Domestic gold price today April 26, 2025

At the time of survey at 4:30 p.m. on April 26, 2025, the domestic gold price increased slightly back to the 121 million VND mark. Specifically:

DOJI Group listed the price of SJC gold bars at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company Limited - SJC at 119-121 million VND/tael (buy - sell), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

At Mi Hong Jewelry Company, the price of Mi Hong gold at the time of survey was listed at 119-121 million VND/tael for buying and selling. Compared to yesterday, the gold price increased by 500 thousand VND/tael for both buying and selling compared to yesterday.

SJC gold price at Bao Tin Minh Chau Company Limited is traded by businesses at 119-121 million VND/tael (buying - selling), an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

SJC gold price at Phu Quy is traded by businesses at 118.5-121 million VND/tael (buy - sell), gold price increased by 1 million VND/tael in both buying and selling directions compared to yesterday.

As of 4:30 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 114-116.5 million VND/tael (buy - sell); an increase of 1.5 million VND/tael in buying - an increase of 1 million VND/tael in selling compared to yesterday.

Bao Tin Minh Chau listed the price of gold rings at 117-120 million VND/tael (buy - sell); an increase of 500 thousand VND/tael in both buying and selling directions compared to yesterday.

The latest gold price list today, April 26, 2025 is as follows:

| Gold price today | April 26, 2025 (million dong) | Difference (thousand dong/tael) | ||

| Buy | Sell | Buy | Sell | |

| SJC in Hanoi | 119 | 121 | +500 | +500 |

| DOJI Group | 119 | 121 | +500 | +500 |

| Red Eyelashes | 119 | 121 | +500 | +500 |

| PNJ | 119 | 121 | +500 | +500 |

| Vietinbank Gold | 121 | +500 | ||

| Bao Tin Minh Chau | 119 | 121 | +500 | +500 |

| Phu Quy | 118.5 | 121 | +1000 | +1000 |

| 1. DOJI - Updated: April 26, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Domestic gold price | Buy | Sell |

| AVPL/SJC HN | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC HCM | 119,000 ▲500K | 121,000 ▲500K |

| AVPL/SJC DN | 119,000 ▲500K | 121,000 ▲500K |

| Raw material 9999 - HN | 113,800 ▲1500K | 115,600 ▲1000K |

| Raw material 999 - HN | 113,700 ▲1500K | 115,500 ▲1000K |

| 2. PNJ - Updated: April 26, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 999.9 gold bar | 11,900 | 12,100 |

| PNJ 999.9 Plain Ring | 11,450 | 11,750 |

| Kim Bao Gold 999.9 | 11,450 | 11,750 |

| Gold Phuc Loc Tai 999.9 | 11,450 | 11,750 |

| 999.9 gold jewelry | 11,450 | 11,700 |

| 999 gold jewelry | 11,438 | 11,688 |

| 9920 jewelry gold | 11,366 | 11,616 |

| 99 gold jewelry | 11,343 | 11,593 |

| 750 Gold (18K) | 8,040 | 8,790 |

| 585 Gold (14K) | 6,110 | 6,860 |

| 416 Gold (10K) | 4,132 | 4,882 |

| PNJ Gold - Phoenix | 11,450 | 11,750 |

| 916 Gold (22K) | 10,477 | 10,727 |

| 610 Gold (14.6K) | 6,402 | 7,152 |

| 650 Gold (15.6K) | 6,870 | 7,620 |

| 680 Gold (16.3K) | 7,221 | 7,971 |

| 375 Gold (9K) | 3,653 | 4,403 |

| 333 Gold (8K) | 3,126 | 3,876 |

| 3. SJC - Updated: April 26, 2025 16:30 - Time of the source website - ▼/▲ Compared to yesterday. | ||

| SJC Gold 1L, 10L, 1KG | 119,000 ▲500K | 121,000 ▲500K |

| SJC gold 5 chi | 119,000 ▲500K | 121,020 ▲500K |

| SJC gold 0.5 chi, 1 chi, 2 chi | 119,000 ▲500K | 121,030 ▲500K |

| SJC 99.99% gold ring 1 chi, 2 chi, 5 chi | 114,000 ▲1500K | 116,500 ▲1000K |

| SJC 99.99% gold ring 0.5 chi, 0.3 chi | 114,000 ▲1500K | 116,600 ▲1000K |

| Jewelry 99.99% | 114,000 ▲1500K | 115,900 ▲1000K |

| Jewelry 99% | 110,752 ▲1990K | 114,752 ▲990K |

| Jewelry 68% | 72,969 ▲680K | 78,969 ▲680K |

| Jewelry 41.7% | 42,485 ▲417K | 48,485 ▲417K |

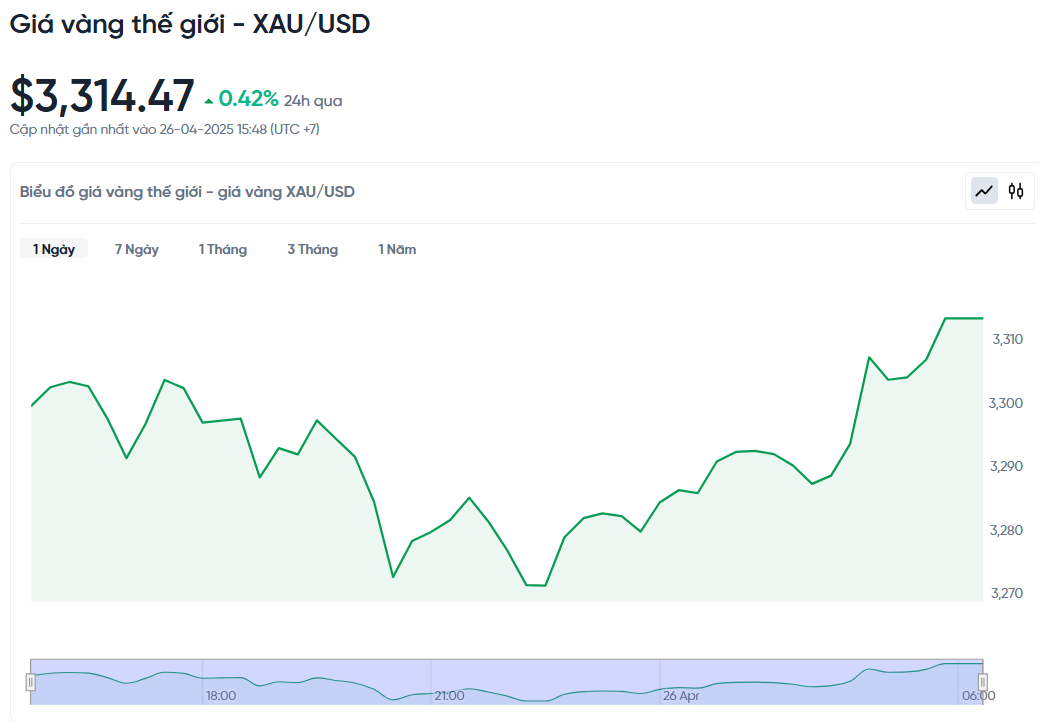

World gold price today April 26, 2025 and world gold price fluctuation chart in the past 24 hours

According to Kitco, the world gold price recorded at 4:30 p.m. today, Vietnam time, was 3,314.47 USD/ounce. Today's gold price increased by 13.81 USD/ounce compared to yesterday. Converted according to the USD exchange rate at Vietcombank (26,200 VND/USD), the world gold price is about 105.77 million VND/tael (excluding taxes and fees). Thus, the price of SJC gold bars is 1 million VND/tael higher than the international gold price.

World gold prices fell significantly at the end of the week due to the easing of US-China trade tensions and the renewed interest in the USD and US bond yields, causing investors to take profits to invest in other commodity markets.

Gold prices fell 0.37% week-to-date as of writing and 6% from Tuesday’s record high of $3,500 an ounce. Jesse Colombo, founder of BubbleBubble Report, said the decline was a healthy correction. He said gold could continue to move sideways through the summer and needs to hold support around $3,000 an ounce.

Colombo said gold is still in the early stages of its bull cycle. Pullbacks are normal, even in the strongest bull markets. He said he would not sell physical gold but would be more cautious with short-term positions such as gold futures or gold mining stocks.

Adam Turnquist, Technical Strategist at LPL Financial, commented that the progress of trade negotiations is changing market sentiment from focusing on high tariffs to expectations of tariff reduction through agreements. This shows that the instability of the world economic situation has temporarily subsided, no longer causing strong fluctuations in gold prices.

However, many experts believe that even if market tensions ease, the level of uncertainty is still high enough to support gold prices at current levels. While US President Donald Trump announced that he had begun trade negotiations with China, China denied this information.

In the first quarter of 2025, the People’s Bank of China (PBoC) recorded its fifth consecutive month as the world’s largest buyer of sovereign gold. In the first three months of the year alone, China added more than 27 tonnes of gold to its official reserves, bringing its total holdings to more than 2,300 tonnes, the highest in the country’s modern history. China’s gold buying spree is part of a broader strategy to reduce its reliance on the US dollar and strengthen the yuan’s position in global trade.

The US Federal Reserve is facing growing political pressure to cut interest rates amid rising trade tensions. The International Monetary Fund (IMF) has cut its forecast for US GDP growth in 2025 to 1.2%. US Treasury Secretary Scott Bessent has criticized the IMF and World Bank for focusing too much on social policies rather than economic stability, and called for a reset of the global monetary order.

Gold Price Forecast

Kelvin Wong, Senior Market Analyst at OANDA, believes that the gold rally is not over yet. If there is no breakthrough in the US-China negotiations and the US continues to impose tariffs on many industries, the risk of business uncertainty and stagnant inflation will increase. This could weaken the US dollar and push gold prices higher. The medium- and long-term uptrend of gold remains intact, with the next resistance levels at $3,670 - $3,750/ounce and $3,890/ounce.

Lukman Otunuga, senior market analyst at FXTM, said that the recent decline in gold prices was mainly due to profit-taking, but the fundamentals supporting gold remain intact. There will be a number of important economic data releases from the US next week, including GDP, the Fed’s closely watched inflation reading and the jobs report. These could influence expectations of a Fed rate cut, which in turn could impact gold prices.

Technically, if gold prices fall below $3,250 an ounce, there is a high chance of a further decline to $3,170. Conversely, if $3,250 holds, prices could recover to $3,390 or even $3,500.

Thu Lan Nguyen, Head of FX and Commodities Research at Commerzbank, said that the recent decline is only temporary in a long-term uptrend for gold. It is still unclear when and in what form a trade deal between the US and China will be reached, with conflicting statements from President Trump, US Treasury Secretary Scott Bessent and China. Therefore, gold will continue to be sought after as a safe-haven asset in the near future.

According to Kitco News, gold prices could reach $6,000 an ounce by the end of President Donald Trump's term, according to Frank Holmes, CEO of US Global Investors and Executive Chairman of Hive Digital Technologies. In an interview with Kitco, Holmes said that the current strong rally in gold is due to profound changes in the global financial system, the trend of de-dollarization and the increase in gold reserves of countries, especially China.

Mr. Holmes emphasized that if the US continues to raise the tax rate to 25%, the USD will also have to decrease by 25%, thereby supporting a strong increase in gold prices. He believes that the target of 6,000 USD/ounce is completely feasible during Mr. Trump's term, especially when the world's geopolitical and financial factors are changing profoundly.

However, not all experts are bullish on gold. Philip Strieble, chief market strategist at Blue Line Futures, believes it is time for investors to shift their focus to other precious metals, such as silver. He predicts that if financial markets are past their peak of uncertainty, silver could start to outperform gold. Silver will benefit as industrial demand recovers. Some investors have already started to move from gold to silver.

Source: https://baonghean.vn/gia-vang-ngay-26-4-2025-gia-vang-trong-nuoc-va-the-gioi-tang-nhe-tro-lai-ve-moc-121-trieu-10296025.html

![[Photo] Many young people patiently lined up under the hot sun to receive a special supplement from Nhan Dan Newspaper.](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6f19d322f9364f0ebb6fbfe9377842d3)

![[Photo] Ready for the top competitions of Vietnamese table tennis](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/9c547c497c5a4ade8f98c8e7d44f5a41)

![[Photo] Party and State leaders attend the special art program "You are Ho Chi Minh"](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/18/6895913f94fd4c51aa4564ab14c3f250)

Comment (0)