In Hospitality - the operator of the largest shopping malls in Ho Chi Minh City such as Gem Center and White Palace - reported an 11-fold increase in profits last year.

In Hospitality Joint Stock Company recorded more than 130 billion VND in profit after tax in 2022, an increase of 11 times compared to 2021. On average, this business pockets more than 350 million VND in profit every day.

The sharp increase in profits helped the company's equity increase from 550 billion to over 670 billion VND, an increase of 22%. Thanks to that, the debt-to-equity ratio also decreased to 0.46 times. In Hospitality currently has over 308 billion VND in liabilities, a decrease of more than 17%.

Of which, this enterprise recorded about 33.5 billion VND in outstanding bonds. This is the outstanding volume of a lot issued in May 2019, with an original value of 180 billion VND. The interest rate of this bond lot is 9.5% per year, with interest paid monthly. Last year alone, the company spent about 12.6 billion VND to pay interest on the above bond lot.

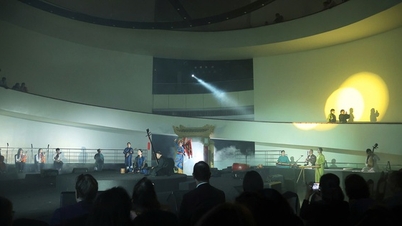

Gem Center - one of the conference centers of In Hospitality. Photo: Gem Center

In Hospitality is a company specializing in providing management services, investing in related projects and developing brands in the field of hotels, restaurants and conference and exhibition centers (MICE). The company currently operates the largest conference centers in Ho Chi Minh City such as Gem Center (District 1), White Palace Hoang Van Thu (Phu Nhuan), White Palace Pham Van Dong (Thu Duc City) and The Log restaurant (District 1).

In Hospitality’s conference centers have long been known as venues for many large events, conferences, and forums. In recent years, the development of the entertainment industry has helped these conference centers welcome more visitors from fan meetings, product launches, and press conferences of domestic and regional artists. The company is investing in building new conference centers including Gem Center Hanoi and White Palace Can Tho.

The predecessor of In Hospitality is PQC Convention Joint Stock Company, part of the In Holdings ecosystem founded by Nguyen Huu Phu and Nguyen Huu Quy. In 2020, VinaCapital's VOF fund bought 15% of In Holdings shares with an announced deal value of 25 million USD. Accordingly, the company's valuation at that time reached 167 million USD. VOF said that In Holdings committed to a growth rate of EBITDA (profit before tax, depreciation and interest) of 25-30% in the period 2020 - 2022.

Siddhartha

Source link

![[Photo] Cutting hills to make way for people to travel on route 14E that suffered landslides](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/11/08/1762599969318_ndo_br_thiet-ke-chua-co-ten-2025-11-08t154639923-png.webp)

![[Video] Hue Monuments reopen to welcome visitors](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/11/05/1762301089171_dung01-05-43-09still013-jpg.webp)

Comment (0)