Foreign exchange rates, USD/VND exchange rate today, August 19, recorded that USD is struggling to regain momentum, while EUR has skyrocketed, surpassing the main resistance level.

Foreign exchange rate update table - Vietcombank USD exchange rate today

| 1. VCB - Updated: August 20, 2024 00:58 - Time of website supply source | ||||

| Foreign currency | Buy | Sell | ||

| Name | Code | Cash | Transfer | |

| Australian Dollar | AUD | 16,267.90 | 16,432.22 | 16,959.82 |

| Canadian Dollar | CAD | 17,813.76 | 17,993.70 | 18,571.43 |

| SWISS FRANC | CHF | 28,218.02 | 28,503.05 | 29,418.22 |

| YUAN RENMINBI | CNY | 3,429.72 | 3,464.37 | 3,576.14 |

| DANISH KRONE | DKK | - | 3,630.14 | 3,769.25 |

| EURO | EUR | 26,884.28 | 27,155.84 | 28,359.11 |

| Sterling Pound | GBP | 31,544.77 | 31,863.41 | 32,886.46 |

| HONG KONG DOLLAR | HKD | 3,126.40 | 3,157.98 | 3,259.38 |

| INDIAN RUPEE | INR | - | 296.95 | 308.83 |

| YEN | JPY | 166.53 | 168.22 | 176.26 |

| Korean Won | KRW | 16.21 | January 18 | 19.65 |

| KUWAITIAN DINAR | KWD | - | 81,545.03 | 84,807.26 |

| MALAYSIAN RINGGIT | MYR | - | 5,653.50 | 5,776.96 |

| NORWEGIAN KRONER | NOK | - | 2,294.26 | 2,391.72 |

| Russian Ruble | RUB | - | 267.20 | 295.80 |

| SAUDI RIAL | SAR | - | 6,641.13 | 6,906.81 |

| SWEDISH KRONA | SEK | - | 2,348.37 | 2,448.14 |

| SINGAPORE DOLLAR | SGD | 18,597.26 | 18,785.11 | 19,388.26 |

| THAILAND BAHT | THB | 641.92 | 713.24 | 740.58 |

| US DOLLAR | USD | 24,790.00 | 24,820.00 | 25,160.00 |

Exchange rate developments in the domestic market

In the domestic market, according to TG&VN at 7:30 a.m. on August 19, the State Bank announced the central exchange rate of the Vietnamese Dong to the USD at 24,254 VND.

The reference USD exchange rate at the State Bank's Transaction Office is listed at: 23,400 VND - 25,450 VND.

USD exchange rates at commercial banks buying and selling are as follows:

Vietcombank: 24,860 VND - 25,230 VND.

Vietinbank : 24,750 VND - 25,200 VND.

|

| Foreign exchange rates, USD/VND exchange rate today August 19: EUR soars, bright outlook. (Source: Vietnamnet) |

Exchange rate developments in the world market

The Dollar Index (DXY), which measures the USD against six major currencies (Euro, JPY, GBP, CAD, SEK, CHF), stopped at 102.4.

The DXY index is struggling to regain momentum. The strong recovery from last week's low of 102.27 failed to sustain. The DXY index fell sharply from around 103.2 to close the week at 102.4, down 0.71%.

The DXY index currently has a very important support level at 102. The index needs to stay above 102 and bounce back from there to avoid further sharp declines.

A bounce from around 102 could send the index back up to the 103-103.5 zone again. In that case, 102-103.5 could be a trading range that can be maintained for a short period of time.

If the DXY index falls below 102, the outlook will be very negative. Such a breakdown could drag the index down to the 101-100 zone.

The area between 103.5 and 104 is the major resistance.

The yield on the 10-year US Treasury bond remained below 4% last week. The outlook remains unclear. The index has a resistance zone in the 4-4% range. Yields must rise above 4.1% to establish momentum back towards 4.3%.

If yields remain below 4.1%, the trend will remain bearish, possibly seeing a drop to the 3.6-3.5% range in the coming weeks. A drop below 3.8% could trigger this decline.

Currently, yields may fluctuate in the 3.8-4.1% range for a while with a bearish bias.

On the other hand, the EUR surged above the key resistance level of 1.095 last week. The area between 1.095 and 1.093 will act as a good support level for the EUR/USD index.

Should the index drop below 1.0930, the EUR could come under further downside pressure.

Current outlook is bullish, EUR could rise to 1.11-1.12 in the short term.

Source: https://baoquocte.vn/ty-gia-ngoai-te-ty-gia-usdvnd-hom-nay-198-dong-eur-tang-vot-trien-vong-sang-283076.html

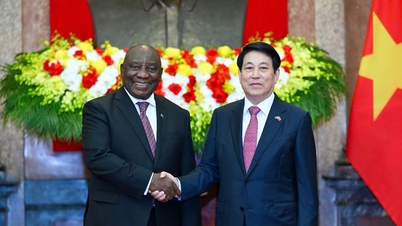

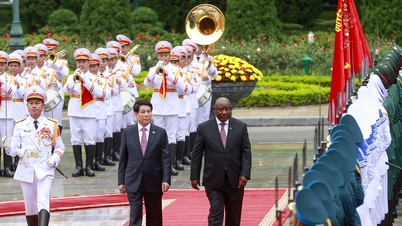

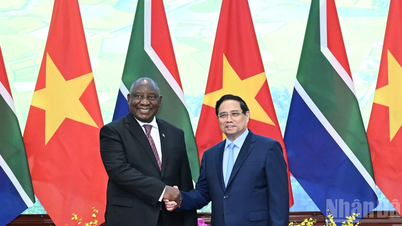

![[Photo] President Luong Cuong holds talks with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761221878741_ndo_br_1-8416-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh chairs meeting on railway projects](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761206277171_dsc-9703-jpg.webp)

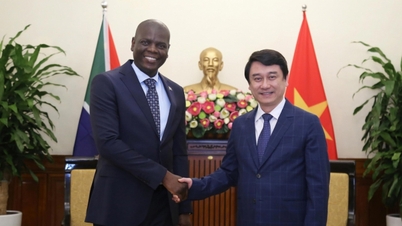

![[Photo] Prime Minister Pham Minh Chinh meets with South African President Matamela Cyril Ramaphosa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/23/1761226081024_dsc-9845-jpg.webp)

Comment (0)