The Vietnam Commodity Exchange (MXV) said that at closing, the MXV-Index increased by 1.5% to 2,182 points.

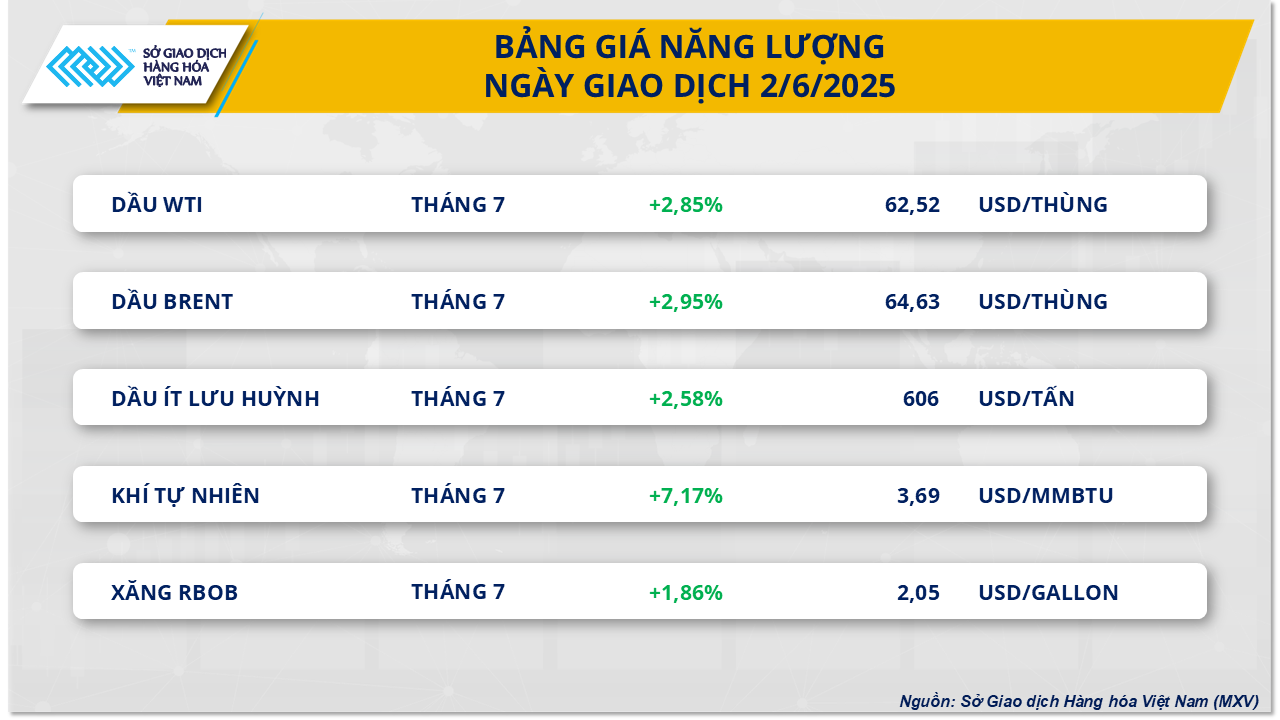

Energy commodity market covered in green. Source: MXV

At the end of the first trading session of the week, the energy market witnessed a strong increase in all 5 commodities in the group. In which, the price of two crude oil commodities simultaneously increased by nearly 3% despite the fact that the OPEC+ group will continue to increase production in July.

Specifically, WTI oil price recorded an increase of 2.85%, reaching 62.52 USD/barrel. Meanwhile, Brent oil price also increased from 62.78 USD/barrel to 64.63 USD/barrel, equivalent to an increase of up to 2.95%.

Goldman Sachs predicts that August could become the fourth consecutive month of OPEC+ increasing production by 411,000 barrels per day, with the reason given being the cyclical increase in consumption in the coming summer, which is also the peak travel season for Americans.

Last week, both the US Energy Information Administration (EIA) and the American Petroleum Institute (API) reported a sharp decline in US commercial crude oil inventories, and gasoline inventories also fell last week. This could lead to market expectations for the start of a new cycle of fuel consumption growth in the US. At the same time, the weakening of the greenback also supported the strong increase in oil prices.

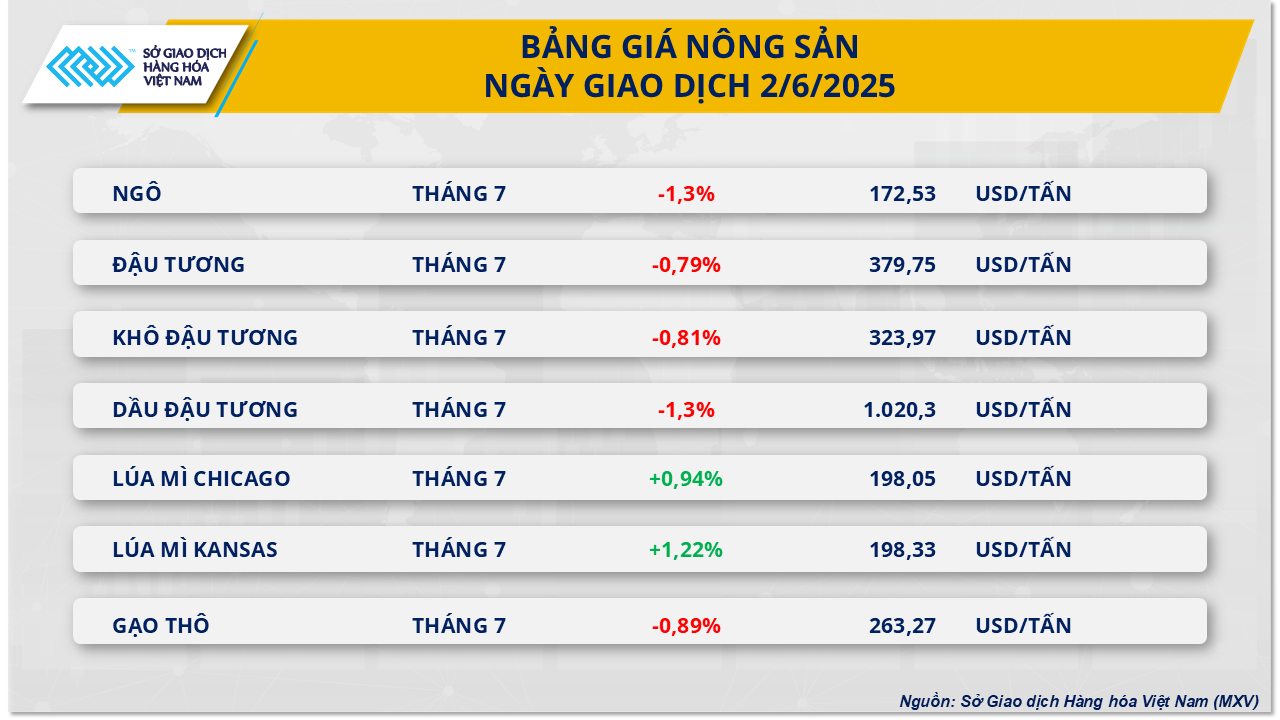

Agricultural commodity market with red dominating. Source: MXV

According to MXV, red dominated the agricultural market in yesterday's trading session. In particular, soybean prices opened the new month in red, down 0.79% to $379/ton. In addition to favorable weather conditions in the US, the market was also under pressure from negative signals in US-China trade relations and the weakening of soybean oil prices.

According to the USDA Export Deliveries report, soybean shipments for the week ending May 29 were 268,343 tons, up from the previous week but still down from 361,000 tons a year ago. While consistent with the current situation, this figure is not enough to support prices.

The market focus is that China – the largest import partner of the US – has completed receiving the last soybean shipment for the 2024-2025 crop year without any new orders for the 2025-2026 crop year. This has shown that the trade relationship between the two countries is falling into a frozen state, creating negative sentiment in the market.

Source: https://hanoimoi.vn/thi-truong-hang-hoa-nhom-nang-luong-phu-sac-xanh-704341.html

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)