Domestic gold price today April 27, 2025

At the time of survey at 4:30 a.m. on April 27, 2025, the domestic gold price increased slightly back to the 121 million VND mark. Specifically:

DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119-121 million VND/tael (buying - selling), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.5-121 million VND/tael (buy - sell), gold price increased by 1 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); an increase of 1.5 million VND/tael in buying - an increase of 1 million VND/tael in selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, April 27, 2025 is as follows:

| Gold price today | April 27, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119 | 121 | +500 | +500 |

| DOJI Group | 119 | 121 | +500 | +500 |

| Red Eyelashes | 119 | 121 | +500 | +500 |

| PNJ | 119 | 121 | +500 | +500 |

| Vietinbank Gold | 121 | +500 | ||

| Bao Tin Minh Chau | 119 | 121 | +500 | +500 |

| Phu Quy | 118.5 | 121 | +1000 | +1000 |

| 1. DOJI - Updated: April 27, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC HCM | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC DN | 119,000 ▲500K | 121,000 ▲500K |

| Raw material 9999 - HN | 113,800 ▲1500K | 115,600 ▲1000K |

| Raw material 999 - HN | 113,700 ▲1500K | 115,500 ▲1000K |

| 2. PNJ - Updated: April 27, 2025 04:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| HCMC - PNJ | 114,500 | 117,500 |

| HCMC - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Hanoi - PNJ | 114,500 | 117,500 |

| Hanoi - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Da Nang - PNJ | 114,500 | 117,500 |

| Da Nang - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Western Region - PNJ | 114,500 | 117,500 |

| Western Region - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - PNJ | 114,500 | 117,500 |

| Jewelry gold price - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - Southeast | PNJ | 114,500 |

| Jewelry gold price - SJC | 119,000 ▲500K | 121,000 ▲500K |

| Jewelry gold price - Jewelry gold price | PNJ 999.9 Plain Ring | 114,500 |

| Jewelry gold price - Kim Bao Gold 999.9 | 114,500 | 117,500 |

| Jewelry gold price - Phuc Loc Tai Gold 999.9 | 114,500 | 117,500 |

| Jewelry gold price - Jewelry gold 999.9 | 114,500 | 117,000 |

| Jewelry gold price - Jewelry gold 999 | 114,380 | 116,880 |

| Jewelry gold price - Jewelry gold 9920 | 113,660 | 116,160 |

| Jewelry gold price - Jewelry gold 99 | 113,430 | 115,930 |

| Jewelry gold price - 750 gold (18K) | 80,400 | 87,900 |

| Jewelry gold price - 585 gold (14K) | 61,100 | 68,600 |

| Jewelry gold price - 416 gold (10K) | 41,320 | 48,820 |

| Jewelry gold price - 916 gold (22K) | 104,770 | 107,270 |

| Jewelry gold price - 610 gold (14.6K) | 64,020 | 71,520 |

| Jewelry gold price - 650 gold (15.6K) | 68,700 | 76,200 |

| Jewelry gold price - 680 gold (16.3K) | 72,210 | 79,710 |

| Jewelry gold price - 375 gold (9K) | 36,530 | 44,030 |

| Jewelry gold price - 333 gold (8K) | 31,260 | 38,760 |

| 3. SJC - Updated: April 27, 2025 04:30 - Source website time - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,000 ▲500K | 121,000 ▲500K |

| SJC gold 5 chi | 119,000 ▲500K | 121,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,000 ▲500K | 121,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▲1500K | 116,500 ▲1000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▲1500K | 116,600 ▲1000K |

| Jewelry 99.99% | 114,000 ▲1500K | 115,900 ▲1000K |

| Jewelry 99% | 110,752 ▲1990K | 114,752 ▲990K |

| Jewelry 68% | 72,969 ▲680K | 78,969 ▲680K |

| Jewelry 41.7% | 42,485 ▲417K | 48,485 ▲417K |

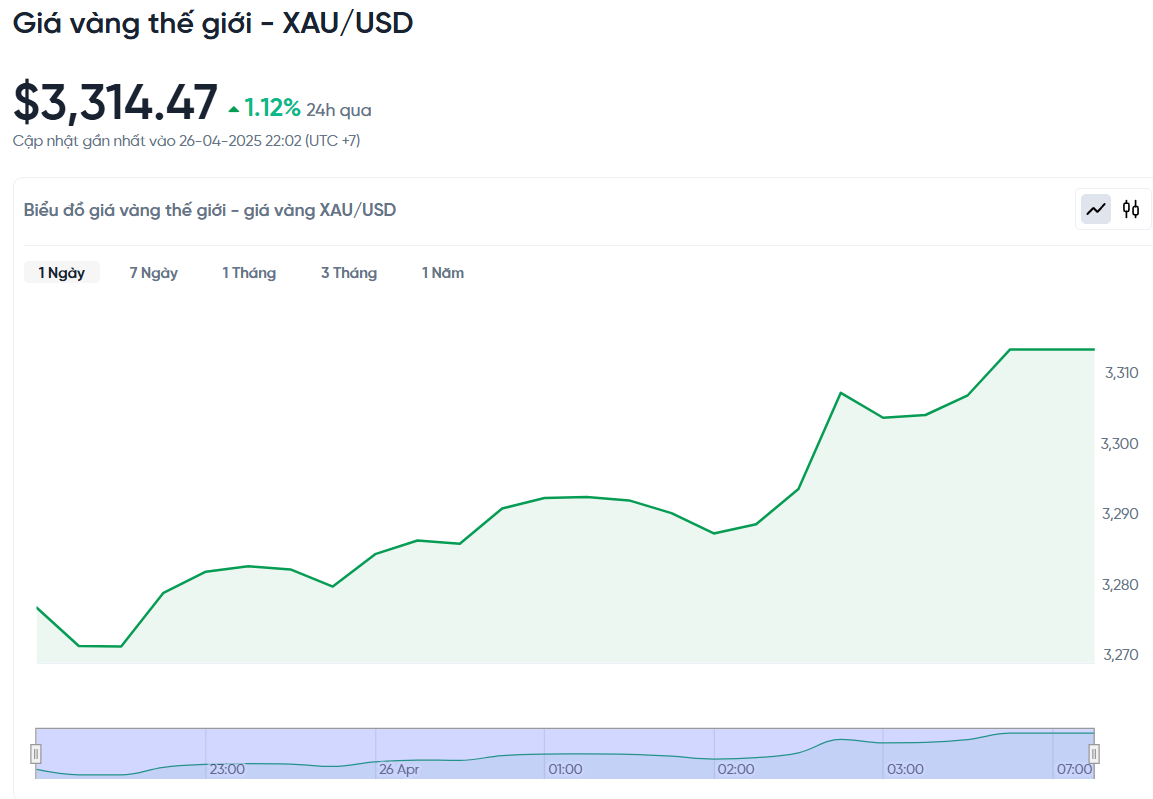

World gold price today April 27, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 am today, Vietnam time, was at 3,314.47 USD/ounce. Today's gold price increased by 13.81 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,200 VND/USD), the world gold price is about 105.77 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 15.23 million VND/tael higher than the international gold price.

World gold prices had their first weekly decline in April, down 0.37% amid strong selling pressure throughout the week. US-China trade tensions showed signs of easing as both sides expressed their desire to resume negotiations. Bloomberg reported that China is considering suspending a 125% tariff on some US imports, while the US also excluded some Chinese electronics from its high-tax list.

The US labor market remains stable. The Labor Department reported that new jobless claims rose to 222,000, as expected. Gold prices continued to fall after the data was released, indicating that consumers are particularly concerned about the risk of rising inflation and an economic recession in the near future.

However, the future of gold remains a big question mark, especially since it is still unclear whether there has been any trade agreement between the US and China. US Treasury Secretary Scott Bessent said that Washington and Beijing are on the verge of a trade breakthrough, promising to cool down the tariff war. Meanwhile, China has issued a new statement on tariffs: 'Extremely selfish', 'There have been no negotiations, let alone a deal'.

Gold continues to be a safe haven asset, especially as the role of the US dollar weakens globally, according to Bart Melek, an expert at TD Securities. Gold ETFs have seen significant inflows this year, with Chinese investors actively seeking protection against trade risks.

Central bank demand for gold, especially from China, is also providing strong support for gold prices. In the first quarter of 2025, the People’s Bank of China added more than 27 tonnes of gold to its reserves, bringing its total gold holdings to over 2,300 tonnes, the highest in the country’s modern history. This aggressive move is aimed at reducing dependence on the US dollar and enhancing the role of the yuan in global transactions.

Colombo believes that gold prices are still in the early stages of a major bull cycle and that the current pullbacks are normal. He said he is not selling physical gold and is just being more cautious with short-term positions.

Frank Holmes, CEO of US Global Investors, said China’s gold buying spree is part of a strategy to reduce its reliance on the US dollar and strengthen the yuan. President Xi Jinping has dramatically increased military spending, invested in nuclear icebreakers and declared the Arctic Ocean a strategic area for China. These geopolitical factors, Holmes said, are contributing to the weakening of the US dollar’s structure and boosting demand for gold as a safe haven.

In addition, the Fed is under increasing political pressure to lower interest rates, while the IMF has lowered its forecast for US GDP growth in 2025 to just 1.2%. US Treasury Secretary Scott Bessent has also criticized the IMF and World Bank for focusing too much on social policy instead of prioritizing economic stability, while calling for a reset of the global monetary order.

Gold Price Forecast

Kelvin Wong, senior market analyst at OANDA, said the gold rally is not over yet. If the US-China talks fail to reach a breakthrough and the US continues to impose tariffs on a wide range of products, economic uncertainty and the risk of stagflation will increase. This could weaken the US dollar and push gold prices higher.

Gold's medium- and long-term uptrend remains intact, with the next resistance levels at $3,670–$3,750/ounce and $3,890/ounce.

According to Lukman Otunuga, an expert at FXTM, the recent decline in gold prices is mainly due to profit-taking, while the fundamental factors supporting gold are still intact. Next week, the market will receive a series of important economic data from the US, such as GDP, the Fed's inflation index and the employment report. This information can strongly affect the Fed's interest rate cut expectations and affect the price of gold.

Technically, if gold falls below $3,250 an ounce, it is likely to continue falling to $3,170. Conversely, if it holds $3,250, it could rebound to $3,390 or even $3,500.

Thu Lan Nguyen, Head of Research at Commerzbank, believes that the current price decline is only temporary in a long-term uptrend. She said that the US-China trade agreement is still uncertain due to conflicting statements from the parties involved. Therefore, gold will continue to be considered a safe haven asset in the near future.

Another factor supporting gold prices is the expectation of lower interest rates in both the US and China to stimulate the economy. Low interest rates are generally good for gold because they reduce the attractiveness of other income-bearing assets. In addition, demand for gold from central banks, especially China and India, also provides a solid support. In 2025, many countries will continue to accumulate gold to reduce their dependence on the US dollar and cope with global economic fluctuations.

According to Kitco News, Mr. Frank Holmes, CEO of US Global Investors, predicted that gold prices could reach $6,000/ounce by the end of President Donald Trump's term. He said that changes in the global financial system, the trend of de-dollarization and the increase in gold reserves of countries, especially China, are driving the increase of this precious metal.

However, not all experts are bullish on gold. Philip Strieble, chief market strategist at Blue Line Futures, said investors should start moving into silver. He predicted that as industrial demand recovers and financial uncertainty eases, silver will have a chance to outperform gold. Already, some investors have started to move from gold to silver.

Source: https://baonghean.vn/gia-vang-hom-nay-27-4-2025-gia-vang-trong-nuoc-va-the-gioi-co-tuan-giam-dau-tien-trong-thang-4-10296041.html

![[Photo] A delegation of 100 journalists from the Vietnam Journalists Association visits the soldiers and people of Truong Sa island district.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/0984a986227d4e988177f560d2e1563e)

![[Photo] General Secretary To Lam receives Chief of the Central Office of the Lao People's Revolutionary Party](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/140435f4b39d4599a3d17975dfb444c5)

![[Photo] National Conference "100 years of Vietnamese Revolutionary Press accompanying the glorious cause of the Party and the nation"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/1cf6cd5c8a934ebfa347028dcb08358c)

![[Photo] Journalists moved to tears at the Memorial Service for the soldiers who died in Gac Ma](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/30/9454613a55c54c16bf8c0efa51883456)

![[Infographics] From July 1, 2025, what additional benefits will you get if you participate in Health Insurance continuously for 5 years or more?](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/30/24c62c1508c24655ac4be4735580a9e7)

Comment (0)