The Ministry of Finance has just announced a draft submission to the National Assembly Standing Committee's Resolution on adjusting the family deduction level in personal income tax, applicable from the 2026 tax period.

The proposal was made on the basis of the consumer price index (CPI) in the 2020-2025 period increasing by 21.24%, exceeding the 20% threshold - the level that needs to be adjusted according to current regulations in the Personal Income Tax Law.

The Ministry of Finance proposes to raise the family deduction to a maximum of VND 15.5 million/month from 2026. (Illustration photo)

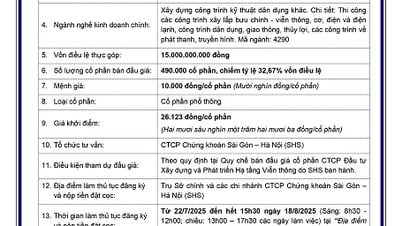

Accordingly, the Ministry of Finance proposed two options to adjust the deduction level for submission to competent authorities for consideration.

Option 1, adjusted according to the CPI growth rate. Thus, the deduction for the taxpayer himself will increase from 11 million to about 13.3 million VND/month. And the deduction for dependents will increase from 4.4 million to 5.3 million VND/month.

The Ministry of Finance assesses that this plan is in accordance with the current Personal Income Tax Law, ensuring basic living needs and inflation from the most recent adjustment time.

Option 2, according to the growth rate of per capita income and per capita GDP. Accordingly, the deduction for taxpayers is expected to be 15.5 million VND/month, and for dependents 6.2 million VND/month.

The Ministry believes that this option will contribute to reducing tax obligations for taxpayers at a higher level. If implemented according to this option, the budget will reduce revenue, but when the family deduction level is higher, tax payments will decrease, and people's disposable income will increase. Thereby, this will contribute to stimulating increased household spending, social consumption, and indirectly help increase budget revenue from other sources in the medium and long term.

Thus, the family deduction under the two options will increase by VND2.3 to VND4.5 million for taxpayers, and VND0.9 to VND1.8 million for each dependent. If approved, the new deduction will apply from the 2026 tax period.

Personal income tax includes taxes from salaried employees (mainly) and business individuals. This is one of the three main taxes of the budget, along with corporate income tax and value added tax (VAT).

Currently, the family deduction is 11 million VND and each dependent is 4.4 million VND/month. This level has been maintained since July 2020.

Source: https://vtcnews.vn/de-xuat-nang-muc-giam-tru-gia-canh-len-cao-nhat-15-5-trieu-dong-thang-tu-2026-ar955495.html

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)