The silent "pandemic" called non-communicable diseases

Discussing at the hall about the draft Law on Special Consumption Tax (amended) recently, delegate Le Hoang Anh, full-time member of the National Assembly's Economic and Financial Committee, said that the tax rate plan for Vietnamese standard sugary soft drinks of 5g/100ml of 8% and 10% postponed until 2027 and 2028 is too slow and too low, not the right point of view.

According to him, the goal of drafting the law is not consistent with the conclusion of General Secretary To Lam in Notice No. 176 of the Central Party Office, which is to put health and health care in a strategic priority position in all strategies.

The development policy argument that imposing a 10% tax could affect growth or that a balance between health and growth goals is needed is only true in ideal conditions, when Vietnam is not facing a silent “pandemic” of non-communicable diseases that is ravaging every family.

Specifically, more than 21 million Vietnamese adults suffer from cardiovascular disease, equivalent to 1/4 of our country's population, of which 200,000 people die each year from this non-communicable disease. More than 5 million Vietnamese people are living with diabetes, 40% of urban children are overweight or obese.

“Sugar-sweetened beverages, which have no significant nutritional value, are one of the few major culprits that we cannot ignore. Not only that, the increasing consumption of sugar-sweetened beverages can also increase the risk of cancer, a disease that has been claiming the lives of hundreds of thousands of Vietnamese people,” Mr. Hoang Anh emphasized.

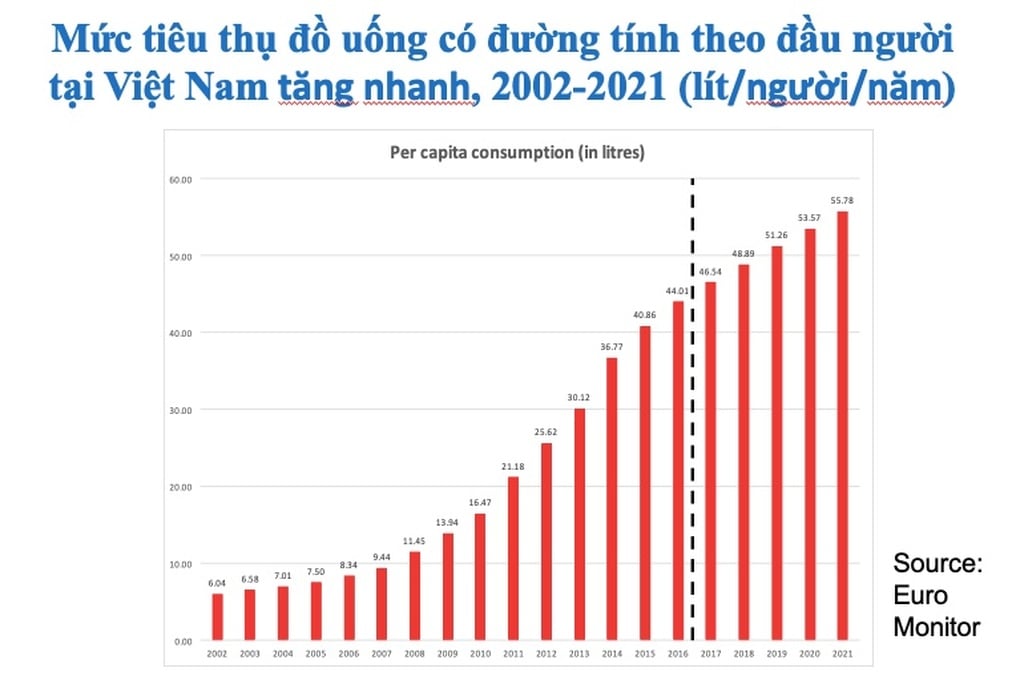

Meanwhile, the consumption of sugary drinks in Vietnam has skyrocketed from 1.59 billion liters in 2009 to 6.67 billion liters in 2023, equivalent to an increase of 420%. On average, each Vietnamese person consumes nearly 70 liters/year, double the recommended level to ensure health.

“If we don't act today, tomorrow we will pay the price with our health budget, with our productivity and with the lives of our people,” he said.

Therefore, he proposed not to reduce the tax rate to 8% but to keep it at 10% from 2026 and 20% from 2030, and to add an absolute tax according to sugar content as the model applied by Thailand.

Without intervention, sugary drink consumption will continue to increase

Dr. Angela Pratt, Chief Representative of the World Health Organization (WHO) in Vietnam, also said that now is a very suitable time for Vietnam to impose special consumption tax on sugary drinks because compared to other countries in the region and the world, Vietnam is lagging behind.

“Without intervention, the trend of sugary drink consumption will continue to increase, leading to many negative consequences for children, adolescents, adults and society as a whole.

Dr. Angela Pratt, WHO Representative in Vietnam (Photo: Nhat Bac).

We warmly welcome the announcement by Deputy Minister of Health Tran Van Thuan that Vietnam will gradually provide free annual health check-ups for people by 2030 to detect diseases early, reduce treatment costs and improve public health and productivity,” the WHO Representative emphasized.

Vietnam has various options to finance this, she said, including earmarking revenue from tobacco, alcohol, and sugary beverage taxes if it is introduced soon.

Imposing special consumption tax on soft drinks containing more than 5g of sugar per 100ml does not mean banning the use of this product, but only serves to guide consumers to choose healthier products.

The 8% tax rate as proposed in the new draft Law only serves to warn consumers that this product is harmful to health and has little effect on reducing consumption.

The National Assembly will vote and pass the draft Law on Special Consumption Tax (amended) on June 13.

Source: https://dantri.com.vn/suc-khoe/vi-sao-viet-nam-can-som-ap-thue-tieu-thu-dac-biet-voi-nuoc-ngot-20250606073029410.htm

![[Photo] Nearly 104,000 candidates in Hanoi complete procedures to take the 10th grade entrance exam](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/7/7dbf58fd77224eb583ea5c819ebf5a4e)

![[OCOP REVIEW] Tu Duyen Syrup - The essence of herbs from the mountains and forests of Nhu Thanh](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/5/58ca32fce4ec44039e444fbfae7e75ec)

Comment (0)