In early December 2023, Vietnam Prosperity Joint Stock Commercial Bank ( VPBank ) applied a preferential home loan interest rate of only 5.9%/year. Global Petroleum Bank (GPBank) also launched a home loan interest rate of 6.25%/year.

Many concerns

Previously, in order to stimulate people's demand for home loans at the end of 2023, Vietnam Joint Stock Commercial Bank for Investment and Development ( BIDV ) reduced home loan interest rates to 7.5%/year for the first 18 or 24 months. Meanwhile, banks such as Saigon Thuong Tin (Sacombank), Ho Chi Minh City Development (HDBank)... applied home loan interest rates of 6.5% - 6.8%/year in the beginning.

Not only domestic banks but also many foreign banks have reduced interest rates for home loans since the beginning of December. For example, Shinhan Bank applies a home loan interest rate of only 6.6%/year. This rate is down 4.3% compared to 10.9% in December 2022. Hong Leong Bank offers home loans at 7.3%/year, down from 7.5% in November.

Although the loan interest rates are quite soft, according to Mr. Vo Minh Tri, Director of the Joint Stock Commercial Bank for Foreign Trade of Vietnam ( Vietcombank ) Dong Sai Gon Binh Tay Branch, very few people still open home loan procedures, mainly stopping at the research and exploration stage. The reason may be that borrowers are waiting for house prices and loan interest rates to decrease further. At the same time, they are also listening to the economic situation. Because, if the economy continues to lack improvement, their jobs and income may decrease, which will greatly affect their debt repayment in the future.

Ms. Tran Thi Diep, an employee of a foreign company in Ho Chi Minh City, revealed that with 2 billion VND saved, she wants to borrow about 1 billion VND from the bank to buy a house to settle down and start a business. "What I am concerned about is after the preferential period, how will the bank calculate the loan interest rate and related costs?" - Ms. Diep wondered.

Regarding this issue, credit officers said that most banks only apply "low" interest rates for a short period of time, then they will float according to market interest rates. At some banks, borrowers may have to participate in additional savings service packages, beautiful account numbers, credit cards... which increase borrowing costs.

Mr. Le Van Ly (Binh Tan District, Ho Chi Minh City) said that with his current job and income, he can absolutely borrow from the bank to buy a house. "However, the difficulty is that I do not have any collateral" - Mr. Ly said. However, Mr. Tran Van Tam, a credit officer of Eximbank, said this is not difficult. The important thing is that the borrower must have strong enough financial capacity to convince the bank to lend money to carry out payment steps and purchase procedures. Accordingly, to buy a house worth 3 billion VND, the borrower must have an average monthly income of 20 million VND or more, and have 2 billion VND available. At that time, the bank will lend the remaining 1 billion VND within 20 years (240 months), mortgaged with the house to be purchased. The interest rate in the first years that the borrower must pay is about 8% - 10%/year, which means the principal and interest are 10-11 million VND per month.

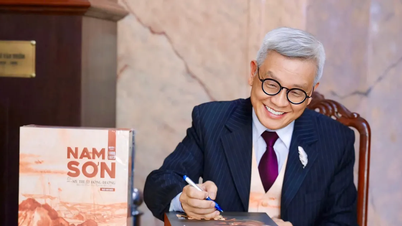

Many banks offer preferential interest rate packages for home loans, but very few people take out loans. Photo: TAN THANH

Old interest rates have not decreased

In fact, many customers who borrowed to buy houses in the past are still bearing huge interest rates, and banks have reduced them very little, and some places have not even reduced them. Reporting to Nguoi Lao Dong Newspaper, Mr. Nguyen Pham (living in District 12, Ho Chi Minh City) said that he has a home loan with an outstanding balance of 1.2 billion VND and has to pay an interest rate of up to 12.35%/year. According to the credit contract, the interest rate will be adjusted every 3 months, but for the past few months, he has not received any reduction. "Every month, I have to pay 12 million VND in interest, not including the principal. I contacted the credit officer in charge of the contract and was told that they do not know when the interest rate will be reduced. Meanwhile, the interest rate table for long-term deposits of 12 months at this bank is only 5.4%/year" - Mr. Pham was upset.

According to VinaCapital statistics, mortgage loan interest rates at Vietnamese banks (including home loan interest rates - PV) have decreased significantly in the third quarter, compared to the second quarter of 2023. If in the second quarter there were still banks offering mortgage loans with the highest interest rate of 16%/year, then in the third quarter, the highest interest rate according to statistics was about 13%/year. However, this interest rate is still high compared to the expectations of borrowers, especially those with old loans.

Why have lending rates not decreased as expected? Economist - Dr. Vo Tri Thanh said that in the short term, lowering the operating interest rate is very difficult, the management agency mainly urges commercial banks to lower lending interest rates. But in reality, commercial banks are also waiting. Specifically, they wait for the operating interest rate to be reduced to commercial interest rates, then affect lending interest rates. Importantly, commercial banks in the late last year and early this year mobilized interest rates that were too high. If they were to lower them immediately, banks would suffer heavy losses even though they really wanted to lend.

Representatives of some banks said that at the end of last year and the beginning of this year, the mobilization interest rate was up to 9%-10%/year and many 12-month term savings deposits have just matured. The interest rate for new loans has decreased rapidly, but the old loans of customers, due to the high input mobilized capital, need time to be absorbed and cannot decrease as quickly as expected by borrowers.

Buy with idle money

Statistics from the Vietnam Real Estate Brokers Association show that by the end of September 2023, there were more than 13,000 real estate products traded nationwide, but most buyers used idle money, and the rate of bank loans was very low.

Source: https://nld.com.vn/de-dat-vay-mua-nha-196231215204339425.htm

![[Photo] Enjoy the Liuyang Fireworks Festival in Hunan, China](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761463428882_ndo_br_02-1-my-1-jpg.webp)

![[Photo] General Secretary To Lam received the delegation attending the international conference on Vietnam studies](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761456527874_a1-bnd-5260-7947-jpg.webp)

![[Photo] Nhan Dan Newspaper displays and solicits comments on the Draft Documents of the 14th National Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761470328996_ndo_br_bao-long-171-8916-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh attends the opening of the 47th ASEAN Summit](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/26/1761452925332_c2a-jpg.webp)

Comment (0)