On July 7, statistics from the Vietnam Securities Depository (VSD) showed that in June alone, domestic investors opened nearly 146,000 new securities accounts. This is the second consecutive month that the number of newly opened securities accounts by domestic investors has increased sharply, after hitting bottom last April (only about 23,000 newly opened accounts).

The stock market recovered both in terms of points and increased new account openings.

By the end of June, the total number of individual investor accounts in the country had exceeded 7.25 million, equivalent to more than 7.2% of the population. Meanwhile, the number of securities accounts opened by organizations stopped at only 8.

Previously, in May, VSD recorded nearly 114,000 newly opened securities accounts. Thus, in June, the number of newly opened securities accounts increased by more than tens of thousands.

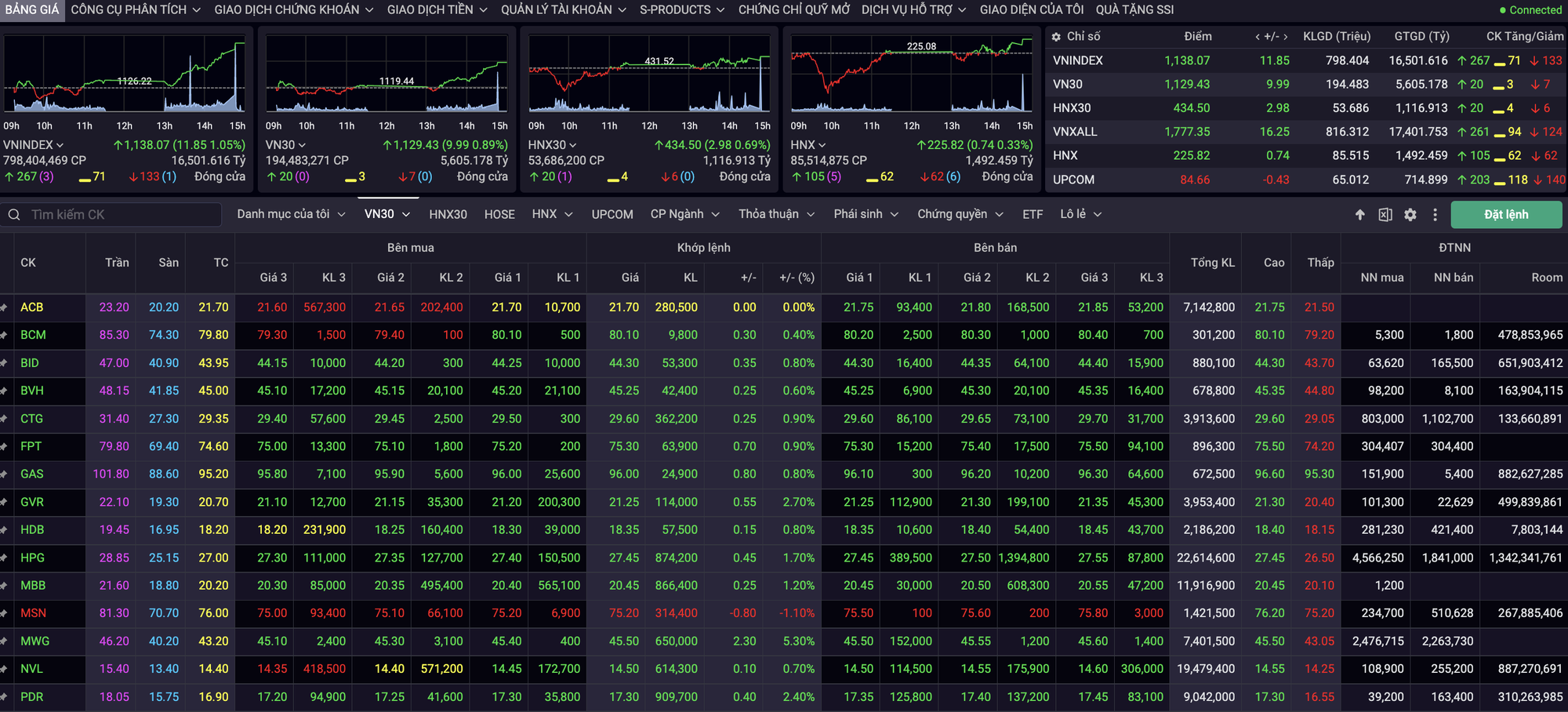

Along with the increase in the number of newly opened securities accounts, the VN-Index also recovered strongly, increasing by more than 4% in June with vibrant transactions, market liquidity reaching billions of USD in some sessions. On the Ho Chi Minh City Stock Exchange (HOSE) alone, the average matched trading value per session reached over VND 15,000 billion, an increase of more than 40% compared to May and the highest level in more than 1 year since April 2022.

Domestic cash flows return to the stock market as interest rates continue to fall

According to some financial experts, the strong recovery of the stock market in recent times has attracted investors' cash flow back to the market after a period of leaving. At the same time, along with the continuous adjustment of bank interest rates, more cash flow is transferred to the stock market, pushing the average transaction value of each session up. In addition, margin is also activated, "pumped" into the stock market more strongly when interest rates decrease.

Notably, on July 6, when working with the Association of Small and Medium Enterprises, Prime Minister Pham Minh Chinh continued to direct further interest rate reductions to provide more timely support to small and medium enterprises. Many stock investors assessed that this is also good news for the stock market because when interest rates are reduced, cash flow will likely continue to shift more into stocks.

According to VSD, in June, while domestic cash flow showed signs of increasing into the stock market, foreign investors continued their net selling trend, but the selling intensity decreased significantly compared to before. Specifically, in June, foreign investors net sold 400 billion VND on HOSE. This was the lowest net selling value in the second quarter after foreign investors net sold 2,800 billion VND in April and more than 3,000 billion VND in May.

VSD also reported that in June, foreign investors opened nearly 200 new securities accounts on the VN-Index. By the end of June, foreign investors had a total of nearly 44,000 accounts.

Source link

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

![Dong Nai OCOP transition: [Part 2] Opening new distribution channel](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/09/1762655780766_4613-anh-1_20240803100041-nongnghiep-154608.jpeg)

Comment (0)