|

| Bank channels are still the destination for people's savings deposits with interest - Photo: D.HA |

According to the State Bank of Region 2, by the end of March 2025, residential savings deposits of credit institutions in the area increased by 4.54% compared to the end of last year, up 11.95% compared to the same period in 2024.

Statistics show that savings deposits of residents in the banking system of Ho Chi Minh City increased by 1.65% in January this year, 1.35% in February, and 1.54% in March.

Residential savings deposits of credit institutions in Ho Chi Minh City by the end of March this year reached 1,516 trillion VND, accounting for 37.2% of total mobilized capital of credit institutions in Ho Chi Minh City, which is an important deposit component in the sustainable business of credit institutions.

At the same time, this deposit segment is becoming an important part of social security, due to its nature of saving, accumulating, and earning interest to serve people's consumption life.

Mr. Nguyen Duc Lenh - Deputy Director of State Bank Region 2, said that people's savings deposits maintained a positive growth rate every month due to effective monetary, credit and interest rate policies. Especially, the macro economy is stable, inflation is kept at a low level, the value of the dong is controlled...

Residential savings, a traditional form of people's trust in the Vietnamese banking system, is still creating a very high level of trust in the market; this reflects the policy trust in the banking system in the process of socio-economic development of Vietnam.

Meanwhile, banks have recently diversified their deposit products and services through online deposits and online savings with printed books to create trust for new depositors using technology.

In addition, depositors also get increased value through payment services, money transfers, credit, bank cards, etc. Especially banking applications (Apps) installed on mobile phones are creating flexibility in transferring non-term deposits to term accounts to take advantage of interest benefits of accumulated deposits.

Compared to other investment channels, bank savings are safer, more effective and less risky. Especially for consumers with a moderate amount of money, and often receive interest to spend monthly on living expenses, bank savings are still more attractive than investing in other channels.

Source: https://thoibaonganhang.vn/tien-gui-tiet-kiem-dan-cu-o-tp-ho-chi-minh-lien-tuc-tang-163125.html

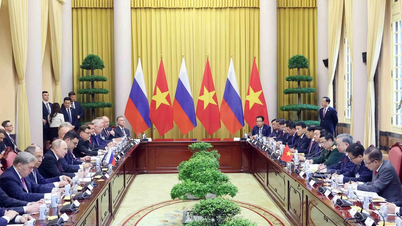

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] General Secretary To Lam begins official visit to Russia and attends the 80th Anniversary of Victory over Fascism](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/5d2566d7f67d4a1e9b88bc677831ec9d)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

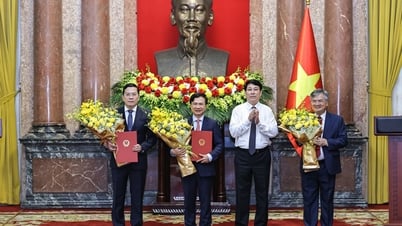

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)