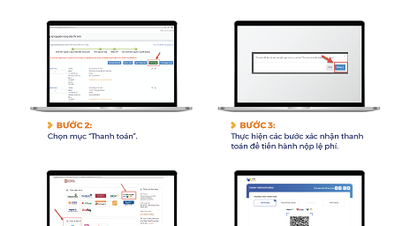

In the draft revised Law on Tax Administration to be submitted to the National Assembly later this year, the Ministry of Finance proposes that e-commerce platforms will declare and pay taxes on behalf of sellers.

On the morning of September 27, answering questions from the press at the regular press conference of the third quarter of the financial sector, Mr. Dang Ngoc Minh - Deputy General Director of the General Department of Taxation - said that the draft revised Law on Tax Administration proposed e-commerce platform will be responsible for declaring and paying taxes on behalf of sellers on the platform. This is a solution to increase the effectiveness and efficiency of tax management.

The current Law on Tax Administration also stipulates that not only businesses but also many management agencies such as the State Bank... must coordinate with tax authorities to collect taxes. For example, e-commerce platforms provide seller information to tax authorities.

According to international experience, this proposal is not a new solution. Foreign suppliers not present in Vietnam have declared and paid on behalf of them. To date, 108 foreign suppliers such as Google, Facebook... have declared on behalf of them.

"Therefore, applying it to domestic enterprises is to ensure fairness. Foreign suppliers declare on their behalf, there is no reason why domestic e-commerce platforms cannot do it?" - Mr. Minh emphasized and added that business on technology platforms should be strictly managed.

Through interviews with domestic e-commerce platforms, directors of these businesses all confirmed that once the policy is issued, they can declare and pay on behalf of individuals. floor sales

At the press conference, Deputy Minister of Finance Nguyen Duc Chi also said that with the strong development of e-commerce activities in recent years, changing tax management methods is inevitable. However, solutions and proposals need to be carefully considered. The Ministry of Finance continues to listen to business opinions to propose appropriate adjustments.

According to the Ministry of Industry and Trade , in the past 5 years, the growth rate has been maintained at 20-25%/year. About 10 years ago, the scale of Vietnam's retail e-commerce market at that time reached about 2.2 billion USD.

By 2023, market size Retail e-commerce has reached 20.5 billion USD, accounting for 8% of total retail sales of goods and consumer service revenue nationwide.

According to the General Department of Taxation, tax revenue from e-commerce has increased steadily over the years with participation not only from domestic enterprises, but also from international platforms such as Google, Facebook and Amazon.

In 2022, tax revenue from trade will reach 83,000 billion VND, in 2023 it will reach 97,000 billion VND, and in just the first 7 months of this year, it has reached more than 78,000 billion VND.

Source

![[Photo] National Assembly Chairman attends the seminar "Building and operating an international financial center and recommendations for Vietnam"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/28/76393436936e457db31ec84433289f72)

Comment (0)