Today's silver price is listed at 915,000 VND/tael for buying and 960,000 VND/tael for selling in Hanoi. The silver price in Ho Chi Minh City is listed higher at 917,000 VND/tael for buying and 962,000 VND/tael for selling. The world silver price is at 756,000 VND/ounce for buying and 761,000 VND/ounce for selling.

Specifically, the latest information on silver prices today in the two largest markets of Hanoi and Ho Chi Minh City on September 18, 2024:

Silver type | Unit | Hanoi | Ho Chi Minh City | ||

Buy | Sell out | Buy | Sell out | ||

99.9 silver | 1 amount | 915,000 | 960,000 | 917,000 | 962,000 |

| 1 kg | 24,411,000 | 25,609,000 | 24,449,000 | 25,655,000 | |

| Silver 99.99 | 1 amount | 921,000 | 961,000 | 922,000 | 966,000 |

| 1 kg | 24,559,000 | 25,621,000 | 24,579,000 | 25,758,000 | |

Latest update on world silver prices on September 18, 2024

| Unit | World silver price today (VND) | |

Buy | Sell out | |

| 1 Ounce | 756,000 | 761,000 |

| 1 finger | 91,144 | 91,737 |

| 1 amount | 911,000 | 917,000 |

| 1 kg | 24,305,000 | 24,463,000 |

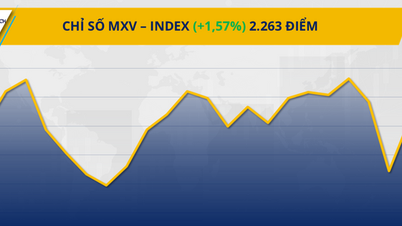

Precious metal prices unexpectedly surged, with silver rising to a near two-month high and platinum surpassing $1,000 an ounce. The main driver behind the growth was growing expectations that the US Federal Reserve (FED) will cut interest rates.

According to the latest data from the US Bureau of Labor Statistics, both the Producer Price Index (PPI) and the Consumer Price Index (CPI) have slowed down compared to previous months, indicating that inflation in the US is gradually cooling down. This strengthens the belief that the Fed will make a move to loosen monetary policy to support the economy.

When economic concerns ease, investors often seek out gold, silver and platinum as safe havens to protect their assets. Low interest rates mean the opportunity cost of holding non-yielding assets like gold decreases, encouraging investors to put money into the market. When the Fed cuts interest rates, the US dollar tends to weaken, increasing the appeal of precious metals to holders of other currencies.

Along with the growth in precious metal prices, the US stock market also recorded green, reflecting the general optimism of investors. Expectations of a strong recovery of the US economy and controlled inflation have boosted the flow of money into risky assets.

The Fed’s monetary policy decision on September 19 will be an important factor affecting the precious metals market in the coming time. If the Fed does decide to lower interest rates, the prices of gold, silver and platinum may continue to rise. However, investors should note that financial markets are always volatile and many other factors can also affect the prices of precious metals.

Source: https://congthuong.vn/gia-bac-hom-nay-1892024-gia-bac-tang-manh-nho-ky-vong-fed-ha-lai-suat-346563.html

Comment (0)