Saigon - Hanoi Commercial Joint Stock Bank (SHB ) has just announced information on transactions of insiders and related persons of insiders.

Accordingly, Saigon - Hanoi Securities Corporation (SHS), chaired by Mr. Do Quang Vinh, registered to sell 20 million SHB shares between August 21 and September 17 through negotiation on the stock exchange.

SHS Securities currently holds nearly 59.5 million SHB shares, equivalent to 1.463% of the bank's charter capital.

Thus, if the entire registered shares are successfully sold, SHS will still hold nearly 39.5 million SHB Bank shares, equivalent to 0.97% of charter capital.

SHS Securities registered to sell SHB Bank shares in the context of the bank chaired by Mr. Hien having its shares increase explosively in price over the past month and a half, from about 11,000 VND/share in early July to over 20,000 VND/share on August 15, equivalent to nearly doubling. SHB shares' liquidity in the market averaged over 100 million shares per session and were continuously net bought by foreign investors in July, with a volume of over 100 million units.

At this price, SHS Securities can earn about 400 billion VND. And if calculated into business results, SHS will have a profit of up to several hundred billion VND for this investment.

In the trading session on August 18, SHB shares continued to increase in price by about 2.2% compared to the previous session, but this is the trading day without the right to pay 2024 dividend in shares at a rate of 13%. Therefore, SHB shares closed at 18,850 VND/share.

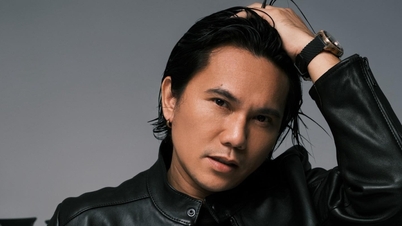

Mr. Do Quang Hien, Chairman of SHB Bank. Photo: HH

Previously, Saigon - Hanoi Commercial Joint Stock Bank, chaired by Mr. Do Quang Hien, announced that it would issue nearly 528.5 million shares to pay dividends to shareholders at a rate of 13%.

SHB will close the shareholder list on August 19 and trade without rights on August 18. The number of additional shares issued will not be subject to transfer restrictions. The capital used to issue shares to pay dividends will come from after-tax profits after setting aside funds in 2024. After the issuance, the bank's charter capital will increase by nearly VND5,285 billion, from VND40,657 billion to VND45,942 billion.

In June, SHB completed paying 2024 cash dividends at a rate of 5%.

Over the past month, banking stocks have been the focus of the stock market. Among them, SHB has been a highlight with very high liquidity, reaching hundreds of millions of units transferred per session (a record of nearly 250 million shares per session). SHB has been the leading stock in liquidity for many sessions in the context of the stock market booming and the VN-Index continuously setting historical peaks and currently above the 1,600 point threshold.

In late July and early August, SHB recorded many sessions of ceiling price increase. With a nearly doubling in a month and a half, SHB's capitalization has reached nearly VND86.6 trillion (equivalent to about USD3.3 billion).

SHB is one of the stocks that foreign investors have been strongly net buying recently, with hundreds of millions of units.

SHB is a mid-sized bank in the Vietnamese banking system but has recently expanded at a very rapid pace. In 2025, SHB aims to have total assets exceeding VND832 trillion and reaching VND1 million billion by 2026. SHB targets pre-tax profit of VND14,500 billion in 2025, an increase of 25% compared to 2024.

By the end of the second quarter of 2025, SHB recorded total assets of nearly VND826 trillion, a sharp increase compared to the level of more than VND747 trillion at the beginning of the year. Total profit after tax in the first 6 months of the year reached more than VND7.1 trillion, a sharp increase compared to the level of nearly VND5.5 trillion in the same period last year.

To date, T&T Group is still one of the largest shareholders of SHB Bank, holding a significant ownership ratio. By the end of 2024, T&T owned more than nearly 287.4 million SHB shares, equivalent to nearly 7.85% of the bank's charter capital. At the end of 2023, T&T held nearly 362 million SHB shares, equivalent to 9.999% of shares.

On August 14, SHS mobilized VND550 billion in 8% interest rate bonds to restructure bank loans. SHS reported completing nearly 50% of the yearly profit plan after 6 months, equivalent to nearly VND789 billion. In 2025, SHS set a business plan with total revenue of more than VND2.5 trillion and pre-tax profit of more than VND1.6 trillion.

Source: https://vietnamnet.vn/shb-tren-dinh-lich-su-chung-khoan-shs-dang-ky-ban-20-trieu-co-phieu-2433420.html

Comment (0)