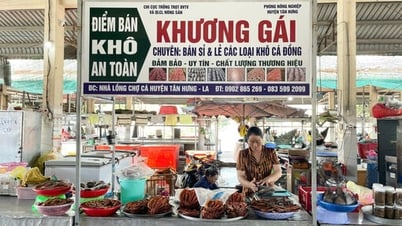

The Tax Department recommends that organizations coordinate with tax authorities to promote the benefits, registration process and use of electronic invoices from cash registers. (Photo: MINH PHUONG)

Pursuant to the provisions of Clause 1, Article 11, Decree No. 70/2025/ND-CP dated March 20, 2025 on amending and supplementing the provisions of Decree No. 123/2020/ND-CP, the Tax Department requests that organizations providing electronic invoices and data transmission and storage services continue to closely coordinate in implementing electronic invoices with codes generated from cash registers. The focus is on supporting business households in the field of retailing goods and services directly to consumers.

Specifically, the Tax Department recommends that organizations providing electronic invoice solutions proactively disclose information about electronic invoice service packages generated from cash registers, and at the same time research and develop convenient, easy-to-use accounting and invoice software suitable for each group of business households. Organizations need to develop reasonable pricing policies and continue to expand support, incentive, and free programs for small and medium-sized businesses.

In addition, the Tax Department recommends that organizations closely coordinate with tax authorities in disseminating information about the benefits, registration process and use of electronic invoices from cash registers; arranging support personnel, providing online or direct guidance at business addresses, especially focusing on the peak period in June and July 2025 to ensure that business households understand and use them proficiently.

Organizations are also recommended to increase information sharing and technical coordination with relevant parties to ensure synchronous integration between the invoice software system and the tax industry's data system. At the same time, it is necessary to establish a specialized, quick-response technical support channel to promptly receive and handle incidents arising during the use of electronic invoice software.

The Tax Department emphasizes the requirement that organizations must support taxpayers in complying with legal regulations during the process of installing, configuring, and instructing on software usage, avoiding falsifying revenue information or causing behavior that is not in accordance with tax laws.

The tax authority expressed its desire to continue receiving coordination and support from organizations providing electronic invoice solutions to support business households, improve the quality of service for taxpayers, and promote administrative procedure reform and modernization of the financial sector in accordance with the direction of the Government and the Ministry of Finance .

Source: https://baotuyenquang.com.vn/cuc-thue-de-nghi-cac-cong-ty-cong-nghe-ho-tro-ho-kinh-doanh-dung-hoa-don-dien-tu-213144.html

Comment (0)