According to the new regulations, imported shipments with a value of less than 1 million VND will be subject to automatic VAT collection through express delivery units. This is a measure to overcome problems arising after the VAT exemption policy for low-value imported goods was abolished.

Statistics from authorities show that previously, every day there were about 4-5 million small-value orders (under 1 million VND) shipped from China to Vietnam through e-commerce platforms.

Before the new policy took effect, shipments valued under VND1 million were exempt from both import tax and VAT.

According to the new regulations, from February 18, these shipments must pay VAT. The implementation of VAT collection not only ensures financial obligations in accordance with regulations but also contributes to increasing revenue for the State budget. With a VAT rate of 10%, it is expected that budget revenue can increase by about VND 2,700 billion per year.

However, in the initial stages of policy implementation, the customs system was not upgraded in time to automatically collect taxes, leading to manual implementation, incurring costs and increasing pressure on both management agencies and businesses.

In order to overcome the above situation and create a legal and technical foundation for automatic tax collection, the Ministry of Finance issued Circular No. 29, effective from July 9. This Circular lays the foundation for modernizing the tax collection process, minimizing administrative procedures and ensuring the principle of correct and sufficient collection for the State budget.

According to the implementation roadmap, after the pilot phase, from August 1, the automatic VAT collection process will be applied uniformly to all businesses providing express delivery services, regardless of the method of transportation.

Source: https://baolaocai.vn/hang-nhap-khau-tri-gia-duoi-1-trieu-dong-bi-thu-thue-vat-tu-dong-tu-18-post648579.html

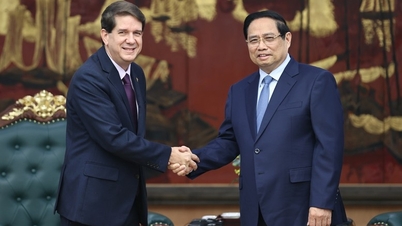

![[Photo] Prime Minister Pham Minh Chinh receives President of Cuba's Latin American News Agency](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F12%2F01%2F1764569497815_dsc-2890-jpg.webp&w=3840&q=75)

![[Photo] President Luong Cuong holds talks with Sultan of Brunei Darussalam Haji Hassanal Bolkiah](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/12/01/1764574719668_image.jpeg)

Comment (0)