IMP4 high-tech factory in Binh Duong - Photo: IMP

Total value over 5,730 billion VND

The information was just announced to investors by Livzon Pharmaceutical Group Inc., a pharmaceutical company listed in parallel on Hong Kong (HKEX) and Shenzhen (SZSE). The transaction was carried out through Lian SGP Holding Pte. Ltd., an indirect subsidiary 100% owned by Livzon.

According to the agreement signed on May 22, Livzon will buy back 64.81% of Imexpharm shares from three current major shareholders including SK Investment Vina III (part of SK Group - Korea), Sunrise (Binh Minh Kim Investment Joint Stock Company) and KBA Investment Joint Stock Company.

The total transfer value is up to more than 5,730 billion VND; of which, SK Investment is expected to receive more than 4,210 billion VND, Sunrise receives 862.5 billion VND and KBA receives nearly 652 billion VND.

The price is determined based on bilateral negotiations, with reference to the average capitalization of Imexpharm in the last 30 trading sessions on HOSE,...

The transaction has not yet been completed and must meet a number of conditions: be approved by the competition authority, not exceed the foreign ownership limit at Imexpharm, and not cause material adverse changes to Imexpharm before the completion date.

The maximum completion period is nine months from the date of signing the agreement.

If the transaction is completed, Imexpharm will become an indirect subsidiary of Livzon, a pharmaceutical group founded in 1985 and with more than 9,000 employees.

Livzon operates in the pharmaceutical industry, is one of the leading enterprises in the fields of pharmaceutical chemicals, biopharmaceuticals, active pharmaceutical ingredients (API), traditional Chinese medicine (TCM),...

Divestment after 5 years of investment

SK became a strategic shareholder of Imexpharm in 2020, when it acquired shares from Dragon Capital group and several other investment funds.

As of the end of 2020, SK Investment Vina III was the largest shareholder of Imexpharm with a 24.02% ownership ratio, surpassing Vietnam Pharmaceutical Corporation (22.03%) and KWE Beteiligungen AG (15.13%).

Since then, Investment Vina III has continuously acquired more shares, increasing its ownership ratio to nearly 65% (with related parties).

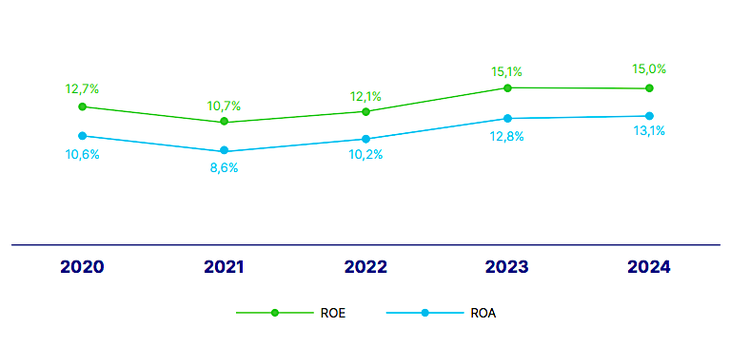

Imexpharm's profitability over the past 5 years - Source: IMP

In late 2024, Bloomberg News reported that SK Group was considering selling its entire 65% stake in Imexpharm.

At the annual general meeting of shareholders on May 15, 2025, some shareholders mentioned rumors that SK was looking to divest.

Responding at the congress, an Imexpharm representative confirmed that SK is reviewing its entire global portfolio, including investments in Vietnam, as part of its restructuring strategy.

"Even if SK decides to divest in the future, we believe that Imexpharm will continue to develop independently and sustainably," said a company representative.

Also at this congress, Imexpharm shareholders approved increasing the maximum foreign ownership ratio from 75% to 77.96% of charter capital.

Currently, Vietnam Pharmaceutical Corporation still holds 22.04% of Imexpharm's capital. The company aims to increase its gross revenue by an average of 15% per year in the period 2024 - 2030.

Imexpharm was established in 1977, formerly a Level II Pharmaceutical Company in Cao Lanh City, Dong Thap Province. The company's name is associated with People's Physician Tran Thi Dao, who is currently the general director.

This enterprise currently operates 4 factories, including 12 production lines meeting EU-GMP standards and leading the antibiotic market share in Vietnam (about 10%).

Source: https://tuoitre.vn/hang-duoc-trung-quoc-du-chi-hon-5-700-ti-dong-de-mua-gan-65-von-imexpharm-20250523015415335.htm

![[Photo] National Assembly Chairman Tran Thanh Man visits Vietnamese Heroic Mother Ta Thi Tran](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/7/20/765c0bd057dd44ad83ab89fe0255b783)

Comment (0)