ANTD.VN - Many online shop owners use tricks to hide cash flow to "avoid" taxes, however, experts warn that these tricks will be difficult to "fool" the tax authorities and the possibility of being charged and fined is very high.

Enough tricks to "avoid" taxes

On many "online market" groups, many sellers are spreading tricks to avoid e-commerce tax. Accordingly, a notice to customers spread online, the shop owner said: From January 1, 2025, the Tax Department has the right to check all personal accounts to collect e-commerce tax. The Tax Department will tax all transactions with the content of money transfer as "buy - sell" to decide to enforce and collect tax.

According to this announcement, all transactions with the content of "buying - selling" will be taxed at 10% of the transferred amount to be paid to the State budget. Therefore, this shop requires customers to make a transfer payment to only write the transfer content including the customer's name plus the word "transfer money", not to write contents such as "deposit money for goods", "purchase goods", "transfer money for goods", "debt payment"...

"If customers write content that violates the above regulations, we will collect 10% of the transfer value to issue an invoice and submit it to the tax authority in accordance with State regulations" - this seller announced.

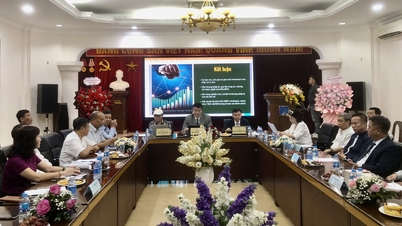

|

From now on, e-commerce platforms will deduct and pay taxes on behalf of sellers. |

The authenticity of the above information is currently unknown, however, according to many buyers, recently when shopping online, they often receive messages from shop owners asking them to only write the name of the social network account when transferring money, and not to write any other information related to the purchase.

This is a trick for online shop owners to avoid paying taxes when tax authorities strengthen tax management measures for e-commerce activities, requiring e-commerce platforms to provide seller information to tax authorities, including bank account information.

In particular, in the Law amending and supplementing a number of articles of 9 Laws recently passed by the National Assembly , the Law on Tax Administration has been amended and supplemented to regulate the responsibility of withholding and paying taxes on behalf of e-commerce platforms for individuals doing business on the platforms.

Accordingly, many ways to hide cash flow have been shared by shop owners. In a recent seminar related to e-commerce tax, another trick that shop owners apply was also mentioned by tax experts, such as using a relative's account number to receive sales proceeds, and when the revenue reaches 99 million VND, then changing to another account number.

Difficult to "fool" the tax authorities

According to Mr. Trinh Hong Khanh, Director of Ba Mien Tax Company, cases like this are like "cicada shedding their shells". However, this tax expert said that this method is quite "dangerous", difficult to fool the tax authorities. Mr. Khanh said that even if the shop does not collect money into the bank account but uses COD (cash collection), the tax authorities will still know, because they have a database, synchronized with the data provided by e-commerce platforms.

“Households/individuals selling online should pay taxes correctly and fully to avoid being charged back taxes and fined for tax evasion,” Mr. Khanh recommended.

According to Ms. Hoang Thi Tra Huong, Consulting Directorof FPT Zbiz, with data synchronization on e-commerce platforms, it will be difficult for sellers to use tax avoidance tricks like the above.

According to Ms. Huong, business households/individuals use citizen identification cards to register shops on many e-commerce platforms, which means many shops have a common identity of one shop owner. The tax authority will not calculate taxable revenue based on the number of accounts receiving income but will calculate it based on the total income of the shop on e-commerce platforms, regardless of which account the shop owner receives money into, or whether they receive cash or not.

"If you exceed the non-taxable threshold without declaring or paying tax, when discovered by state agencies, you will definitely be subject to tax collection," said Ms. Huong.

According to experts, the risk for sellers who evade taxes when discovered by the tax authorities is that they will be subject to tax collection and penalties. Accordingly, tax evasion is fined 2-3 times the amount of tax evaded, so shop owners risk losing 3-4 times the amount of tax that should have been paid.

According to the Law amending a number of articles of 9 Laws (including the Law on Tax Administration) recently passed by the National Assembly, from April 1, 2025, e-commerce platforms will pay taxes on behalf of business households/individuals on the platform, based on actual revenue from the number of orders that business households/individuals initiate and successfully transact on the platform.

Each e-commerce platform will pay taxes to the state budget and deduct taxes for business households/individuals. Tax authorities will have data on the total income of business households/individuals on the platform. Business households/individuals do not need to declare taxable revenue for business activities on e-commerce platforms.

Source: https://www.anninhthudo.vn/chu-shop-online-mach-nhau-chieu-ne-thue-chuyen-gia-canh-bao-nguy-co-bi-xu-phat-post600709.antd

![[Photo] Closing ceremony of the 18th Congress of Hanoi Party Committee](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/17/1760704850107_ndo_br_1-jpg.webp)

![[Photo] General Secretary To Lam attends the 95th Anniversary of the Party Central Office's Traditional Day](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760784671836_a1-bnd-4476-1940-jpg.webp)

![[Photo] Collecting waste, sowing green seeds](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/18/1760786475497_ndo_br_1-jpg.webp)

Comment (0)