How much is 1 USD in VND today?

State Bank USD exchange rate is at 24,036 VND.

Vietcombank USD exchange rate is currently at 24,395 VND - 24,765 VND (buy - sell).

Euro exchange rate is currently at 25,979 VND - 27,405 VND (buy - sell).

The current Japanese Yen exchange rate is 161.55 VND - 170.99 VND (buy - sell).

The current British Pound exchange rate is 30,439 VND - 31,734 VND (buy - sell).

Today's Yuan exchange rate is at 3,360 VND - 3,503 VND (buy - sell).

USD price today

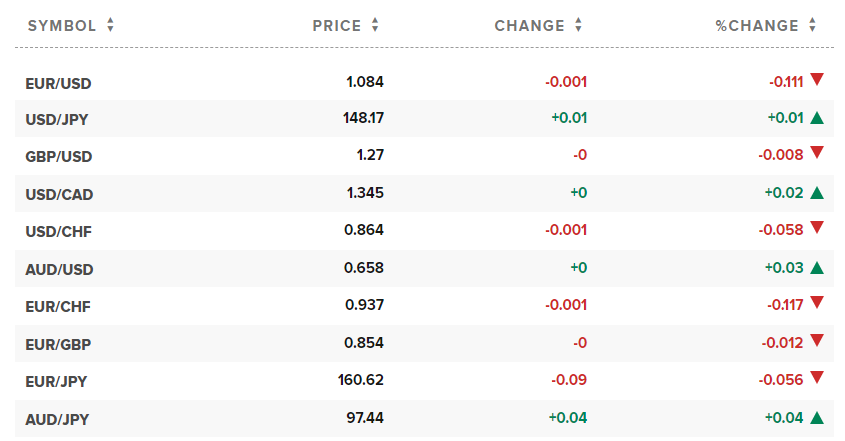

The US Dollar Index (DXY) measures the greenback's fluctuations against six major currencies (EUR, JPY, GBP, CAD, SEK, CHF), recording at 103.41 points.

The US dollar started the week with a slight gain. Markets looked at US economic data ahead of the Federal Reserve's policy meeting this week. Escalating geopolitical tensions in the Middle East began to weigh on risk sentiment.

The USD Index edged up 0.01% to 103.55 on Monday. The DXY is expected to rise 2% in January as markets ease expectations of an early US rate cut.

The Fed surprised markets in December by adopting a dovish stance and projecting a 75 basis point rate cut by 2024. But since then, strong economic data and central bank responses have led markets to adjust expectations. The CME FedWatch tool shows that markets now see a 48% chance of a rate cut in March, up from 86% last month.

“The market recognizes that the tightening cycle is over. The correction will continue in the coming weeks,” said Marc Chandler, market expert at Bannockburn Forex.

Data released over the weekend showed US prices rose moderately in December 2023. This kept annual inflation below 3% for the third consecutive month, raising expectations that interest rate cuts could come this year.

The focus this week is on the Federal Reserve's two-day policy meeting starting on Tuesday. The Fed is expected to keep interest rates unchanged, keeping all eyes on comments from Chairman Jerome Powell.

“This week’s meeting will be very straightforward… There is little reason for the Federal Open Market Committee (FOMC) to change policy. The focus will be on Powell’s attitude,” said Paul Mackel, head of foreign exchange research at HSBC.

In addition to the Fed, investors also watched a series of economic data including the US payroll report, which will help assess the strength of the US labor market.

The euro fell 0.05% to 1.0847 per dollar. The pound was at 1.2703 GBP/USD - up 0.04%.

The yen edged up 0.01% to 148.14 yen per dollar, the Asian currency posting its weakest monthly performance since June 2022.

The market is now on alert for rising geopolitical risks in the Middle East, which should help the yen regain its status as a safe haven.

Elsewhere, the AUD/USD rate was at 0.659, while the NZD/USD rate was at 0.610.

Source

![[Photo] Dan Mountain Ginseng, a precious gift from nature to Kinh Bac land](/_next/image?url=https%3A%2F%2Fvphoto.vietnam.vn%2Fthumb%2F1200x675%2Fvietnam%2Fresource%2FIMAGE%2F2025%2F11%2F30%2F1764493588163_ndo_br_anh-longform-jpg.webp&w=3840&q=75)

Comment (0)