The latest statistics from the Vietnam Banks Association (VNBA) show that some banks have unexpectedly increased deposit interest rates since the beginning of July.

Banks increase savings interest rates and notable trends

At VPBank , interest rates for savings deposits of 1 to 36 months increased by 0.1%. The highest interest rate for deposits at VPBank is about 5.7% - 5.8%/year for long terms of 24-36 months and deposits of 10 billion VND or more.

Techcombank increased the interest rate for deposits with terms of 1 to 36 months by 0.1-0.2%. Customers who deposit long-term savings at Techcombank have the highest interest rate of about 4.85% - 5%/year.

Depositors at VCBNeo ( Vietcombank 's digital bank) also increased the interest rate for 1-6 month terms by 0.1% compared to the previous interest rate schedule. Currently, the highest interest rate at this digital bank is 5.45%/year for terms of 13 months or more.

Idle money from the population flows strongly into the banking system.

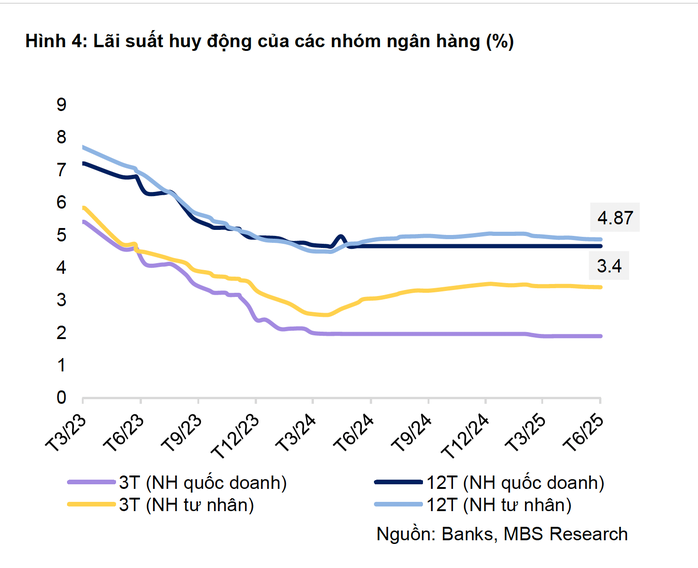

According to MBS Securities Company, the decline in deposit interest rates has slowed down in June with very few banks adjusting their rates down and the reduction margin narrowing. By the end of June, the average 12-month term interest rate of the joint stock commercial banks group decreased by 0.17 percentage points compared to the beginning of the year to 4.87%, while the interest rate of the state-owned commercial banks group remained stable at 4.7%.

The State Bank will continue to direct credit institutions to reduce operating costs, increase the application of information technology, digital transformation and other solutions to reduce lending interest rates.

A notable development, according to VNBA, despite low interest rates, deposits from residential customers have grown for 15 consecutive months. Deposits in the banking system from individual and institutional customers also officially surpassed the 15 quadrillion mark in April 2025.

According to a reporter from the Lao Dong Newspaper , many people still choose to save money despite other investment channels being popular.

Mr. Nhat Minh (residing in Khanh Hoi ward, Ho Chi Minh City) said that despite the low interest rate, he still spends about 1/3 of his investment money on savings. Because the stock market has increased sharply, but it requires investors to be knowledgeable and knowledgeable; real estate requires a large amount of money and the market is not really active.

"I choose to save online, the interest rate is about 0.2%/year higher than at the counter and I can flexibly close when needed. The 3-month term interest rate at the bank I deposit at is about 4.7%/year, a reasonable level for short-term deposits" - Mr. Minh said.

What will the interest rate be?

In the latest forecast on deposit interest rate trends, MBS experts believe that deposit interest rates may increase slightly at the end of the year following the increase in credit. MBS forecasts that 12-month deposit interest rates of major commercial banks will fluctuate around 4.7% this year.

The strategic report of Dragon Viet Securities Company (VDSC) stated that the State Bank will continue its controlled loosening policy, providing liquidity in the open market, providing recapitalization loans to the group of banks participating in the restructuring of banks at 0 VND and in the near future, it may remove the credit ceiling. The State Bank will encourage commercial banks to participate in providing targeted credit packages with preferential interest rates to direct credit flows towards policy priorities.

Source: https://nld.com.vn/mot-so-ngan-hang-tang-lai-suat-gui-tiet-kiem-dieu-gi-dang-xay-ra-196250721085457505.htm

![Dong Nai OCOP transition: [Part 2] Opening new distribution channel](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/09/1762655780766_4613-anh-1_20240803100041-nongnghiep-154608.jpeg)

Comment (0)