The Tax Department of Region I has provided information on the implementation of electronic invoices generated from cash registers according to Decree 70.

In Hanoi , the Tax Department of Region I said it is managing taxes for over 311,000 households and individuals doing business. The number of households and individuals doing business with a revenue of VND1 billion/year or more, who are required to use electronic invoices generated from cash registers, is 4,979 households and individuals doing business. This number accounts for 1.6% of the total number of households being managed.

In the initial phase of Decree No. 70 taking effect, the tax authorities have not yet raised the issue of handling and imposing penalties because many business households are still confused and unfamiliar with the new policies and new technologies. However, for cases of intentional violations, the tax authorities will handle them according to the provisions of the law.

However, recently there have been opinions that some households and individuals are closing or selling at a low level at markets such as Ninh Hiep, Dong Xuan, Long Bien, La Phu or doing business on some commercial streets such as Hang Ngang, Hang Dao (mainly focusing on fabric, clothing, hats, candy, personal items...) due to having to implement Decree No. 70.

According to the Tax Department of Region I, this issue is not being understood correctly.

According to the tax authority's monitoring book, the number of business households that stopped operating in May and June was 2,961. Of these, only 263 were required to use electronic invoices, accounting for 8.8% of the number of households that stopped operating and 5% of the number of households that were required to use electronic invoices generated from cash registers.

The Tax Department of Region I affirmed that the tax policy for business households when implementing electronic invoices generated from cash registers has not changed. Decree No. 70 does not affect the business activities of business households and individuals.

The reason why households and individuals stop doing business is mainly due to fear of counterfeit goods, not a tax policy issue. In addition, many business households are worried about being charged additional tax for the previous period if the actual revenue when using invoices is higher.

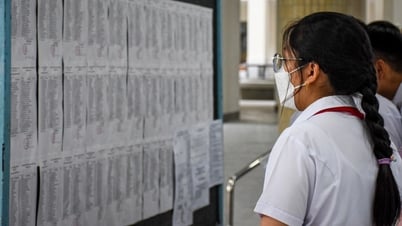

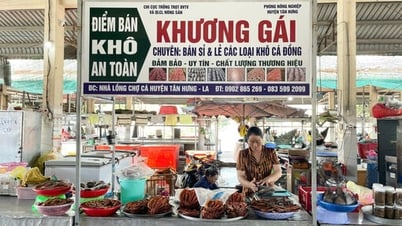

The Tax Department believes that the opinion that some households and individuals are closing their businesses or selling goods at a low level due to having to implement Decree 70 is incorrect (Photo: Nguyen Vy).

Regarding this issue, the Tax Department of Region I said that according to the provisions of the Law on Tax Administration and Circular No. 40/2021, lump-sum tax is determined based on tax authority data combined with the declaration of the business household.

“In case there is a revenue fluctuation exceeding 50% (increase or decrease) during the year, the business household can proactively request an adjustment to the tax rate. The adjustment will only be calculated from the time of the fluctuation onwards,” the unit stated.

Tax authorities hope that business households understand tax policies correctly to do the right thing and fulfill their responsibilities to the state budget. Tax authorities will focus on managing sales revenue of business households and individuals according to each industry and field to calculate tax amounts...

“At the same time, the tax authority recommends that business households and individuals obtain invoices when purchasing goods and services for production and business activities to ensure that the goods are eligible for circulation, and ensure their origin, source, etc., contributing to the Government 's general policy of combating counterfeit, fake, and poor-quality goods,” the unit stated.

Source: https://dantri.com.vn/kinh-doanh/gan-3000-ho-kinh-doanh-o-ha-noi-dong-cua-co-quan-thue-noi-ly-do-20250618014354620.htm

Comment (0)