Reduce reserve requirement ratio for banks

The State Bank has just issued Circular No. 23/2025/TT-NHNN amending and supplementing a number of articles of Circular No. 30/2019/TT-NHNN regulating the implementation of compulsory reserves of credit institutions and foreign bank branches.

Notably, Article 7 of the regulations on reducing the required reserve ratio clearly states that the supporting credit institutions specified in Clause 39, Article 4 of the Law on Credit Institutions (supporting credit institutions) are entitled to a 50% reduction in the required reserve ratio according to the recovery plan for credit institutions under special control approved by competent authorities.

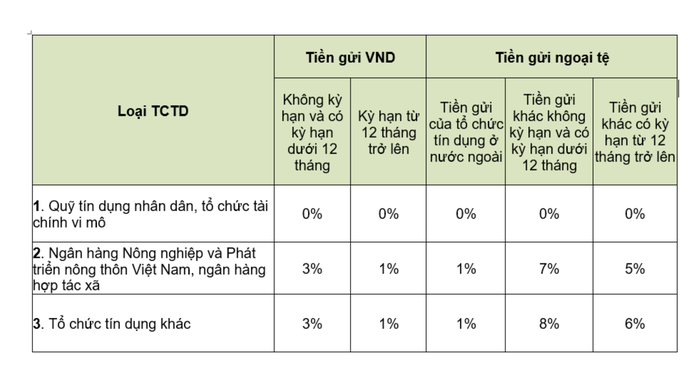

Latest required reserve ratio as announced by the State Bank, applicable from October 2025

The reduction in the required reserve ratio for each credit institution is calculated based on the required reserve ratio for that credit institution, applied to all types of deposits subject to required reserves.

With this regulation, banks that receive mandatory transfers of weak banks will benefit, including: Foreign Trade Bank (Vietcombank), Military Bank (MB), Ho Chi Minh City Development Bank ( HDBank ), Vietnam Prosperity Bank (VPBank). This means that these banks will be able to use tens of thousands of billions of VND from the required reserve to lend and maximize profits.

From the end of last year to early 2025, the State Bank has completed the transfer of 4 weak banks including CB transferred to Vietcombank , Oceanbank transferred to MB, DongA Bank transferred to HDBank and GPBank transferred to VPBank.

According to the State Bank, the compulsory transfer of weak credit institutions is one of the solutions to contribute to ensuring macroeconomic stability, national financial and monetary security, political stability and social order and safety, as well as helping these banks overcome accumulated losses and exit special control status.

With this new regulation, banks that are forced to transfer weak banks will benefit.

What do banks benefit from?

Meanwhile, the transferee banks will enjoy many preferential mechanisms in terms of capital sources and credit room to expand their asset scale and outstanding debt to create motivation for these banks to resolutely participate in successfully restructuring weak credit institutions.

In mid-May 2025, the Government issued Decree No. 69/2025/ND-CP amending and supplementing a number of articles of Decree No. 01/2014/ND-CP on foreign investors purchasing shares of Vietnamese credit institutions.

Accordingly, the total shareholding level of foreign investors in commercial banks receiving mandatory transfers (excluding commercial banks in which the State holds more than 50% of charter capital) may exceed 30% but not exceed 49% of charter capital.

Thus, some banks receiving compulsory transfers can increase the foreign room (ownership ratio) to a maximum of 49%.

Source: https://nld.com.vn/thong-tin-quan-trong-cho-nganh-ngan-hang-va-nen-kinh-te-196250814115346004.htm

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Cambodian Prime Minister Hun Manet](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/72d3838db8154bafabdadc0a5165677f)

![[Photo] Firmly marching under the military flag: Ready for the big festival](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/86df2fb3199343e0b16b178d53f841ec)

![[Photo] The special solidarity relationship between Vietnam and Cuba](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/15/5f06c789ab1647c384ccb78b222ad18e)

![[Photo] Binh Khanh Bridge Ho Chi Minh City is ready to reach the finish line](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/8/14/b0dcfb8ba9374bd9bc29f26e6814cee2)

![[Photo] President Luong Cuong receives Finnish Ambassador to Vietnam Keijo Norvanto](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/8/15/9787f940853c45d39e9d26b6d6827710)

Comment (0)