Update the latest gold price details today, June 9, 2025 in the domestic market

At the time of survey at 6:00 p.m. on June 9, 2025, domestic gold prices recorded a strong upward trend, attracting the attention of investors. Specifically, the price of SJC gold bars in Hanoi was listed at VND 115.7 million/tael (buy) and VND 117.7 million/tael (sell), up VND 800,000 and VND 500,000, respectively, compared to yesterday.

DOJI Group also listed the same SJC gold price, with the buying price of 115.7 million VND/tael and the selling price of 117.7 million VND/tael, showing stable growth in both buying and selling directions.

Mi Hong Company recorded the price of SJC gold bars at 116.7 million VND/tael (buy) and 117.7 million VND/tael (sell), with a significant increase of 1.2 million VND/tael in the buying direction and 700 thousand VND/tael in the selling direction.

At PNJ, today's gold price on June 9, 2025 also showed an upward trend when listed at 111.5 million VND/tael (buy) and 114 million VND/tael (sell), an increase of 500 thousand VND in the buying direction and 400 thousand VND in the selling direction.

The price of 9999 gold jewelry at PNJ is currently at 111.5 million VND/tael (buy) and 114 million VND/tael (sell), with an increase of 500 thousand VND in both directions.

With these fluctuations, today's gold price June 9, 2025 promises to continue to attract attention from investors, especially in the context of complicated developments in the global gold market.

The latest gold price update table today, June 9, 2025 is as follows:

| Gold price today | ||||

|---|---|---|---|---|

| Buy | Sell | |||

| SJC in Hanoi | 115.7 | ▲800K | 117.7 | ▲500K |

| DOJI Group | 114.9 | ▲800K | 117.7 | ▲500K |

| Red Eyelashes | 116.7 | ▲1200K | 117.7 | ▲700K |

| PNJ | 111.5 | ▲500K | 114.0 | ▲400K |

| Vietinbank Gold | 117.7 | ▲500K | ||

| Bao Tin Minh Chau | 115.7 | ▲800K | 117.7 | ▲500K |

| Phu Quy | 115.0 | ▲500K | 117.7 | ▲500K |

| 1. DOJI - Updated: June 9, 2025 18:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| AVPL/SJC HN | 115,700 ▲800K | 117,700 ▲500K |

| AVPL/SJC HCM | 115,700 ▲800K | 117,700 ▲500K |

| AVPL/SJC DN | 115,700 ▲800K | 117,700 ▲500K |

| Raw material 9999 - HN | 108,500 | 112,000 |

| Raw material 999 - HN | 108,400 | 111,900 |

| 2. PNJ - Updated: June 9, 2025 18:00 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 111,500 ▲500K | 114,000 ▲400K |

| HCMC - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Hanoi - PNJ | 111,500 ▲500K | 114,000 ▲400K |

| Hanoi - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Da Nang - PNJ | 111,500 ▲500K | 114,000 ▲400K |

| Da Nang - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Western Region - PNJ | 111,500 ▲500K | 114,000 ▲400K |

| Western Region - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Jewelry gold price - PNJ | 111,500 ▲500K | 114,000 ▲400K |

| Jewelry gold price - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Jewelry gold price - Southeast | PNJ | 111,500 ▲500K |

| Jewelry gold price - SJC | 115,700 ▲800K | 117,700 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 111,500 ▲500K |

| Jewelry gold price - Kim Bao Gold 999.9 | 111,500 ▲500K | 114,000 ▲400K |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 111,500 ▲500K | 114,000 ▲400K |

| Jewelry gold price - Jewelry gold 999.9 | 111,000 ▲500K | 113,500 ▲500K |

| Jewelry gold price - Jewelry gold 999 | 110,890 ▲500K | 113,390 ▲500K |

| Jewelry gold price - Jewelry gold 9920 | 110,190 ▲490K | 112,690 ▲490K |

| Jewelry gold price - Jewelry gold 99 | 109,970 ▲500K | 112,470 ▲500K |

| Jewelry gold price - 750 gold (18K) | 77,780 ▲380K | 85,280 ▲380K |

| Jewelry gold price - 585 gold (14K) | 59,050 ▲290K | 66,550 ▲290K |

| Jewelry gold price - 416 gold (10K) | 39,870 ▲210K | 47,370 ▲210K |

| Jewelry gold price - 916 gold (22K) | 101,570 ▲460K | 104,070 ▲460K |

| Jewelry gold price - 610 gold (14.6K) | 61,890 ▲310K | 69,390 ▲310K |

| Jewelry gold price - 650 gold (15.6K) | 66,430 ▲330K | 73,930 ▲330K |

| Jewelry gold price - 680 gold (16.3K) | 69,830 ▲340K | 77,330 ▲340K |

| Jewelry gold price - 375 gold (9K) | 35,210 ▲180K | 42,710 ▲180K |

| Jewelry gold price - 333 gold (8K) | 30,110 ▲170K | 37,610 ▲170K |

| 3. SJC - Updated: 06/09/2025 18:00 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 115,700 ▲800K | 117,700 ▲5 00K |

| SJC gold 5 chi | 115,700 ▲800K | 117,720 ▲5 00K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 115,700 ▲800K | 117,730 ▲5 00K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 111,500 ▲300K | 113,800 ▲300K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 111,500 ▲300K | 113,900 ▲300K |

| Jewelry 99.99% | 111,500 ▲300K | 113,200 ▲300K |

| Jewelry 99% | 107,579 ▲297K | 112,079 ▲297K |

| Jewelry 68% | 70,233 ▲204K | 113,800 ▲204K |

| Jewelry 41.7% | 40,459 ▲125K | 47,359 ▲125K |

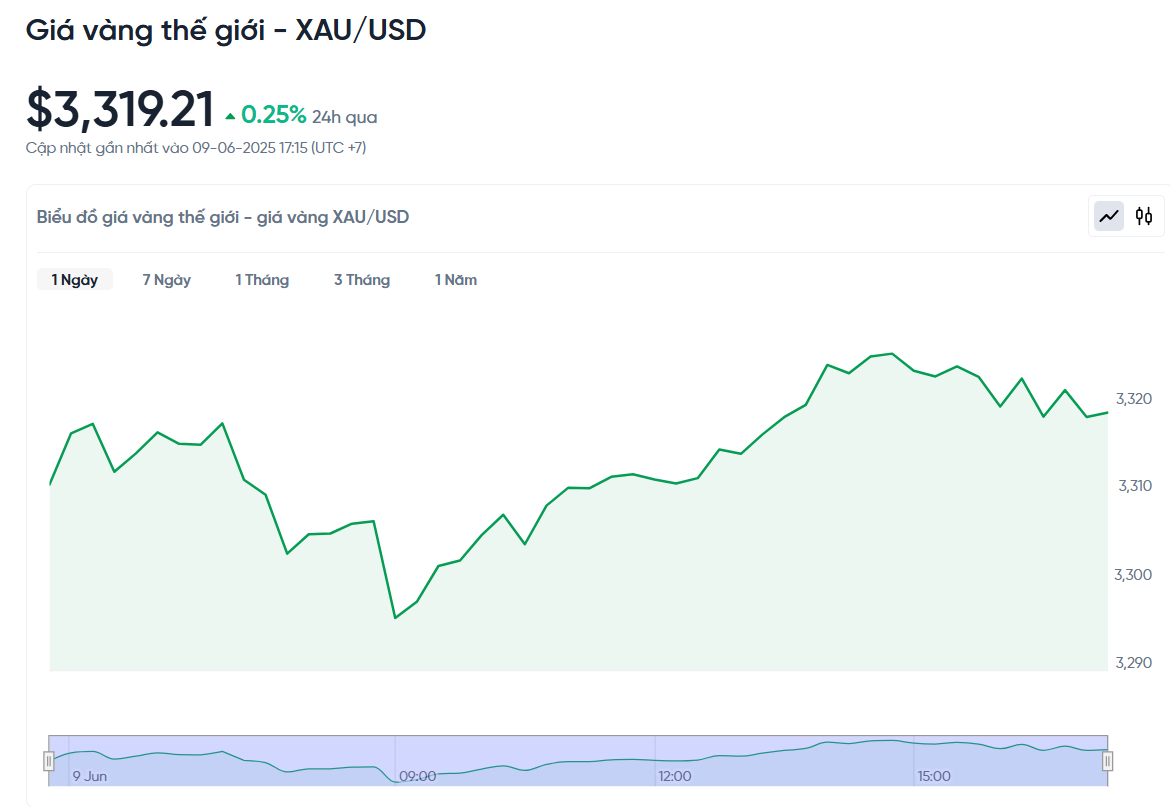

Update gold price today June 9, 2025 latest on the world market

At the time of trading at 5:15 p.m. on June 9, 2025 (Vietnam time), the world gold price recorded by Kitco was at 3,319.21 USD/ounce. Converted according to the USD exchange rate on the free market (26,220 VND/USD), the world gold price is equivalent to about 105.02 million VND/tael (excluding taxes and fees). Compared with the domestic SJC gold bar price on the same day (115.7-117.7 million VND/tael), the SJC gold price is currently about 12.68 million higher than the international gold price.

Gold prices edged up on June 9, 2025, helped by a weaker US dollar ahead of trade talks between the US and China. These talks are aimed at resolving the rising trade tensions between the two superpowers. Spot gold prices rose 0.4% to $3,323.71 per ounce, after falling to a low of $3,293.29 in the previous session, the lowest since June 2.

US gold futures were steady at $3,344.70. The weakening US dollar, down 0.3% against a basket of currencies, made gold cheaper for holders of other currencies. Investors see the main factors that affect gold prices such as trade tensions, debt concerns and weak economic growth as still in place and will continue to support gold prices in the coming months.

Top US and Chinese officials will meet in London today for talks aimed at easing a bitter trade dispute between the two countries that has expanded in recent weeks beyond tit-for-tat tariffs to include export controls on goods and components critical to global supply chains.

Stronger-than-expected US nonfarm payrolls data prompted investors to revise down their expectations for a Federal Reserve interest rate cut this year from two to just one in October. Market attention is now turning to US consumer price index (CPI) data, due out next Wednesday, for further clues on the direction of the Federal Reserve’s monetary policy.

Gold, considered a safe haven asset in times of political and economic uncertainty, tends to thrive in low-interest-rate environments. Meanwhile, China's central bank increased its gold reserves in May for the seventh straight month.

Platinum also rose 3% to $1,210.80, its highest since May 2021. Platinum's rise was supported by expectations of tight supplies, improved industrial sentiment and the continuation of the bullish trend in other precious metals. Silver also rose 1% to $36.30 an ounce, while palladium rose 2.3% to $1,070.97.

In summary, the gold price today, June 9, 2025, on the world market is trending positively, thanks to ongoing economic and political factors.

Gold price forecast tomorrow 6/10/2025

Gold price forecast for tomorrow, June 10, 2025 is influenced by platinum reaching a 4-year peak, from the slight increase in gold prices today mainly due to the cautious sentiment of investors, as they are waiting for the results of trade negotiations between the US and China. This meeting took place in London with the participation of three senior advisors from the US government and representatives of China. Many people hope that this discussion will help ease tensions between the two largest economies in the world, which could have a positive impact on the gold market.

However, in the context of no clear information about the outcome of the negotiations, many short-term investors tend to be cautious and do not want to bet big on gold prices. According to expert Kelvin Wong of OANDA, although the possibility of the US completely removing tariffs is not yet, the discussions can help reduce pressure on the global economy. However, factors such as high business costs and budget deficits in the US are still risks that can lead to rising inflation.

Technically, gold prices are likely to retreat to the support level of $3,296/ounce. In addition, positive US employment data has reduced expectations of a rate cut by the Federal Reserve (Fed). The upcoming consumer price index (CPI) data will be the next important indicator for the market.

Meanwhile, China continued to buy gold for a seventh consecutive month, which helped to strengthen the precious metal's momentum. Other metals such as silver and platinum also saw slight fluctuations, while palladium prices fell slightly.

Based on these factors, domestic gold prices, especially SJC gold, are likely to change sharply in the morning trading session on June 10, 2025. Consumers and investors should closely monitor the situation to make reasonable decisions in the context of a volatile gold market.

Source: https://baoquangnam.vn/du-bao-gia-vang-ngay-mai-10-6-2025-chiu-anh-huong-khi-bach-kim-dat-dinh-4-nam-3156388.html

![[Photo] Panorama of the Opening Ceremony of the National Press Festival 2025](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/20/6b835ee92c2c4df587af73cb2d1f4f5f)

![[Photo] General Secretary To Lam chairs the 14th Central Military Commission Conference](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/6/20/a9d25fc6dd664fb9a3757502f32e5db0)

![[Maritime News] Wan Hai Lines invests $150 million to buy 48,000 containers](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/6/20/c945a62aff624b4bb5c25e67e9bcc1cb)

Comment (0)