promote communication on key contents in the implementation results of tasks and tax work such as: e-commerce tax management, invoice fraud prevention, digital transformation.

Hoang Yen

Source: https://baotayninh.vn/day-manh-thanh-tra-kiem-tra-chong-that-thu-thue-a190881.html

![[Photo] Nearly 104,000 candidates in Hanoi complete procedures to take the 10th grade entrance exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/7/7dbf58fd77224eb583ea5c819ebf5a4e)

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)